Bitcoin miners are feeling the heat after Bitcoin Halving. However, is BTC ready to surge above $74,000 with the supply shock?

Bitcoin is cyclic, irrespective of whether you are a trader, HODLer, or miner. After the highs of 2021, prices crashed in 2022, only to bounce back strongly in the second half of 2023.

Those who bailed out, taking a hit, meant they missed the ride to all-time highs.

Though Bitcoin is weaving horizontally just below $70,000, which is at 2021 highs, the uptrend remains, and there could be more room for growth.

This applies if you are a trader or HODLer.

It is very different for Bitcoin miners and associated investors.

Roughly two months after celebrating record revenue when BTC broke $73,500 to register new all-time highs, miners are facing a harsh reality.

(BTCUSDT)

The contraction of prices in May, coupled with the Halving event on April 20, has seen their earnings plummet to the lowest level since October 2023. But there is hope.

Like in the past, analysts expect prices to pierce above $74,000 in a post-Halving rally.

Nonetheless, a critical question remains: Is this revenue slump a temporary bump or a sign of a coming crypto winter?

The Bitcoin Halving Impact on BTC Price

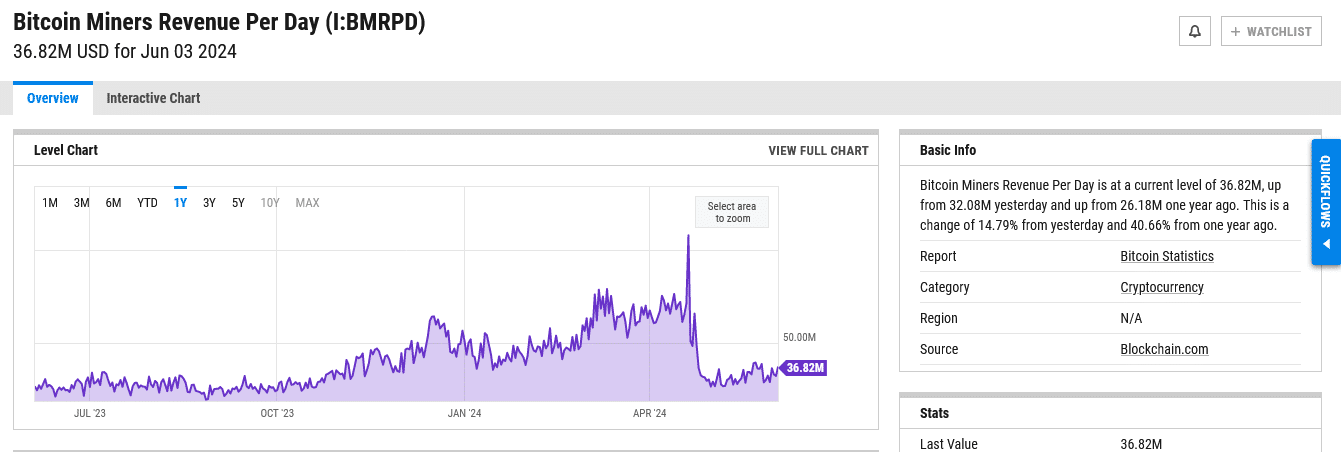

Presently, on-chain mining data paints a sobering picture. According to YCharts, daily Bitcoin mining revenue plummeted from an average of $70 million in April to around $30 million in May.

(yChart)

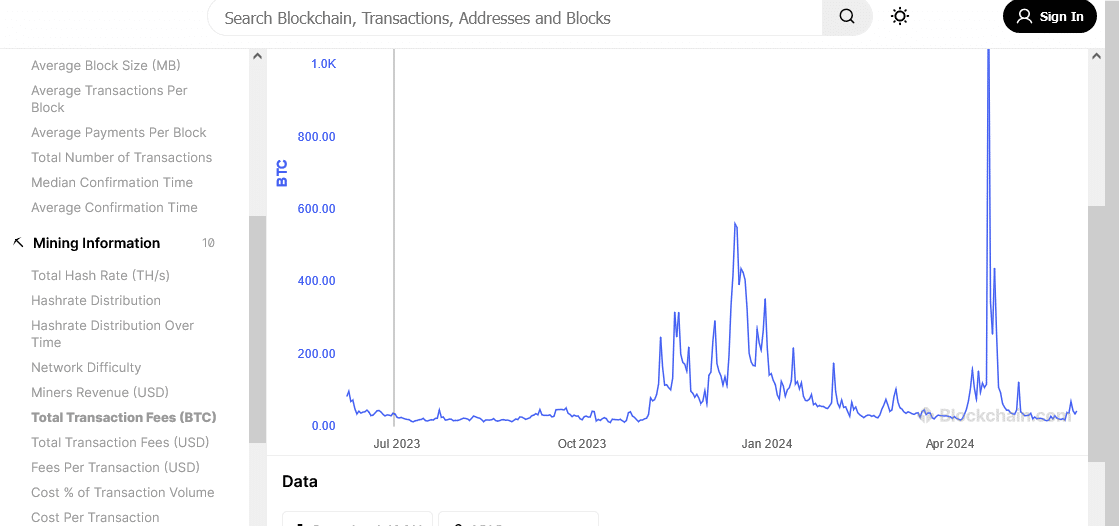

Worryingly, this decline is not just about block rewards—which were chopped on Halving Day—but also in transaction fees.

While block rewards are at 3.125 BTC, transaction fees slightly fell in April, according to blockchain.com data.

The drop was due primarily to Halving, a pre-programmed event that slashes mining rewards roughly every four years.

Every halving is expected to put a financial strain on Bitcoin miners since most rely on block rewards for revenue. There is evidence to highlight this.

Bitfarms, a public Bitcoin mining company, aptly exemplifies these challenges. Mining revenue fell 42% in May as they only mined 156 BTC, down from 263 BTC in April.

Bitfarms attributes this decline to a combination of factors.

Post-halving economics undoubtedly played a role. Even so, Bitfarms said frigid weather at its Argentinian facility forced them to stop operations for eight days.

Bitcoin Miners Update: Is There a Bitcoin Supply Shock?

Despite the current downturn, there are some positive signs for miners. The hash price, a metric reflecting the profitability of mining Bitcoin, improved in May, rising from $47 per PH/s to $58 per PH/s.

It is much lower than the $170 per PH/s registered on April 21. At the same time, prices have stabilized, rising from the $56,500 level registered in May.

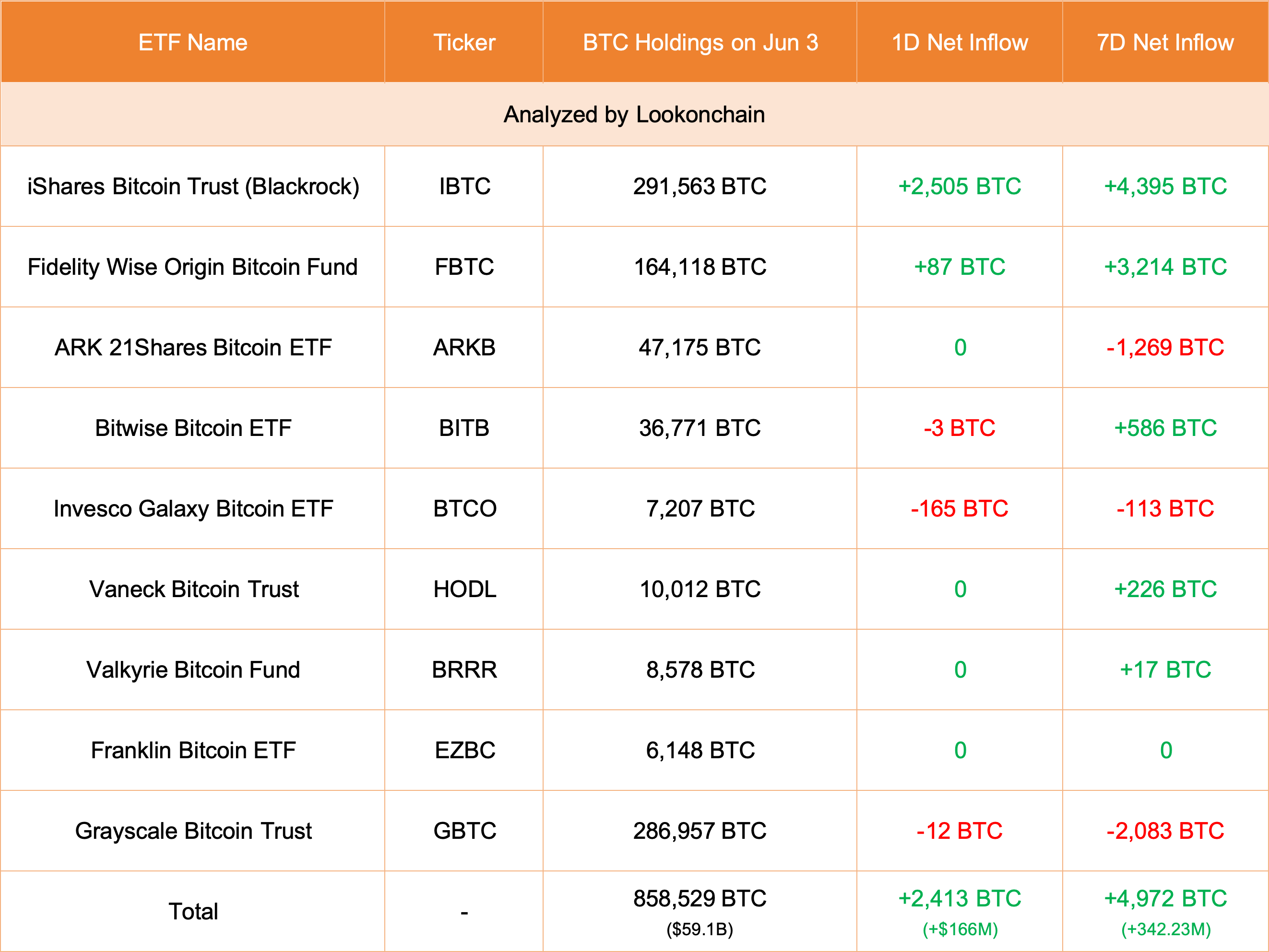

There could be more room for growth in the coming sessions, but demand will play a key role. Encouragingly, inflows to spot Bitcoin ETFs are rising. In the last week of May, issuers have been buying far more BTC than mined.

DISCOVER: How to Buy Bitcoin Spot ETF in June 2024

Yesterday, Lookonchain data shows that issuers bought 2,413 BTC worth over $166 million. Only 450 BTC are mined every day in the current epoch.

If this is sustained, the daily supply of coins will be far less than demand, creating a supply shock that will only benefit bulls.

EXPLORE: Bitcoin “Going” To Cardano Ahead of The Chang Hard Fork

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.