Bitcoin prices might be dumping at spot rates, but Bitfinex whales are rapidly accumulating. But is this a net positive for BTC prices?

Bitcoin is selling off, dropping below the all-important round number of $60,000 yesterday.

While price swings like these are common, the most important question is whether BTC will recover or continue to dip.

There are analysts with varied opinions. Though some expect even more losses in the days to come, exciting developments suggest possible accumulation, not by retailers but by big whales.

Big Whales Accumulating BTC: Will Bitcoin Price Recover?

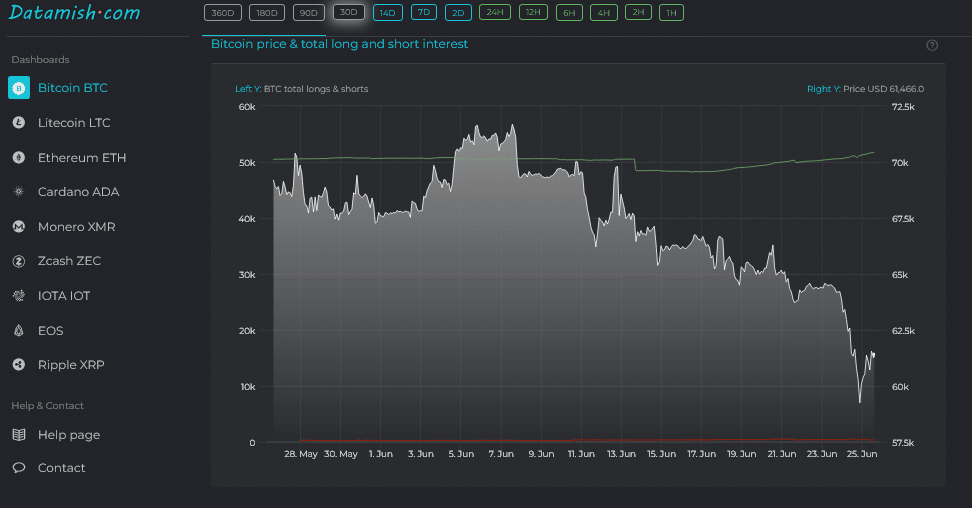

According to datamish data, Bitfinex whales have been increasing their long positions over the last week despite the series of lower lows.

Their decision to buy has seen more than 2,500 BTC added to their portfolios, reversing previous declines and pushing their total haul to over 50,800 BTC.

The action by whales is key: Most of the time, these entities are usually institutions, family offices, or even hedge funds. Their decision to buy, even amid the FUD and BTC bloodbath, means they believe prices will rise in the future, reversing from spot rates.

There are several explanations for this bullish outlook.

Bitcoin proponents argue that the coin is emerging as a digital “store of value” asset.

The primary argument is that regardless of the economic scenario, whether the economy heats up and inflation spikes or there is a financial crisis, including the collapse of leading banks, Bitcoin remains the best tool to hold.

Should inflation in the United States continue rising, Bitcoin supporters maintain that it will likely continue outperforming traditional assets like stocks or even real estate.

Unlike fiat, which has an infinite supply, BTC’s supply is capped at 21 million. Moreover, it is increasingly deflationary due to Halving. According to recent trends, global liquidity is rising ahead of the highly contested presidential election in the United States.

In the past, a spike in liquidity has massively benefited crypto and Bitcoin. Though analysts are upbeat, some are not boarding.

One thinks the coin is weak at spot rates and may drop.

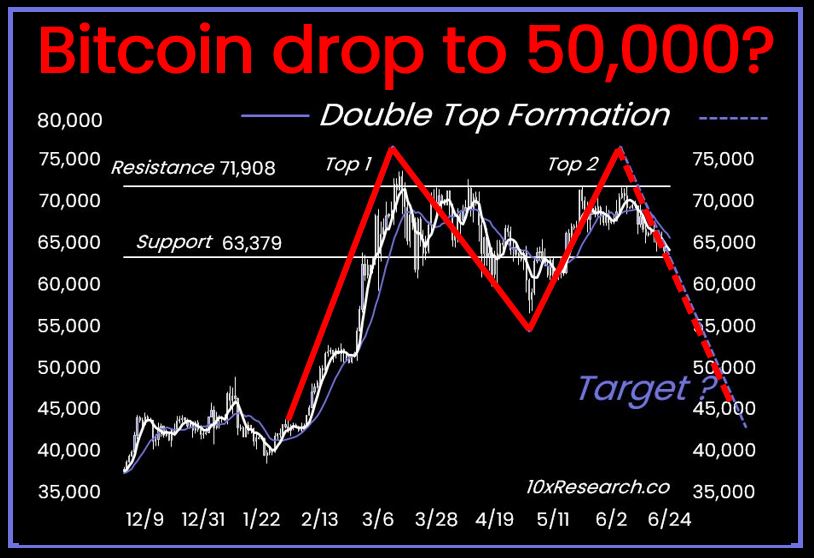

Bitcoin Price Analysis To Drop Below $50,000?

Taking to X, the analyst has identified a “double-top,” a bearish pattern. Often, this forms when prices are peaking, and bulls cannot push higher.

(Source)

Looking at the daily chart, bulls didn’t push prices above $74,000 in April. Moreover, prices have yet to break above $72,000.

There is a clear liquidation between $72,000 and $74,000.

(BTCUSDT)

There could be more losses if the price breaks below the support level (neckline) at around $58,000.

Should sellers take over, he predicts Bitcoin will retest $50,000 or even $45,000 in a bear trend continuation pattern, confirming the June 7 and 11 bear bars.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.