Crypto markets have taken a hit, and the Uniswap price is under pressure. Still, the downturn in UNIUSDT has hit some harder than others after Aave liquidated a UNI-backed loan, leaving one unfortunate investor utterly rekt.

UNI, the native token of the decentralized exchange (DEX) Uniswap, is undertaking a major downturn at the time of writing on April 11, and, as on-chain analysts now reveal, dumping prices has caused maximum pain and suffering for one unfortunate Aave borrower.

(UNIUSDT)

Uniswap Downtick Turmoil: Aave Borrower Liquidated By Brutal UNI Price Move

According to Lookonchain data, on April 11, a UNI holder reached maximum pain.

After accumulating roughly $3m worth of the UNI token between March 1 and 13 at an average price of $11.42, he went all in on Aave, a decentralized lending and borrowing platform. Taking out a loan of $1.8 million in stablecoins in expectation of consistent upside moves by UNI price.

However, with crashing UNI prices, the borrower has now been forced to sell over $1 million of the coin to repay the current debt on Aave.

With this liquidation, the holder now has roughly $1.46 million worth of UNI left under their control–a significantly depleted equity position.

Downside Triggered By Gensler – Again: United States SEC To Sue Uniswap

On April 10, the United States Securities and Exchange Commission (SEC) served Uniswap Labs with a Wells Notice, a precursor to a formal enforcement action.

While the specific accusations remain unclear, the move was clearly enough to spook markets, and past actions might offer insights into precisely what the regulator will sue the decentralized exchange operator for: offering unregistered securities or possibly running an unregistered exchange.

Since the crackdown on crypto players in 2023, many have accused the United States SEC of bias and damaging investors in their crusade against the industry.

Specifically, they say the absence of clearer guidelines stifles innovation – yet, for many in the space, it’s incidents like the UNI swap price collapse that epitomizes just how much chaos the agency creates.

Uniswap Price Collapse: Whales Cash Out, Amplifying UNI Price Slide

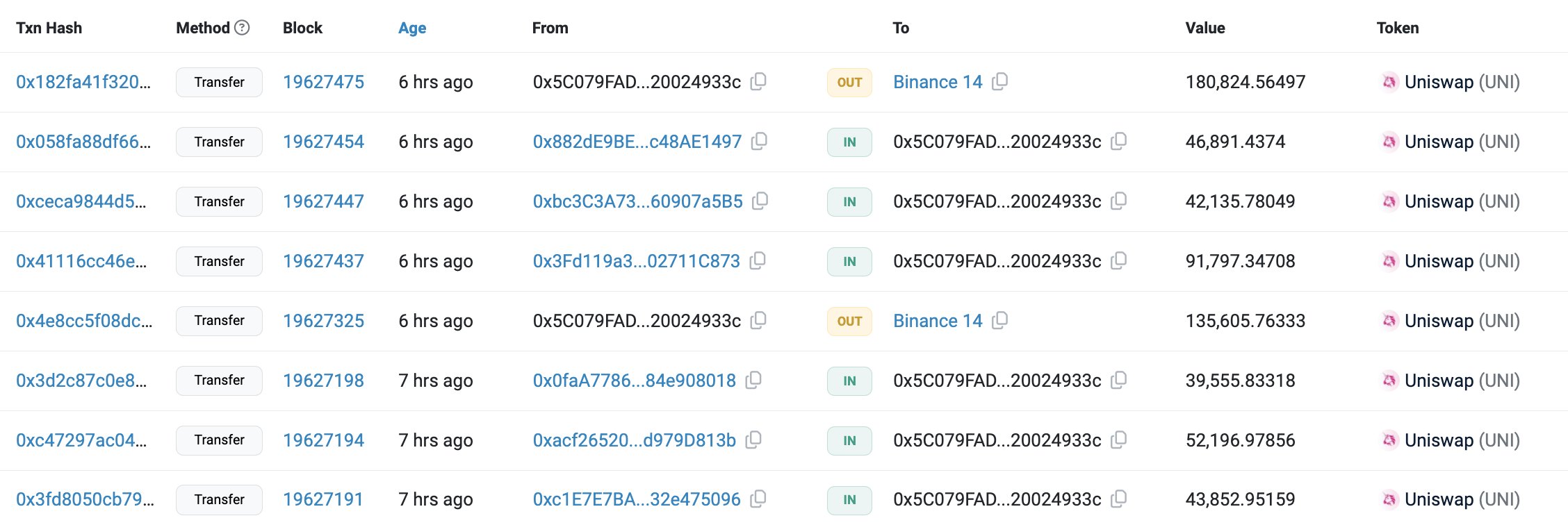

News of the SEC’s action triggered a panicked sell-off from major UNI holders, often referred to as ‘whales’ which acted to exacerbate downside moves.

According to Lookonchain, three whales collectively dumped over $20m worth of UNI tokens, further driving down the price.

One whale, identified by their wallet address 0x4A0B, sold nearly half a million UNI for a profit of over $1.6 million.

Additionally, two other whales, 0x2F8b and 0x3555, transferred a combined $11.7 million in UNI back to Binance, potentially signaling their intent to sell for a profit of around $3.5 million.

Explore: Bitcoin Halving Date 2024: Unpacking CPI Data, Spot ETF Inflows, Bitcoin Price To Hit $250k?

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

No Comments

No Comments