Find out how the expiration of Bitcoin options and crypto options worth $8.12 billion could influence the crypto market. Stay informed about potential price action.

With $8.12 billion in Bitcoin and Ethereum options expiring today, the crypto scene is on high alert for any market moves.

Bitcoin’s share is $4.65 billion across 261,390 contracts. Deribit data shows a put-to-call ratio of 0.6, pointing to bullish trader sentiment.

(GeekLive)

The maximum pain point for these expiring Bitcoin options is $65,000, according to Geek.Live data.

Similarly, Ethereum options are also seeing a major expiration today, with 2,750,922 contracts set to expire, worth $3.47 billion in notional value.

The put-to-call ratio for ETH also slightly favors calls over puts.

Crypto markets are poised for extreme price action based on this news.

May 31 Options Data

69,000 BTC options expired with a Put Call Ratio of 0.37, a Maxpain point of $66,000 and a notional value of $4.7 billion.

920,000 ETH options expired with a Put Call Ratio of 0.46, Maxpain point of $3,300 and notional value of $3.5 billion.

The crypto market… pic.twitter.com/1yMZymIcYZ— Greeks.live (@GreeksLive) May 31, 2024

Crypto Options: Current Market Sentiment and Volatility

Right now, millions in open interest are betting on Bitcoin to reach $70K, $75K, $80K, and even $100K.

Greeks.live says volatility will stay low, setting up a good scene for options trading. Expect some price drama from these expirations, but don’t worry too much—markets typically level out by the next day.

DISCOVER: How to Buy Bitcoin Anonymously in 2024

May saw the SEC greenlight a spot ETH ETF, sparking a 20% rise in ETH prices. Yet, the approval was just for the 19b-4 filing, delaying the real action.

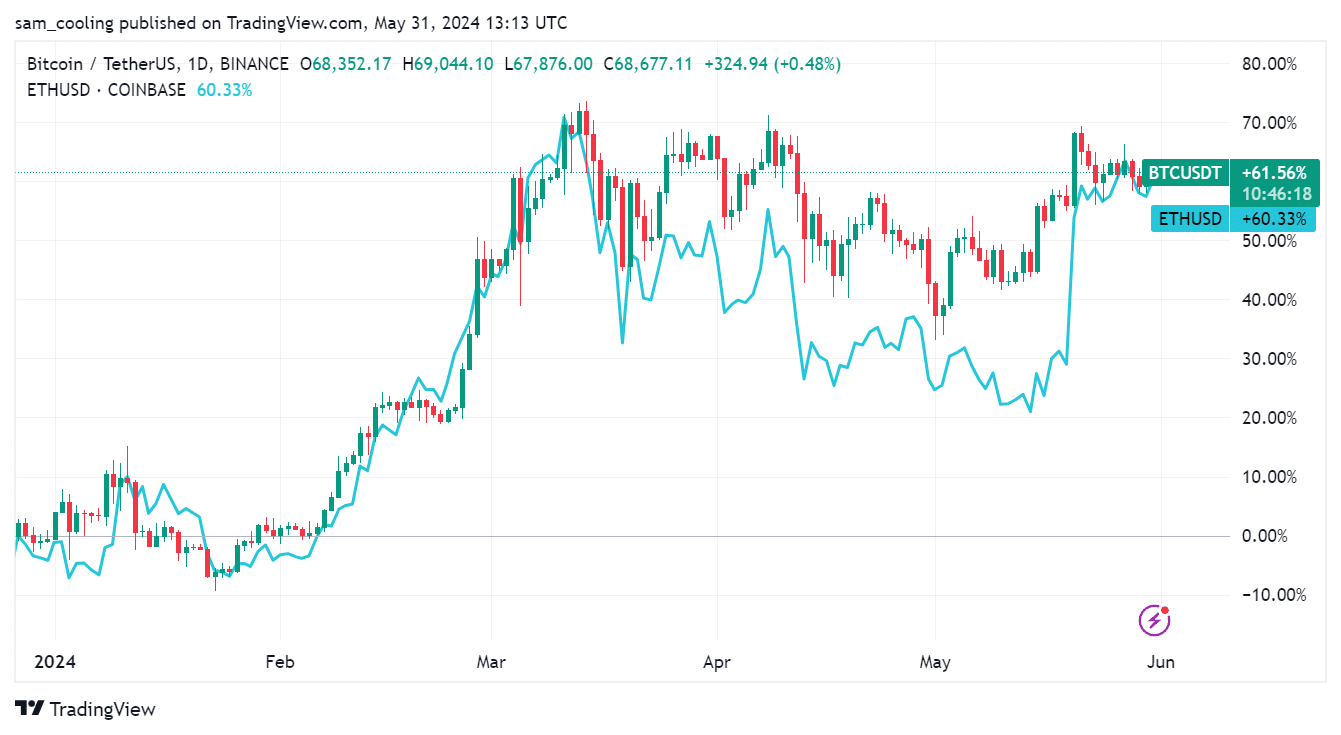

Post-approval, the market’s been stuck in neutral. ETH remains below $4,000, and BTC is under $70,000. The recent bullish run is now correcting into a bearish phase.

(BTCETH)

The Bottom Line: Keep an Eye on the Market

History shows any wild moves are usually short-lived. Traders should keep a close eye on key indicators and stay sharp.

This massive expiry highlights the crypto market’s growing sophistication. Whether you’re a pro or a rookie, grasping these dynamics is crucial. Stay alert—today’s expirations could lead to some interesting action.

EXPLORE: Crypto Whales Rinsed By Latest Phishing Scam – Here’s How to Avoid $6.9M Losses

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.