A little over three months ago, SegWit, a Bitcoin upgrade, was activated after a long and hefty debate. The result of this debate also created an altcoin called Bitcoin Cash, which was created as the opposition to the Segwit solution. Now, we’re on the verge of another split in the Bitcoin network called Segwit2x. For a complete history of everything that’s happened until now, read this post.

The much-awaited Segwit activation came with a condition: a block-size increase within three months of activation (i.e., a hard fork). Miners who were initially against Segwit activated it under the terms of the so-called New York Agreement (NYA). The NYA is also known as the Silbert or DCG Agreement after Barry Silbert, the deal’s broker and the founder of the Digital Currency Group. Silbert brokered the deal between various industry players, most notably mining firm Bitmain, the Coinbase exchange, and the BitPay payment service.

The SegWit soft fork is seeing steadily increasing usage to the network’s benefit (such as lower fees). Further dependent improvements (chiefly, the development of the Lightning Network) are virtually assured. Focus has now shifted to the NYA’s final part, which demands a mid-November 2017 hard fork to increase block size.

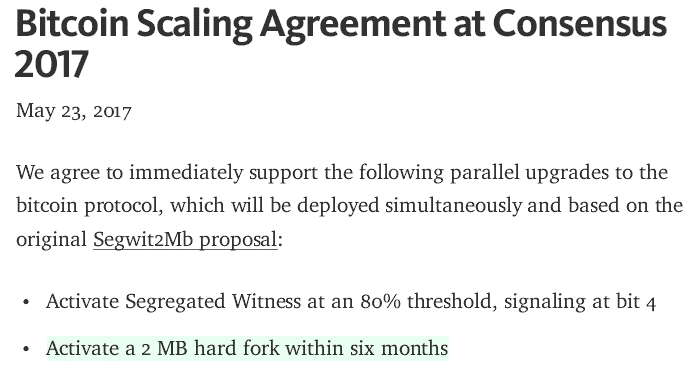

Text from the agreement’s announcement on Medium.com

This hard fork is now commonly referred to as SegWit2x, or “S2X.” S2X is implemented in code as btc1 by former Core developer and Bloq CEO Jeff Garzik. It’s scheduled for activation at block height 494,784. The estimated time remaining is displayed via the 2x Countdown site.

6 Major Objections to the NYA

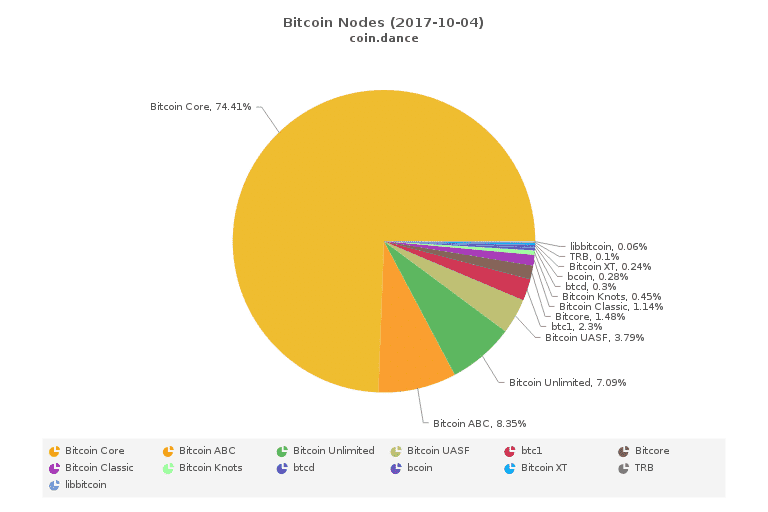

NYA has proven highly unpopular among the Bitcoin user base, judging by commentary and activism across various media platforms. Many Twitter users have adopted the NO2X tag to signal their resistance. As more concrete evidence, consider the number of nodes (97.7% at the time of writing) that have chosen not to switch to btc1:

A breakdown of recent Bitcoin client distribution from Coin.dance; btc1 is displayed as khaki.

Here are the top six objections to the agreement:

1) The primary objection is political. Although the meeting was called “Consensus,” it involved only a small sample of CEOs. The NYA was concluded without input from Bitcoin developers, a majority of companies, or millions of users.

2) As SegWit and its related improvements have already upgraded the transaction capacity of Bitcoin blocks, there’s no pressing need to raise the block size further. Blocks are far from congested. Thus, the secondary aim of the NYA lacks justification.

3) As hard forks are inherently and unavoidably risky and disruptive, they’re best reserved for emergency usage. The only exception is a hard fork with unanimous support that’s been planned long in advance. Forcing through a hurried hard fork with only minority support for no tangible benefit (see point #2) will likely achieve nothing besides chaos and the creation of an S2X altcoin.

4) Multiple Core developers are on record as likely to halt all code contributions should S2X become the dominant chain. All contributors who’ve made their positions known have indicated their rejection of S2X. Without the competence and experience of these developers, the future of Bitcoin is highly uncertain.

5) S2X does not include comprehensive replay protection. This means that after the fork, a transaction on either chain may be “replayed” on the other. This is dangerous and likely to lead to losses. Users who are unaware of this issue will send equal amounts of both S2X and BTC whenever they attempt to send only one kind.

6) S2X has deliberately opposed Core’s attempts to prevent a messy network split with certain code in the 0.15 and later releases.

The NYA: Less than the Sum of Its Parts

In the course of our assembling a spreadsheet of companies listed in the NYA, some interesting facts emerged. Let’s begin with a simple count of the signatories:

Total Number of Signing Entities: 56

This is a fairly impressive number at first glance, but it doesn’t hold up to closer examination. Further, it is outweighed by the number of companies that have withdrawn from or never signed the NYA. This list of nonparticipants shouldn’t be considered complete either; countless companies and projects have simply not expressed a preference either way. It also remains to be seen how many miners will redirect their hash rates from pools that don’t follow their preferred chains.

Total Minus Individuals: 54

From this total, we can subtract two individuals: Gavin Andresen, a former Core developer, and Guy Corem, the former CEO of defunct ASIC manufacturer Spondoolies. Because neither individual is an active developer or CEO, their support for SegWit2x is unlikely to extend beyond PR or perhaps the running of a node. As such, they may be discounted as no more influential than any other Bitcoin user.

Total Minus Individuals and Yours: 53

Ryan X. Charles’s “Yours” startup is a signatory; however, about a week before signing the NYA, Charles announced his decision to switch his project from Bitcoin to Litecoin. As such, Yours has no real stake in the future of Bitcoin and may be discarded as irrelevant.

Total Minus the Foregoing and Subsidiaries: 46

From this total, we may safely deduct the signatures of all subsidiary companies as redundant.

1) Bitmain manages and supplies a number of signatory pools: 1Hash, BTC.com, and BTC.top. All of these pools’ contact details point directly to Bitmain. ViaBTC has already broken the terms of the NYA by mining Bcash, and it’s received about ¥20 million in funding from Bitmain and private investors.

2) Two DCG subsidiaries signed the NYA: Grayscale Investments and Genesis Global Trading.

3) Decentral is the Canadian “innovation hub” that develops the multicoin Jaxx wallet. Counting Decentral and Jaxx as separate entities makes little sense.

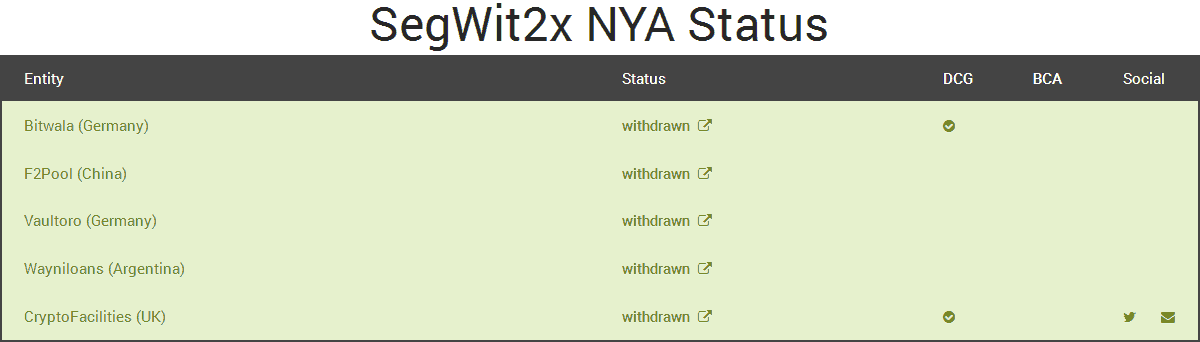

Total Minus the Foregoing and Firms That Have Retracted Support: 41

SegWit.Party displays updated stats on S2X support, along with links to evidence of position changes. It indicates that five signatories have thus far publically withdrawn from the NYA:

Total Minus the Foregoing and DCG-Funded Firms: 16

If we next subtract all the companies that have received funding from the Digital Currency Group according to DCG’s portfolio page, we’ll reach a less-impressive total of a mere 16.

Given that DCG is, in many cases, the majority investor in such companies, these firms may arguably be considered tantamount to subsidiaries. After all, major investment tends to purchase a degree of control, especially over small startups.

This may be the most questionable subtraction, as in many cases, the amount of funding received—and thus, the degree of DCG’s influence—is unknown. It may be that some of these companies are capable of operating entirely autonomously of DCG.

Preparing for the Split

Users who were present for the Bitcoin Cash hard fork should have an idea of what to expect. The first rule is to get your coins into a wallet that is under your control. This means moving your coins off exchanges or any other web wallet. Make sure you have access to your private keys.

As the fork date comes closer, more and more exchanges will probably release statements regarding their plans to handle it (e.g., Coinbase’s statement and Bitfinex’s statement).

The major difference this time around is that it won’t be safe to spend coins after the split has occurred due to the lack of replay protection. At this time, we advise all Bitcoin owners to sit tight and wait for a clear plan of action. It may be necessary for users or companies to manually separate their coins, although there are as of yet no clear guidelines for doing so. We would advise users not to trade around the time of the split and to wait for the “all clear” before resuming normal operations.

Hash Power and Block Times

Unsubstantiated leaks have circulated of late indicating that some major miners fully intend to redirect their hash rates to S2X and perhaps even to attacking the incumbent Bitcoin chain. The more hash rates that switch chains, the slower the blocks on the other chain will be until the difficulty adjusts.

While the removal of significant hash power could result in delayed transactions and higher fees for a time, the market would likely correct the imbalance. The situation would be similar to Coke’s exiting its market: soda would be undersupplied only until the remaining competitors ramped up their operations.

What about “Bitcoin Gold”?

Some of you may have heard about Bitcoin Gold, but this has nothing to do with Segwit2x. Bitcoin Gold is yet another hard fork that is planned for October 25th. We’ll elaborate on it further in a different post.

To Conclude: Keep Calm and Own Your Private Keys

In the end, November’s upcoming fork seems like almost the same story all over again. Users should keep their private keys at hand and refrain from conducting any transactions until the coast is clear. What will happen to Bitcoin, its price, and its adoption? No one can really say. This is just one more “free market” exercise we’re going to have to experience in real time.

For a full list of Segwit2x opposers, visit NOB2X. Feel free to add your company as well if you feel like it. What’s your opinion of S2X and the New York Agreement? I’d love to hear it in the comment section below.

65 Comments

65 Comments

So, I have some open orders on Cryptopia based on an altcoin I am waiting to do something specific. I know leaving funds in an exchange is not recommended, but that said and in my case it being necessary for now, is this exchange something you’d consider safe (as far as exchanges go) in terms of leaving it there versus an Abra or Coinbase?

Hey Shanks,

I’ve used Cryptopia (they’re in New Zealand, right?) and they seem OK… The thing with exchanges is, you only really know there’s a problem with them when there’s a problem – if you see what I mean.

Sometimes there are early warning signs but oftentimes problems occur with no warning. As far as I know, very few exchanges offer anything like multisig accounts or hardware wallet integration which might prevent user losses.

I recommend following cryptocurrency trading social media channels, like reddit’s r/cryptocurrency, as users there will be among the first to report problems with any altcoin exchange. For Bitcoin, reddit’s r/bitcoinmarkets is also good for exchange alerts.

Good article.

I do have a question about the fork.

I currently have my BTC in my ledger nano S, I am in the process of purchasing more bitcoin and plan on storing it in my Ledger nano S as well.

My question being this……

If I have say .5 BTC i my ledger at the time of the BTCG fork and then move .1 out of my Ledger to an exchange for trading, will my ledger get credited with the full .5 BTC that was in my ledger at the time of the BTCG fork?

I’ve been wanting to send some BTC to an exchange to make some altcoin trades but am afraid to because I don’t want to miss out on the free BTCG (Even though it might not do great it is still free money in my eyes)

Thank you

Hey Joseph,

OK, the important thing is not to mix the forks up! The Bitcoin Gold (BTG) snapshot has already been taken, a week or so back. Any coins you had in your Ledger at that time will now entitle you to an equivalent amount of Bitcoin Gold coins, once their blockchain is up and running (which should be only days away).

The SegWit2X (B2X) fork, described in this article, is only occuring sometime around the 2nd week of November. Coins held in your wallet when that occurs will similarly allow you to claim an equal amount of B2X.

The one complication here is that Bgold has added Replay Protection (today) whereas SegWit2X has yet to do so. This makes it risky to actually send S2X as you might also send BTC – and vice versa. So, it’s safe to send bitcoins now, without any risk of losing Bgold, but it won’t be safe to send bitcoins around and after the time of the S2X fork, unless the Replay Protection issue is resolved somehow (it will be but it may take some time).

Hey Steven

Thanks in advance for your help. I have one doubt:

If I have 3 BTC in my own wallet (Let’s say Electrum), when the BTC-GOLD fork happen (24th October 10 am UTC) Will I receive the same amount of BTC-Gold provenient from the 491.407 block? I mean I will have in my wallet balance: 3 BTC and 3 BTC-GOLD?

Thanks

Hi Juan,

Happy to help.

OK, just to clarify, Bitcoin Gold and Segwit2x are different forks. S2X (the subject of this article) will only fork off in November whereas Bgold is forking off this week.

So, if you have 3 BTC in Electrum, after the fork you’ll still have 3 BTC in Electrum. The only difference is that if you install a Bgold wallet and import your Bitcoin / Electrum private keys / seed phrase to it, then you’ll have 3 Bgold coins in that wallet too.

However, depending on the technical details of the Bgold launch (things are still very unclear at this stage), I would warn you against exporting your Bitcoin wallet’s private keys to any Bitcoin Gold wallet – and under no circumstances should you export them to any website, even one which looks official.

Wait for information on a 100% safe method of claiming your Bitcoin Gold to be published on a reputable site, such as here or Bitcoin Magazine. Be cautious of info you find on social media and trust nothing from r/btc or bitcoin.com.

It’s just not worth risking real bitcoins for Bgold. Only claim them if / when there’s no risk involved.

Thank you, you helped me a lot:-)!

Thank you for quick answer! So you reccomand Electrum Bitcoin Wallet as the safe one?

Hey Korina,

Electrum is popular, reliable and actively developed. I think it’s a good choice as a light wallet, particularly when coupled with the security of a hardware wallet.

Electrum handled the previous Bcash hard fork very well. Electrum went so far as to release a guide detailing a safe method for claiming Bcash, despite the fact the Bcash clone of Electrum, “Electron,” violated their usage policy in some way.

I think Electrum will be well prepared for the S2X fork and I further believe that if you follow their instructions, you should be quite safe.

Hi

Great article

My question would be- will you be funded the equivalent of partial bitcoins? I am looking to get involved but can’t afford a whole one 🙂

Thanks

Lew

Hey Lew,

Yes, that’s right. Any amount of real bitcoin you own at fork time will be matched by any equivalent amount of S2Xcoin on the S2X chain.

Thanks Steven. Good to know I could have a go with only a part of a BTC