The Beginner’s Guide to Bitcoin Forks

By: Alexander Reed | Last updated: 2/21/24

A Bitcoin Fork is a term describing a split in the Bitcoin network. A fork can result in the creation of new coins that can be claimed by existing Bitcoin owners. In this post I’ll explain in detail what Bitcoin forks are, what risks they entail, and how to claim coins generated from forks safely.

Don’t like to read? Watch the Video Guide Instead

Bitcoin Forks Summary

A Bitcoin fork happens when new code is “branched” out of Bitcoin’s source code in order to slightly change the rules of the Bitcoin network. Soft forks that play well with the old rules, and hard forks that create new rules completely.

Hard forks result in the creation of new coins that abide to these new rules. Each person that held Bitcoins before the fork, will now get new “forkcoins” equal to the amount of his Bitcoin holdings at the time of the fork.

Forkcoins can either be claimed freely using DIY methods or by using services, which take the hassle away but may charge considerable fees.

That’s Bitcoin forks in a nutshell. If you want a more detailed explanation about Bitcoin forks keep on reading. Here’s what I’ll cover:

- What is a Bitcoin Fork?

- Why Should I Care About Forks?

- The Dark Side of Bitcoin Forks

- Step by step guide for claiming coins from hard forks

- Conclusion

1. What is a Bitcoin fork?

I discussed Bitcoin forks initially back in 2017 when Bitcoin Cash was just coming out. If you want a robust technical explanation, you can read the original post. If you want the quick, dirty, easy to understand the explanation, keep on reading…

A Bitcoin fork is basically an alteration of the current Bitcoin code (or protocol). It means someone is changing the rules of the Bitcoin network. Sounds confusing? Let me give you an example.

Imagine you’re playing a game with thousands of people from all around the world and then someone says, “Let’s change the rules.” Normally, for the game to work properly, everyone needs to agree on the rules being changed. If that happens, then the change is implemented and everything continues as normal.

However, if there isn’t a large consensus about the change, two versions of the game will be created – one with the old rules and one with the new rules. In other words, there will be a fork in the game.

The same can happen with Bitcoin’s code. Generally speaking, when a fork happens, you’ll have an “original Bitcoin” and a “new Bitcoin.”

The Bitcoin Cash Fork

Back in August 2017, a Bitcoin fork brought a new coin into existence: Bitcoin Cash. Bitcoin Cash initially changed the block size from 1 MB to 8 MB so more transactions could be processed with each block.

There were those who supported this change and switched to the new coin called Bitcoin Cash (BCH), and there were those who decided to stay with the original rules and keep using the original Bitcoin.

Of course, this is a very simplified explanation of forks, as not all forks are created equal.

There are soft forks, which allow the new rules to play well with the old rules and don’t create new coins. Additionally there are hard forks, which don’t allow this and result in the creation of a totally different coin. Still, most of the Bitcoin forks you’re hearing about are usually hard forks.

2. Why should I care about forks?

There are several reasons you should care about Bitcoin forks:

- You may want to switch over to the new rules and the new coin because you think it’s better than using the original Bitcoin.

- The fork could have an impact on the Bitcoin community, Bitcoin’s adoption, and even Bitcoin’s price (we’ll get to that later on).

- Finally, you may want to profit from the fork by selling the new coins that can be claimed by every Bitcoin holder at the time of the fork.

This last issue requires a little more explaining, let’s go back to our game analogy:

Imagine your game has been running for a very long time, and people already accumulated a considerable amount of points in it. Now someone wants to change the rules but doesn’t want everybody to lose their points.

To make sure of that, it is decided that the new game with the new rules will start with everyone having the same amount of points they did before the rules were changed.

So if, for example, you had 150 points in the original game, you could join the new game and start off with 150 points. In fact, you could even play both games in parallel and have 150 points in each.

How Are Forked Coins Awarded?

When a fork occurs, the people who decide on forking Bitcoin say: “Look, we don’t like the original rules—we want to create new rules. So starting from block number 453,342 (for example), we’ll change to the new rules.”

Once the said block is reached, all Bitcoin holders will now have two types of Bitcoins: the original one and the new one. Holders have an amount of forked Bitcoin equal to the amount of original Bitcoins in their possession at the time of the fork.

So if, for example, you had 1 Bitcoin in your possession when the fork occurred, you’ll still have that 1 Bitcoin, but you’ll also be able to claim 1 “new Bitcoin” on the network that’s running the “new Bitcoin rules”.

But there’s a catch….this doesn’t happen automatically.

You’ll need to claim these new coins. Since each new coin has a different claiming mechanism, I won’t be able to cover them all but I’ll touch some of the main points later down the post.

Once you claim your new coins, you can then hold on to them or sell them if they’re traded on an exchange – just like with any other crypto asset you have.

In other words – thanks to forking you can basically generate money for nothing; all you did was claim coins from thin air and sell them on an exchange.

Easy money… Or is it?

3. The Dark Side of Bitcoin forks

When the forking trend started out with Bitcoin Cash back in 2017, it seemed that the fork was a legitimate way of expressing discontent with the road Bitcoin was taking.

However, since then forks became pretty similar to each other, and it seems like the main reason for creating them had more to do with marketing than actual ideology.

Simply put, if someone thinks they can create a better coin than Bitcoin, they can create a brand new altcoin—there’s no need to create a Bitcoin clone, right?

In my opinion, the way things are nowadays, developers decide to fork Bitcoin for three main reasons:

Marketing buzz

A bit like ICOs, Bitcoin forks are a way to raise funds. Everyone is looking to get free coins, so people are actively looking for information (you’re reading this article, aren’t you?). What better way to get eyes on your project without a lot of work? Just say you’re forking Bitcoin and you have all the attention you want.

Quick money for developers

Some of these forks aren’t really copies of Bitcoin’s history. The rules are changed in such a way that developers receive a large initial amount of the new coin, which they can then dump onto the market once the coin starts trading.

In other words, the developers could have developed a cryptocurrency from scratch but decided to branch it out of Bitcoin so they can have a nice amount of buzz and coins to start with.

Scams

Some forks, such as Bitcoin Platinum, are flat-out scams. Scams can come in the form of forks that are created to short Bitcoin’s price (e.g., Bitcoin Platinum) or something more elaborate such as forks that are created to steal users’ real Bitcoins in the process of claiming the new coin (e.g. Bitcoin Gold fake wallet).

4. Step by Step Guide for Claiming Forks

Step 1 – Important Guidelines

Claiming forkcoins involves considerable risks, and requires some advanced knowledge. Before moving any further to claim coins from a fork, make sure to read the below safety tips and general guidelines:

Guideline #1: Move your coins to a new wallet

I cannot emphasize this enough (and will probably repeat this again later on), but the one rule you should always follow before trying to claim any forkcoin is to move your Bitcoins to a new Bitcoin wallet with a new seed phrase.

At some point you’ll need to share your private key with the fork’s wallet or a fork claiming tool. You don’t want to share a private key of an active Bitcoin wallet.

As you can never be sure of new software, the only safe way to claim forkcoins is to first move all your bitcoins to a new wallet. Once the BTC has been safely moved, they can’t be harmed. Taking this step will eliminate the risk of having your Bitcoins stolen.

Note: If you’re still using a Legacy Bitcoin wallet (with addresses starting with 1), claiming these forks is an excellent motivation for moving your coins to a SegWit wallet. Doing so will reduce all your future transaction fees, and prepare you to use the Lightning Network.

Guideline #2: Get to know the fork

As a general rule of thumb, I’d suggest reading a bit about a project, before you take any step to claim its coin. Find out who the developers are, what their track record is, how far along they are in their road map, what have other publications written about them, and the like.

If all that makes sense to you, then perhaps the fork is indeed legit.

Guideline #3: Risk Vs. Reward

Even if a fork is legit, it doesn’t mean it’s worth going through the hassle of claiming its coins. The claiming process is usually complicated, and you risk losing your coins if you don’t know exactly what you’re doing.

Say you’re holding 0.5 Bitcoins, and you’re eligible for 0.5 Bitcoin Gold. I’m not sure the immediate profit is worth the risk. This is a personal decision you should make.

In order to determine the risk-reward ratio there are several aspects you should check:

Fork Height

This is the time and date (measured in Bitcoin block height) when the fork took place. Any address in a Bitcoin wallet that contained any value at the time of the fork will be eligible for forkcoin rewards. A Bitcoin address that received value after the fork won’t be eligible for any forkcoins.

Reward Ratio

Forkcoins are often awarded in direct proportion to the amount of bitcoin in each address (e.g. 1.582 forkcoins for 1.582 BTC) but this ratio can vary. For example, Bitcoin World awards 10,000 BTW for every 1 BTC.

Transaction replay protection

On some forks, someone with bad intention could broadcast on the original network the transaction you sent on the forked network, and by doing this steal your coins. Make sure a fork has transaction reply protection to protect you from such cases.

Available markets

You need to make sure where you can sell or trade your forkcoins once you’ve claimed them. Small, unknown forks, may not even be traded at all. In the end, you don’t want to risk your Bitcoins for coins that can’t be traded for actual money.

Guideline #4: Choose your guide Wisely

Follow guides only from well-known wallets (e.g. TREZOR, Ledger, etc.) or credited publications. Still, keep in mind that in the end, it’s your money, and no publication will be able to take responsibility if you do something wrong along the way.

Step 2 – Initial Preparations

Export your Private Keys

To claim most forkcoins, it’s necessary to export the private keys from your old wallet by using a format that the import tool (described below) can read. Please see your particular wallet’s documentation for instructions on how to export your private keys.

In most cases, a file will be generated that contains all your addresses and their respective private keys.

Certain wallets, especially hardware wallets, won’t allow you to export the private keys. In such cases, it’s necessary to enter your hardware wallet’s seed phrase into a tool (such as Ian Coleman’s BIP39 Tool ), which should be run offline. Another option is to import your seed into a compatible HD wallet, such as Electrum.

Check Balances and Make a List

To save time, don’t import private keys that contain no value. You can use tools like findmycoins.ninja to check the claimable forkcoin balance of your old Bitcoin addresses.

Record all valid addresses and private key combinations in a text file or spreadsheet. Use any type of file that allows you to easily copy, paste, and replace text. The recording format should be a private key, followed by the address.

Also, number each entry, and note the approximate amount of Bitcoin that they contained at the date of the earliest fork that you’re eligible for. Numbering each key pair will prove helpful for ordering purposes.

Noting the sizes may also prove useful. For example, you can pull out the largest-valued address for rapid-exchange funding or the smallest-valued address for testing purposes.

Step 3 – Claiming the Forked Coins

It’s possible to download the official wallet of each forkcoin in most cases, then sync its blockchain and import your private keys. But this method takes a lot of time and it’s possible that a wallet may contain malware.

There are two safer, faster DIY methods available for claiming the current crop of forks:

DIY Method #1 – BitPie & Bither

BitPie & Bither are two Bitcoin wallets. When used together, they allow you to claim several fork coins, including BTP (a coin that is otherwise impossible to sell). It doesn’t work with SegWit addresses (i.e., addresses that start with 3, not 1) and has fairly high transfer/claiming fees.

We will use Bither to extract forkcoins and BitPie to sell them. There’s some partnership between these two wallets, and it seems that Bither will reject non-BitPie addresses when claiming.

Bither is featured on the Bitcoin.org site, so it should be fairly reliable. The Bither wallet is available for smartphones (including Androids) and desktops, whereas BitPie is best used on an Android. Even though BitPie is also available for iOS, there have been several reports of difficulties when using that operating system.

If you don’t have an Android or would prefer to do everything on your personal computer, install the BlueStacks Android emulator.

You’ll need a Google account to access the Google Play Store, in order to install BitPie (and Bither, if you so choose) within BlueStacks. You may be able to get around this requirement by downloading the .apk files.

Judging from past experience, BitPie is updated with wallets and an exchange function for most new forkcoins. Once claimed, this exchange can also be used to sell the forkcoins.

For a quick overview of the process, watch this video tutorial (first-time users should use the text version and not the video tutorial).

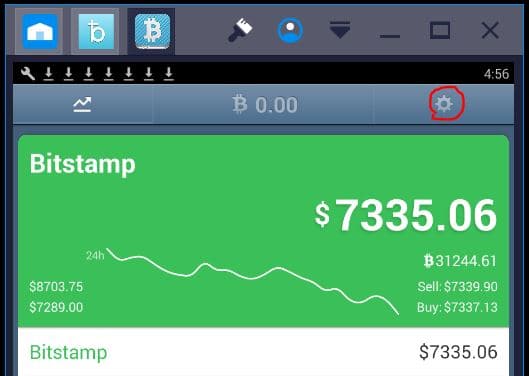

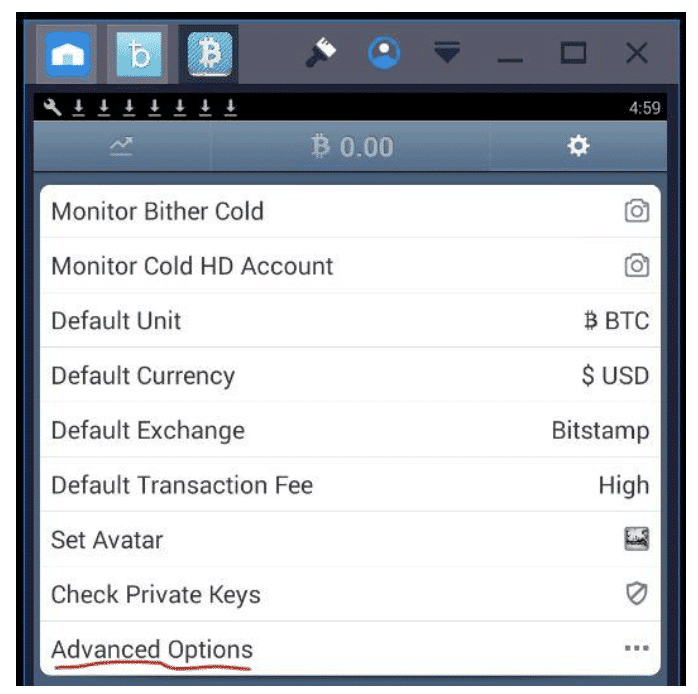

- Open the Bither wallet, complete the setup process, backup your seed phrase and password, and select the gear icon at the top right:

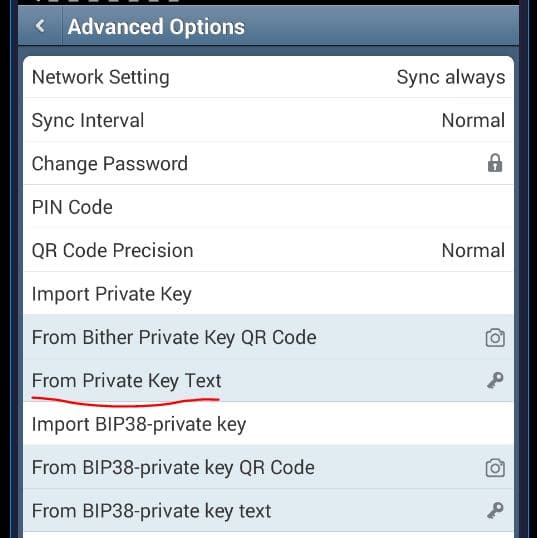

- Select “Advanced Options” >“Import Private Key” > “From Private Key Text”

- Paste your private key as text (which you should have obtained from Ian Coleman’s tool or your new wallet).

- Bither will ask for the password you set for it, depending on whether you import the private keys in a compressed or uncompressed format.

- Select compressed.

- Repeat this process for all private keys/addresses that contain a claimable balance.

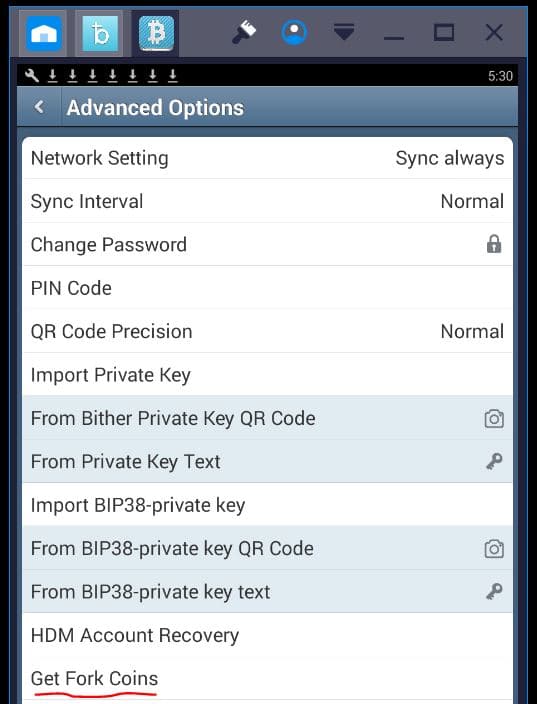

- After importing all the relevant private keys, click “Get Fork Coins” in Bither:

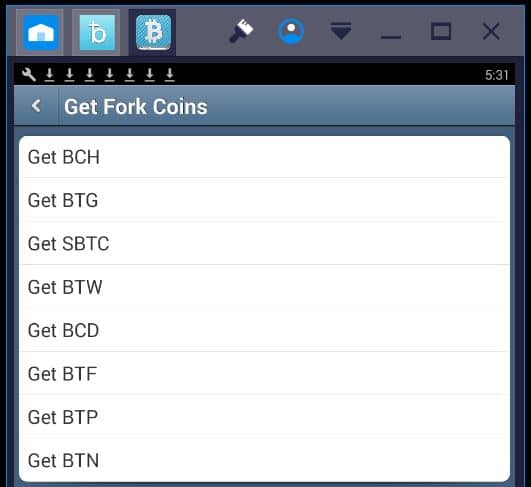

- Select the forkcoin you wish to claim:

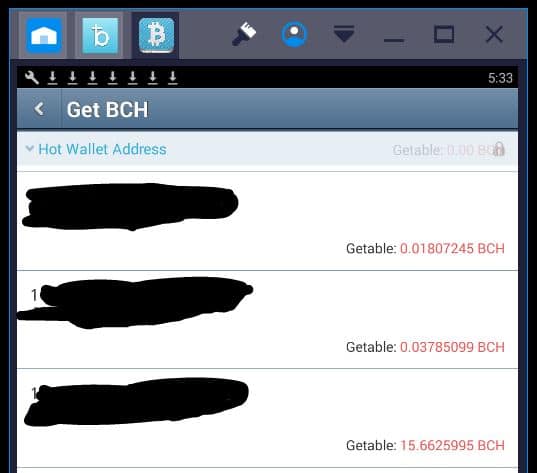

- Here, BCH has been selected. Addresses are displayed on the left, and their claimable balance is on the right. Previously claimed addresses will be marked as “You already got XXX.”

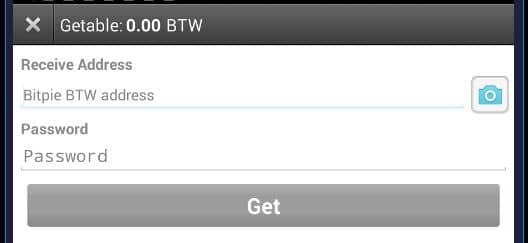

- Click all “Getable” balances:

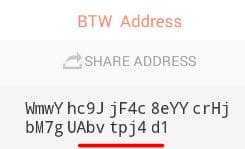

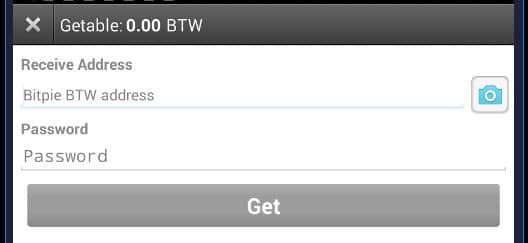

- Bither will specifically request a BitPie address to send to:

- Open BitPie

- Complete the setup process,

- backup your seed and pass

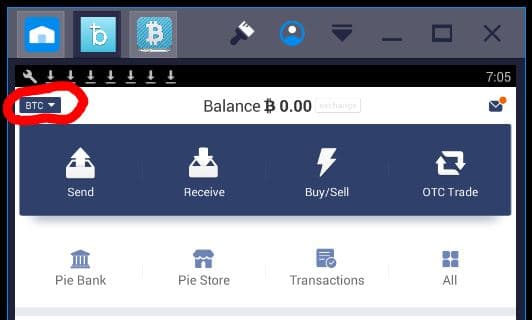

- You can switch between coins from the dropdown menu at the top left:

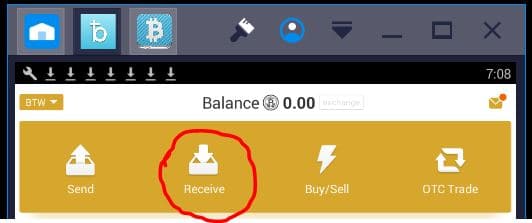

- Here, Bitcoin is selected. Navigate to whichever forkcoin you wish to claim within Bither, and hit the “Receive” tab:

- By clicking the address displayed below the QR code, you will copy it to the clipboard:

Go back to Bither, enter the address, and click “Get”:

- After a few seconds, you should get a notification from BitPie about incoming funds. Repeat the process from Step 6 (where you click “getable balance”), until all addresses are claimed.

Warning: BitPie’s UI is such that it’s easy to mistakenly select the wrong coin. Always double-check that you’re using the correct type of coin, in order to claim your receiving address.

DIY method #2 – Ymgve’s fork claimer

Another DIY way to claim forkcoins is Ymgve’s excellent script. Ymgve’s script supports SegWit addresses and has lower mining fees than BitPie/Bither, which gives it a significant advantage over the previous method.

More than that, Ymgve’s script allows you to send coins to any address, so claimed coins may be sent directly to your exchange’s deposit account.

On the downside, the script does require use of the command line, and is a bit more complicated.

While the script apparently requires you to enter about 180 random characters for every address you claim, the workload can be greatly reduced with some judicious copying, pasting, and replacing. In this guide, I will share my copy-paste method that saves me a lot of time.

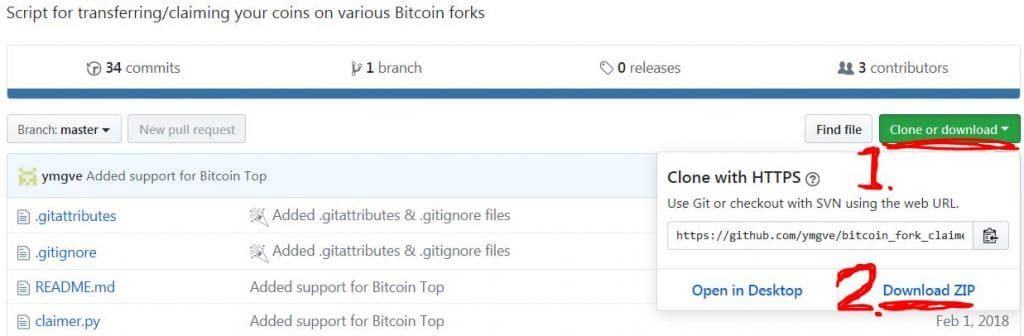

- Visit the GitHub page. It will explain that you need to install the Python 2 (not 3) programming language first, which you can download here.

- Download the script as a .zip file:

- Refer back to the list you made of claimable addresses (in the beginning of this chapter).

- Look up each of these addresses using any Bitcoin block explorer, and find the Transaction ID (txid) of the last transaction before forktime.

- Enter each txid into your list, above the private key.

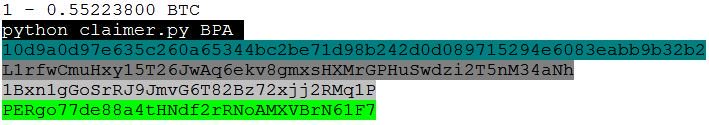

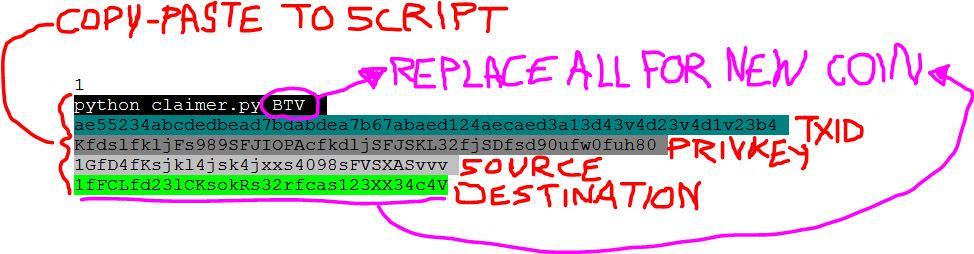

- Above TXID, enter the following text: python claimer.py XXX (XXX is a substitute for the ticker code of whichever coin you wish to claim e.g. BCH, BPA, etc.). The format of your list should now look like this (the parts to copy and paste have a highlighted background):

- (Entry Number) – (Approximate amount)

- python claimer.py XXX

- TXID [obtainable from block explorer, last transaction before forktime]

- Private Key

- Source Bitcoin Address

- Destination Forkcoin Address [deposit address, obtainable from exchange]

*Ensure that your list doesn’t contain line breaks (“enters”), as they will cause the information to be entered over multiple lines when pasted into the script, which causes the script to fail.

In this order, this list will save you a great deal of time when entering commands for multiple addresses and forkcoins into Ymgve’s claimer tool.

Entering the necessary commands by hand will take forever, and has a very high chance of error.

- In Windows, do not run Python from its .exe file. Instead, launch a command window and navigate to the directory where you installed the script. If you use Linux, you should have no trouble with this step.

- Select the coin you wish to claim e.g. BPA.

- Save your list by using a file name that reflects the coin you intend to claim (e.g., scriptBPA.txt).

- Use your text editor’s “Replace All” function to replace XXX with the coin’s code (XXX becomes BCH).

- Important! Before executing the command, ensure that you’re able to withdraw from the exchange without completing the verification procedures! This is a very important step; In case these procedures fail or the exchange requires info that you’re unwilling to share, you might end up with your coins trapped.

- Use your text editor’s “Replace All” function to set the Destination Forkcoin Address to the correct one for depositing forkcoins on your chosen exchange.

- Highlight and copy (CTRL-C or right-click copy) the following information from your list:

Python claimer.py BCX [or whichever supported coin-ticker you’re claiming]

TXID

Private key

Source Bitcoin Address

- Right-click the command window, paste this information in the command line and click ‘Enter’. If everything is correct, the script will ask you to confirm your command by entering the following text:

I am sending coins on the [relevant] network, and I accept the risks.

You may copy the above text for pasting purposes, as it will have to be entered again for every address you claim. Alternately, if you’ve already entered the disclaimer, then you should be able to repeat it automatically by pressing the up arrow.

- Allow the script to run for a while. It will either fail, succeed (usually within a minute or so), or get stuck in a cycle of retrying connections. In the latter case, you can cancel the script (control-C in Windows) and move on. Note what happened with each address, so that you can retry failed or stalled addresses later.

- Move down your list of addresses and private keys. Once you reach the end, save the file under the name of the next forkcoin you wish to claim, then replace the ticker codes and destination address.

- Repeat as desired, or until all your forkcoins are claimed.

Consider sending Ymgve a thank-you note about his excellent script, which he continues to improve. Here’s his Bitcoin address: 1HDW5sy8trGE8mEKUtNacLPGCx1WRtebnp

Fork claiming services

If you don’t fancy the DIY approach, you can pay a percentage (usually around 5%) of your forkcoin profits to experts who’ll handle the process for you. This is the easy way, but I can’t vouch for any of these services since I’ve never used them.

The ones listed here all seem to have received a lot of positive feedback. Besides CoinPanic, they’ll require your private keys.

- Reddit user Camku can claim and sell just about anything and seems very helpful.

- CoinPanic is an interesting service, which doesn’t demand your private keys for claiming.

- Loyce has a claiming service on the BitcoinTalk forum and has a lot of positive feedback.

DIY vs Claiming Services

BitPie is fairly easy (although not without bugs and delays) and is currently the only way to sell the forkcoin known as Bitcoin Pay (BTP).

Although the BitPie exchange usually has worse prices than regular exchanges, it doesn’t require any personal information. You should avoid storing funds long-term in the BitPie wallet, as its security properties are unknown.

Ymgve’s script is excellent. You’ll probably extract the most BTC and education by using it. As it’s usually updated whenever a valid coin is released, it’ll probably be the quickest path to claiming and selling new forkcoins.

It has low fees and supports many coins. However, it can be a little time-consuming and is perhaps tricky for newcomers.

The various claiming services can save you a lot of hassle, and allow you to sell at various exchanges without the verification processes. However, these services take a percentage and require trust. Research each service or provider before using it!

5. Conclusion

Bitcoin forks are changes made to the Bitcoin rules or protocol; Soft forks are slight changes that comply with the existing coin while hard forks result in a new type of coin. Bitcoin forks allow you to claim coins out of thin air, however, you need to be careful not to get scammed.

There are several ways to claim coins from forks; DIY methods offer you better rates and more security while using claiming services are faster and easier, but most will charge you 5% fee.

I believe that in the future the overall buzz about forks will probably die down, as more and more people understand that many of the forks are usually worthless and don’t have any clear ideology behind them.

That’s it! If you have any comment or personal experience about forks you wish to share, let me know in the comment section below.

Bither app no longer has option “Get Fork Coins” ?!?!!?!?!?!?

Conomi App seems to do it

I

m trying to import a private key from a paper wallet to Bither. After scanning the QR code I am asked to "Enter original password". Which password? The paper wallet is not encrypted... What should I type there? Trien Bither wallets address but it didn`t work… How do I import private keys which are not password protected?It’s asking you to set password for Bither

The methods to claim the forkcoins are a cery difficult read. I do not understand them. Perhaps the main lesson here is, don’t pay atention to forks.

Hey I’ve been reading your stuff because I’m looking to join crypto currency. I have a settlement coming soon and was thinking about buying a little bit Bitcoin and letting it grow and get a Bitcoin Mining Rig – 1 Gpu, Alt Coins, Pro Crypto Currency Miner Bit for 1200 and add more Gpu’s to it with Max power being 1000w or if anyone has a recommendation on one. And just mine while my bitcoins grow. Is this a good or bad idea, help?

Hi Mikah,

Well, you can’t mine bitcoins with a GPU, you need specialized ASIC hardware for that. Check out our Let’s Mine section up top for more info. You can mine certain altcoins, such as Ethereum, using GPUs however, and convert them to BTC. It’s quite a lot more work that way however, so the easiest and safest way is just to buy Bitcoin and hold it, ideally in a hardware wallet for max security. See our Get a Wallet section for more on wallets.

Bitcoin Myk check out that fork. mykoscoin.com

FEB. 2018 Bitcoin Euro is started bitcoineuro.io