Deflation has been a point of debate among the various schools of economic thought for a very long time. One one hand, the Keynesians and Neo-Keynesians argue that deflation is a very negative economic phenomenon and constantly warn of a “deflationary death spiral,” in which people will stop spending indefinitely—in constant anticipation of lower prices—and businesses will fail. Obviously, if all the business failed there would of course be huge waves of unemployment and economic depression. On the other hand, the Austrian school, and some students of the Chicago school, argue that a “deflationary death spiral” can not happen in the real world. Austrian economists especially argue that such a concept only holds weight in a static or evenly rotating economy—a theoretical construct where the economy is in perfect equilibrium, there is no economic growth or decay, and profits equal costs—and is completely irrelevant in the real world.

What is Deflation?

Deflation is the counterpart to inflation. These two terms refer to the changes in the purchasing power of a nation’s, or the global, money supply. Inflation occurs when the purchasing power of money declines as a result of rising prices; deflation represents an increase in money’s purchasing power as a result of a decrease in prices.

Inflation occurs for two reasons, although in the real world it generally only happens for one reason. The first scenario in which inflation can occur is one where the demand for money drops below its supply. If that shift in the money-relation happens, there is simply more money than people want. Consequently, people begin spending money on any kind of good in order to rid themselves of the now less valuable money, which then drives up prices. The second, and much more common, cause of inflation comes from the supply-side rather than the demand-side. Inflation in the real world is almost always caused by a deliberate injection of currency into circulation by a government or central bank. The increase in the supply of money shifts the money-relation once again so that there is more money in circulation than people want or have a need for. People then spend more—since they value their money less—and prices go up because of a perceived increase in demand. While the outcomes of both scenarios are the same, there is more money than people want or need, there is indeed a very distinct difference between demand-side and supply-side inflation. In the former, the change in the money relation comes about as a result of a natural change in subjective valuations. Such a change is generally gradual and spread out over time; therefore, markets can generally adjust much easier to demand-side inflation. The latter, on the other hand, is the result of a forced injection of money into the economy. The injection is usually so large and sudden that it shocks the market and abruptly changes the production structure. The implications of these cash-induced changes in the money relation will be examined below.

Deflation occurs for three reasons, but all three of these scenarios of deflation have happened often in the history of the real world, unlike with inflation. The first scenario where deflation could occur is when prices drop due to innovation and competition in the economy. As the production structure is streamlined and capital is allocated to the most profitable enterprises, supply tends to increase, which leads to a decrease in prices. The second instance of deflation occurs as a direct result of a change in the money-relation, where either A) demand for money increases beyond the supply of money or B) the supply of money diminishes and can no longer fill the demand for money. Supply-side deflation generally occurs because governments or central banks deliberately tighten the money supply through a contraction of credit or through increased taxes. The third scenario of deflation is a sudden decrease in the supply of money due to currency being lost or destroyed. The destruction of currency can happen in a number of ways, including deliberate acts of money destruction on the part of governments in an attempt to contract the money supply. This scenario happened in the American Civil War; the Confederate States of America suffered from hyperinflation, so the CSA’s federal government began levying confiscatory taxes and destroying the money that came into the Treasury’s possession as a result of those taxes.

This discussion on deflation has interesting implications when applied to Bitcoin. The digital currency is actually designed to be deflationary. As a certain amount of bitcoins are produced through the process of Bitcoin mining, the amount of bitcoins that are rewarded to the miners per block is decreased. Simultaneously, as more and more bitcoins are mined, the difficulty of the hashing algorithm increases, which then requires more computing power to solve. As a result, Bitcoin mining becomes more expensive, and miners get less coins as Bitcoin mining progresses, so mining will only continue if the bitcoin rewards are worth more than the cost of the electricity that the Bitcoin mining process requires. So deflation is literally hard-wired into the Bitcoin protocol. Furthermore, contrary to mainstream economic arguments, deflation is actually a net positive for a progressing economy as it entails increased saving, which spurs investment.

Now, given the contentious debate on deflation and the inherently deflationary nature of the Bitcoin value, it is understandable that this inherent characteristic of Bitcoin has garnered much criticism among the anti-Bitcoin individuals who follow the mainstream schools of economic thought. However, when looking at the recent fluctuations in the Bitcoin price—especially the Bitcoin price fluctuations surrounding the Mt. Gox debacle—some could argue that Bitcoin is not really deflationary, but that Bitcoin value experiences both inflationary and deflationary periods.

Is Bitcoin Value Really Deflationary?

There cannot be, however, any argument over whether or not Bitcoin was designed to be deflationary, there is no doubt that it was. The amount of coins rewarded per block does indeed diminish as more and more bitcoins are mined and the hashing algorithm does indeed get more difficult—thus requiring a higher expenditure of resources—as the Bitcoin mining process progresses. The discussion, then, should be focused on how Bitcoin operates on the market, how fluctuations in the demand for the currency affects the Bitcoin value regardless of the state of its supply.

Those who may argue that Bitcoin is not consistently deflationary may do so on the basis of pointing to the rapid fluctuations in the Bitcoin price that occur regularly. If a currency is deflationary then its value should constantly appreciate, correct? So why does the Bitcoin value suffer from intense and frequent, although brief, periods of depreciation? Why can the Bitcoin price be $1000, only to fall down to $300 in the course of a few months?

The problem here is that it makes no sense to claim that a deflationary currency must always appreciate in value and never suffer brief periods of depreciation. A dip in the Bitcoin price is not a sign of inflation in the slightest, because it is connected to no trends at all. Making this statement would undoubtedly give rise to counterarguments that point to several downward trend in the Bitcoin price through the use of price analysis. Yes, Bitcoin price analysis is a growing practice in the Bitcoin community and it is very important, if done correctly. However, it must be understood that these types of price analyses merely analyze short term movements in Bitcoin markets and are more geared towards those who are investing in Bitcoin. Price analysis of this sort is not a tool for general economic analysis. A downturn in the Bitcoin price, even if it establishes a temporary trend that lasts for several days, or even several weeks, does not negate all of the preceding data. Looking at all of the data from Bitcoin’s 5 year life thus far, we see that the Bitcoin price is on a definite uptrend that has not been broken. If the price fell 100% in one year, but is up 1000% overall, it can hardly be considered a decrease in the Bitcoin value. So while the Bitcoin price may fall and establish a short-term downtrend, it has recovered from all such dips thus far, maintaining its steady upward course.

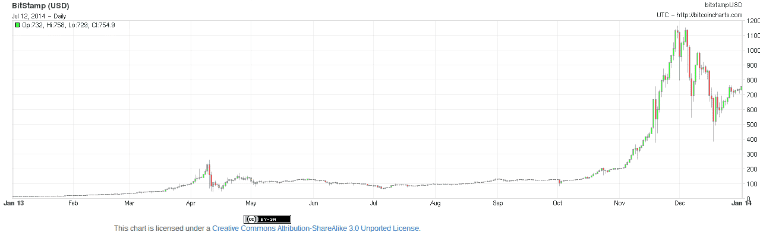

See the Bitcoin price from the beginning of 2013 and at the end of 2013, there is a clear and definite upward trend despite several dips that occurred throughout the year:

Now, it is clear that the Bitcoin price in the first half of 2014 has been on an overall downward trend. However, we are only six months into the year and a new, short-term trend was established in May that is still persisting, which could prove to make 2014 yet another bull year for Bitcoin. See the Bitcoin price from January 1, 2014 to July 11, 2014:

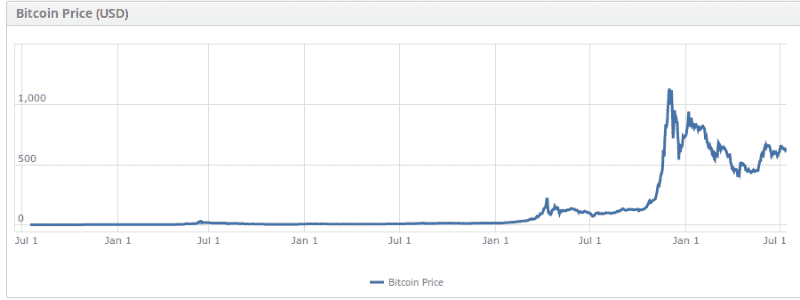

However, regardless of whether or not the year-long trend for 2014 is bullish or bearish, the fact still stands that he entire lifespan of Bitcoin thus far has been marked by steady appreciation of the Bitcoin value. See the Bitcoin price from July 2010 to July 2014:

So, it is hard to deny that Bitcoin has been deflationary throughout its life. Between July 17, 2010 and July 11, 2014, the Bitcoin price has gone from $0.05 to $634 (at the time that this article was written); a net increase of 1267900%! Clearly, the Bitcoin value has had a very strong and definite deflationary trend!

In part two, we will discuss whether or not this deflationary nature is a positive or negative for the Bitcoin economy, as well as the deflation vs. inflation argument in general.

No Comments

No Comments