Dig into Bitcoin mining analysis as 99Bitcoins unpack the impact of the BTC Halving Event, leading pundit Charles Edwards of Capriole Fund claims Bitcoin mining has decisively shifted after halving its miner rewards – is this true?

Charles Edwards, the Founder of Capriole Fund, thinks the Bitcoin mining scene has decisively shifted since Bitcoin halved its miner rewards on April 20.

Moreover, he adds, miner-related data shows that the coin is trading at a massive discount to spot rates.

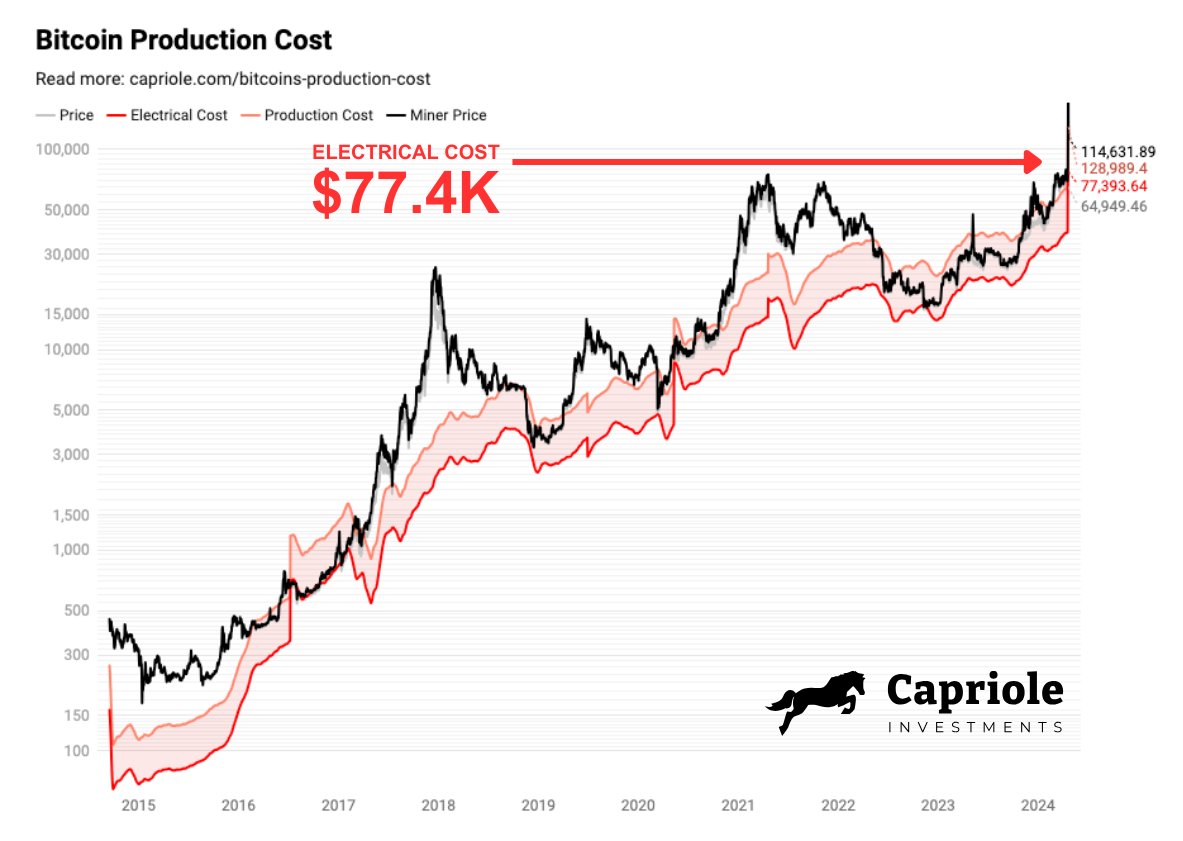

In a post on X, the founder said the raw electricity cost to power the network per mined BTC, also known as the electrical cost, has skyrocketed to a staggering $77,400.

(Capriole)

Charles Edwards: It’s Still Lucrative To Mine Bitcoin

The rise in electrical costs, the founder continued, coincides with a record-breaking Bitcoin Miner Price of $244,000 recorded when the network halved its miner rewards on April 20.

The Bitcoin Miner Price comprises both the block rewards, currently at 3.125 BTC post-Halving, and transaction fees per block given to every successful miner who approves a block of transactions.

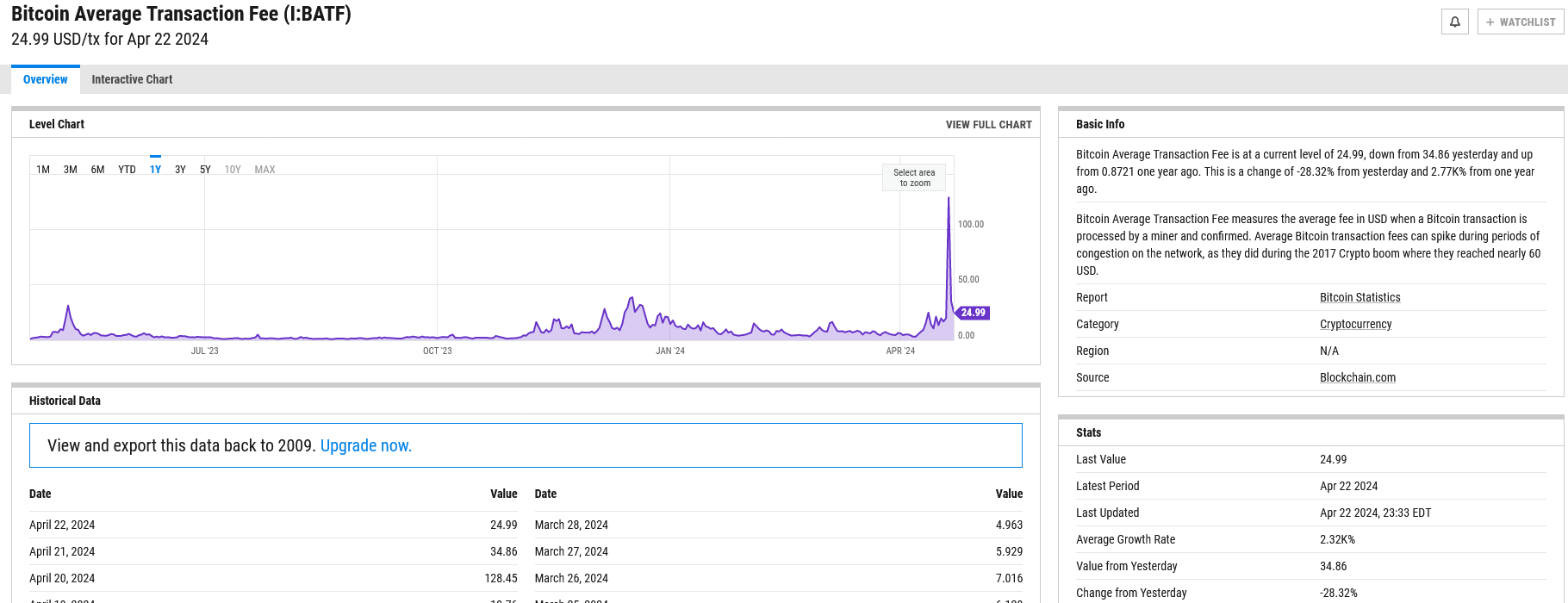

The spike in the Bitcoin Miner Price follows the dramatic change in transaction fees on April 20 when the network halved.

Looking at on-chain data from YCharts, the average transaction fee on April 20 stood at over $128. This was a nearly 7X increase from $19 registered on April 19.

(yChart)

In general, Edwards added that fees have quadrupled compared to their previous all-time high of $58.

The founder continued that this confluence of high electrical costs and substantial rewards to active miners suggests that BTC could tear higher in the weeks to come.

The Bottom Line: Is BTC Price Ready For $100,000?

For this reason, the founder assesses that the current market situation, primarily based on mining costs and network rewards, presents a unique scenario that could boost prices.

According to Edwards, Bitcoin is trading at a huge discount at spot rates since it is trading below its electrical cost of production.

For this reason, the analyst predicts a sharp price spike that will propel the coin above $100,000 in the weeks ahead – suggesting now is a good time to buy BTC.

With production costs exceeding spot rates, Edwards said the incentive to mine is considerably stronger, a net positive for bulls.

(BTCUSDT)

However, higher electrical costs also mean some miners, particularly those operating with less efficient hardware or facing higher electricity costs using non-renewable energy sources, may shut down.

For this reason, there is a risk of possible centralization as market conditions favor deep-pocketed miners operating the latest gear designed to be more efficient.

The founder also predicts transaction fees will remain considerably higher than historical averages, at least in the medium term.

This projection assumes that network activity will rise, pushing the demand for block space even higher.

The situation could worsen following the launch of the Runes protocol on April 20. This release improves Inscriptions and aims to make inscribing more efficient.

No Comments

No Comments