Bitcoin price is falling from its ATH range, however, one analyst says BTC will recover post Halving event in an anticipated return to new ATHs during late Q2 2024.

Fear is gripping the market: Bitcoin price is falling.

It wasn’t meant to pan out like this, at least according to what most jubilant Bitcoin bulls thought – Bitcoin was to roar, one way, to $100,000 and later $1,000,000 this year.

However, that’s not how crypto and trading work. Bitcoin price is under immense selling pressure and appears to be cracking.

One analyst is bullish, comparing the current price action to the 2014 to 2018 cycle.

Bitcoin Price: Here’s Why One Analyst Says BTC is Buoyant

Taking to X, the analyst oozed confidence in what lies ahead, saying prices will recover sharply and break above the immediate resistance level.

(Source)

However, before then, traders should only prepare to survive the “halving and pre-ATH chopfest.”

Currently, BTC is within a broad range, with resistance at $73,800 and support at $61,000.

After the network halves, scheduled for April 19, analysts say the coin will soar, breaking above all-time highs of $73,800.

Historically, prices tend to rise post-halving, breaking all-time highs – some speculate that BTC may soar to as high as $200,000.

(BTCUSDT)

The difference between then and now is that BTC registered fresh highs before halving, a deviation from historical trends, that suggests some concern that this cycle could have been front run.

BTC ETFs Facing Strong Headwinds – Here’s Why

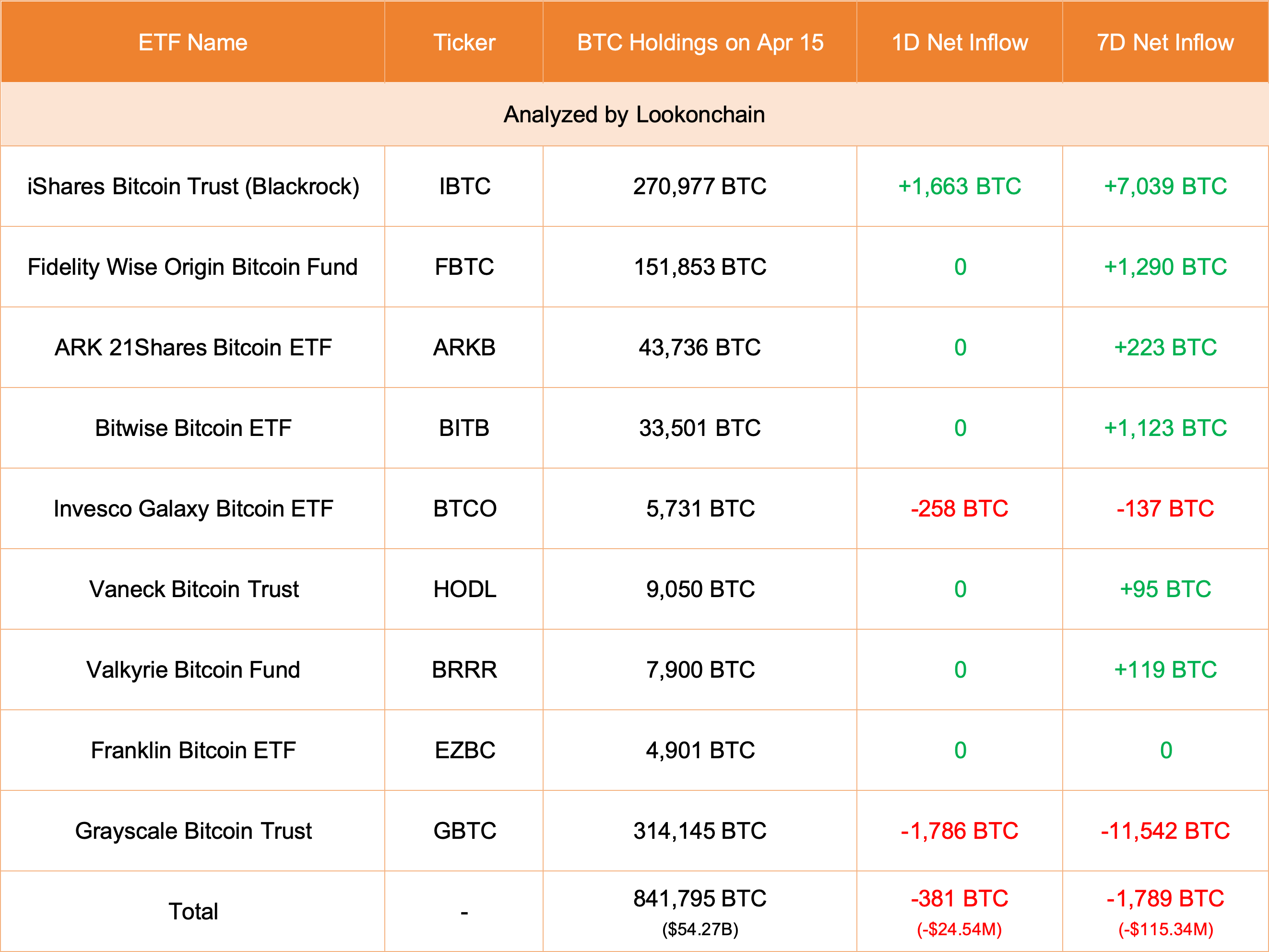

Even with this confidence, Bitcoin is currently facing strong headwinds. The slowdown in inflows to spot Bitcoin exchange-traded funds (ETFs) has dampened investor enthusiasm.

According to Lookonchain data, spot Bitcoin ETFs in the United States saw outflows of around $25 million on April 15.

Notably, only BlackRock’s IBIT recorded inflows, receiving $107 million. BlackRock now holds nearly 271,000 BTC on behalf of its clients.

Whether this will recover will largely depend on prevailing sentiment. The escalating political tensions in the Middle East have led to uncertainty in the global market, diminishing risk-on sentiment and dampening confidence.

Over the weekend, in the wake of Iran’s attack on Israel, Bitcoin price crashed to around $61,000 – however, with a Halving Event imminent – stay tuned!

EXPLORE: Best Gold-Backed Crypto: Could These Coins Offer Best Hedge Against Iran War Political Risk?

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

No Comments

No Comments