This is 99Bitcoins’ weekly Bitcoin price analysis.

27/7/2015 – Bulls need assistance

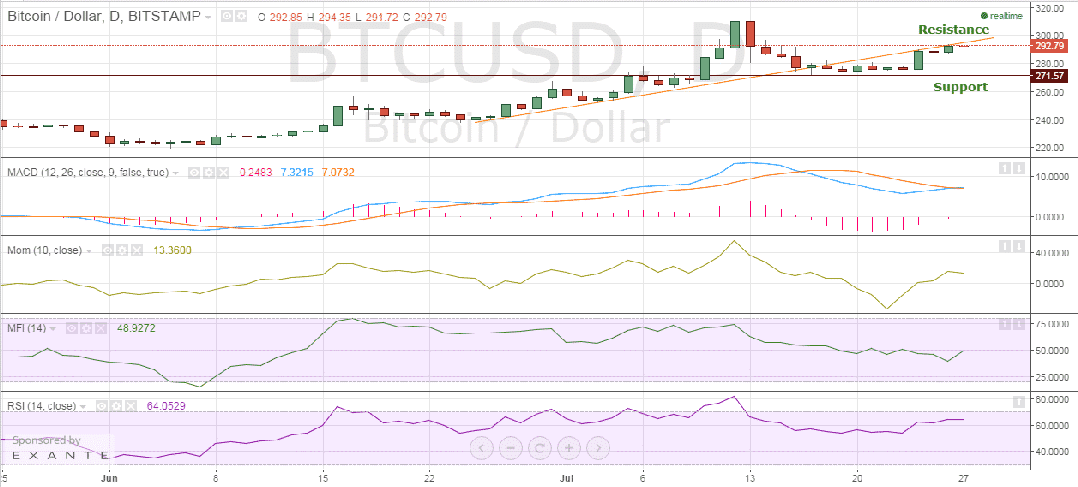

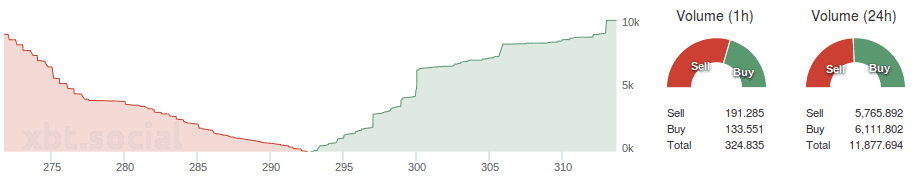

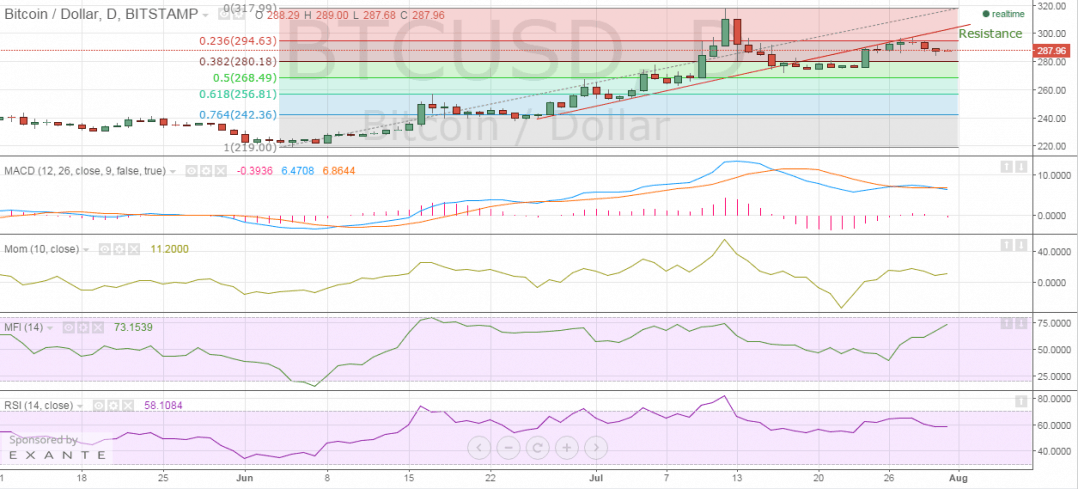

Analysis from the previous week indicated that the Bitcoin market would likely break the silence and show some volatility once again. This prediction was fulfilled, as the market price reached $294.35, but struggled close to the upward tilting resistance. The price improved by 5.90 percent from last week.

Although the market technically held a strong position, it was still likely to drop out in the upcoming phases. Bitcoin’s price held steady for some time before a new price gain and it was expected to cross the previous peak of $310. The MACD (7.3125) moved away from the Signal Line (7.0732), resulting in a positive Histogram of 0.2483. The Momentum indicator took a positive turn at 13.3600. The MFI had a value of 48.9272, suggesting a possible gain in the Bitcoin price. The RSI supported Bitcoin’s price increase with a value of 64.0529.

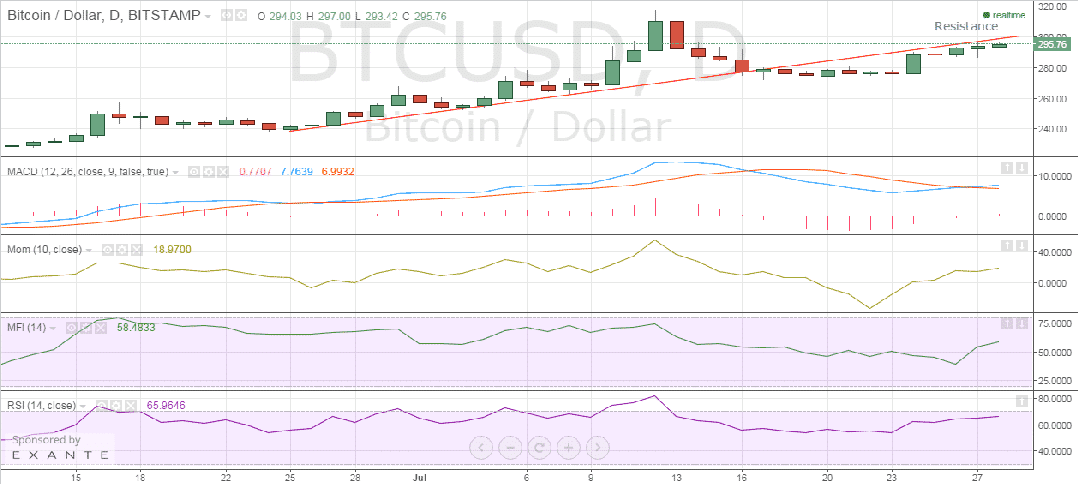

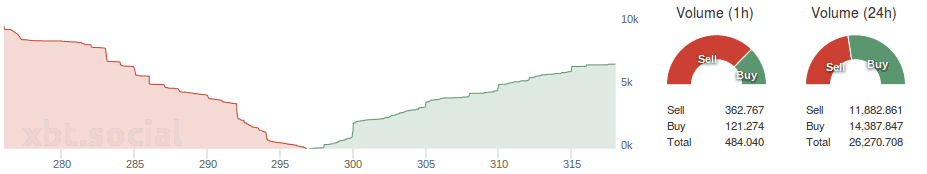

28/7/2015 – Time to buy

All the technical analysis predicted that the Bitcoin market would breach the resistance level. The market also complied with the one percent gain from the previous day and it was trading at $295.76. The MACD put some distance from the Signal Line (6.9932) with a value of 7.7639. As a result, the Histogram increased to 0.7707. The Momentum indicator showed positive movements by going from 13.3600 to 18.9700. The MFI also increased to 58.4833. The RSI maintained a healthy relation with the rising price at 65.9646.

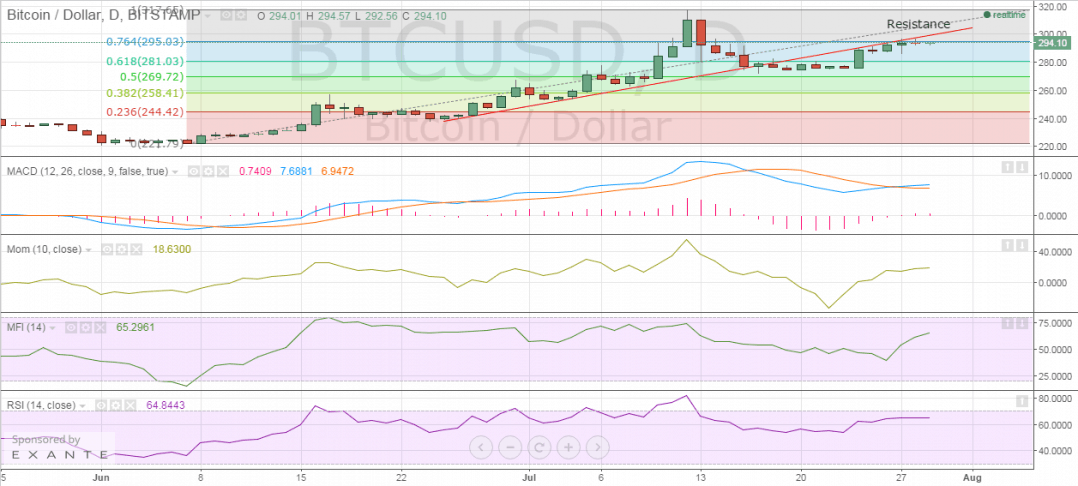

29/7/2015 – Held up

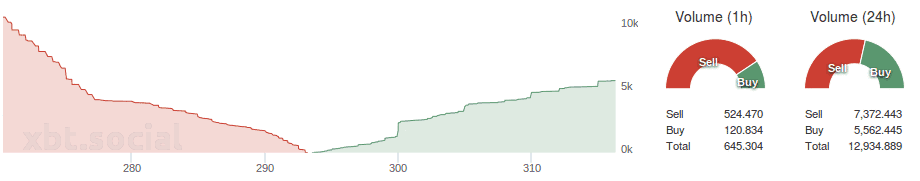

After a bullish price rise in the previous day, the Bitcoin market seemed to just pause under the discussed resistance level. Bitcoin was trading around $294 all day long, a 0.56% down from the previous value. All the technical indications suggested a positive trend for the market price. Still, the market struggled to cross the resistance level for the fifth time on the trot, suggesting a drop in the market price in the long run. The MACD had a value of 7.6881, slightly better than Signal Line’s value of 6.9472. The Histogram was at 0.7409 while the Momentum value consolidated to 18.6300. The MFI kept rising and had a value of 65.2961. The RSI was steady all day long around 64.8443.

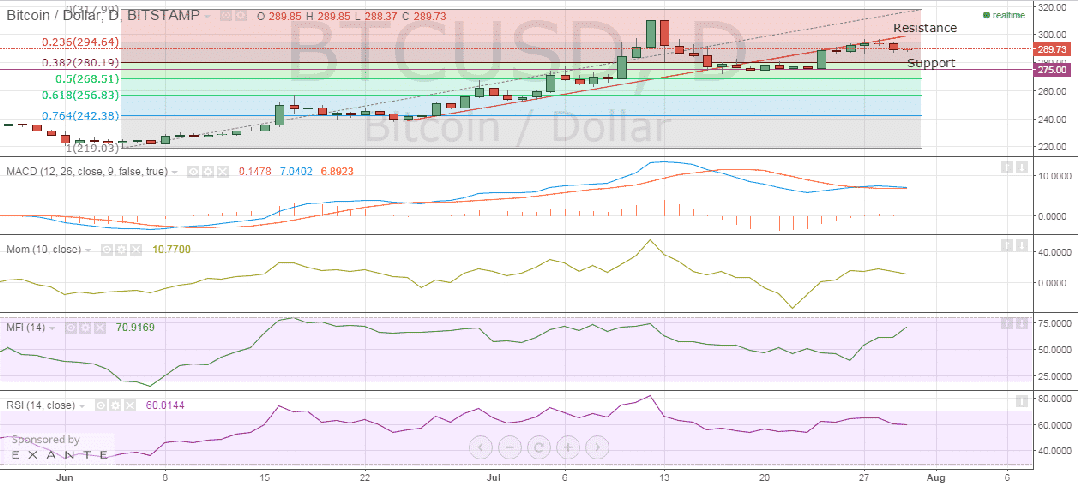

30/7/2015 – Market failed to keep up

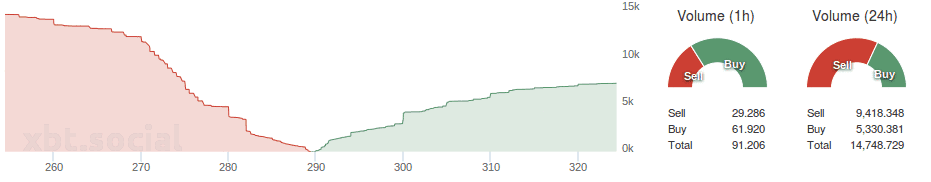

Bitcoin’s price failed to cross the resistance level as it could not keep up with the upward movement. There were minor profits when booking and fresh selling, which eventually lead to a price decline. Bitcoin was trading at $289.73, 1.5 percent down from the previous day. The MACD and the Signal Line were pretty close to touching each other with values of 6.8923 and 7.0402, respectively. That caused a decline in the Histogram value to 0.1478. The Momentum still held a strong position at 10.7700. The MFI progressed to 70.9169 despite the price drop suggesting a price decline in the future. The RSI dropped slightly to 60.0144.

[tweet_box design=”default”]Bitcoin price still looks strong in the long term. But there might be a few drawbacks in the short term before the price picks up to reach the $300 mark.[/tweet_box]

31/7/2015 – Bulls feeling the heat

Fresh selling and profit booking kept pressuring Bitcoin’s market price and the cryptocurrency bulls felt the heat all day long. The Federal Reserve’s announcement regarding the hike in interest rates and the latest quarterly United States’ GDP numbers probably had a mixed depressing effect on the price. Bitcoin’s price dropped by 0.61 percent and was trading at $287.96, $1.77 lower than previous day. The Bitcoin market was bearish in terms of technical effects that paved way for short positions on rallies.

The MACD value of 6.4708 finally made a crossover with the 6.8644 value of the Signal Line. The Histogram had a value of -0.3936. The Momentum had a positive position at 11.2000. The MFI rushed to 73.1539 in a downward market, indicating further decline in the Bitcoin market price due to this divergence. There was slight drop in the RSI value sitting on 58.1084.

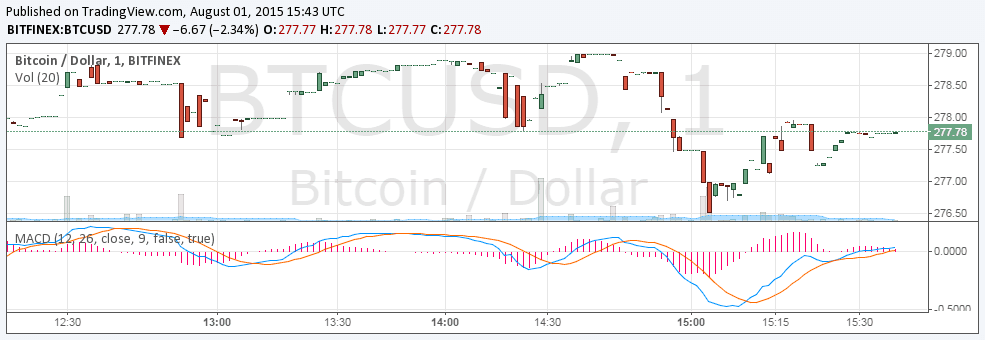

01/08/2015 – Price drops

Price dipped to $280 on Saturday with the cryptocurrently trading at $277, 3.48 percent less when compared to Friday. The price drop caused clear divergence in both the MACD and the RSI value. As a result, the Momentum also declined.

Weekly Bitcoin price prediction

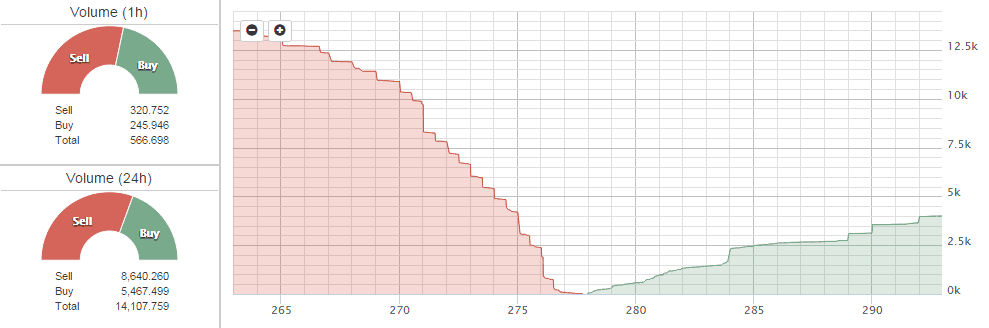

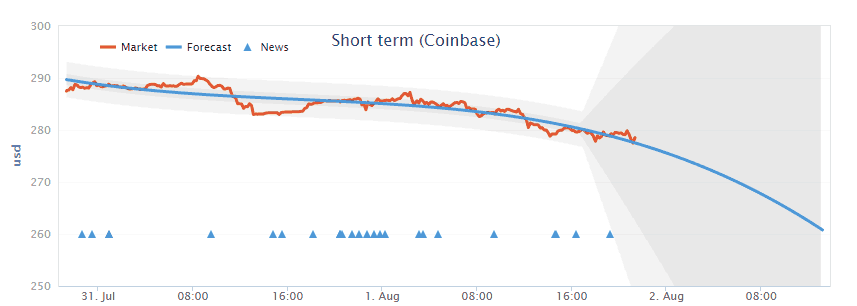

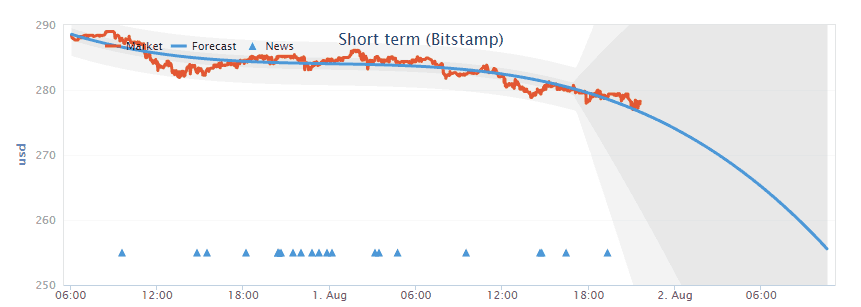

According to Coinbase, the price is expected to drop continuously. It might hit the $270 mark by the start of the next week.

Bitstamp also predicts a price drop for the next couple of days. The price is likely to drop to $260 at the beginning of the next week.

Summary

Bitcoin price still looks strong in the long term. But there might be a few drawbacks in the short term before the price picks up to reach the $300 mark. As for the market, it may try to steady the ship over the course of the next week, although it is not clear for how long the price will remain steady. There’s also no clear indication about a decline or a peak, so it would be best to play safe until some clear indications can be provided.

Chart source: BFXDATA , Bitcoin Forecast

No Comments

No Comments