Uniswap price is up after data reveals the top DEX generated trading volume exceeding $250 billion across Base, Arbitrum, Optimism & Polygon – what does this mean for UNI price analysis?

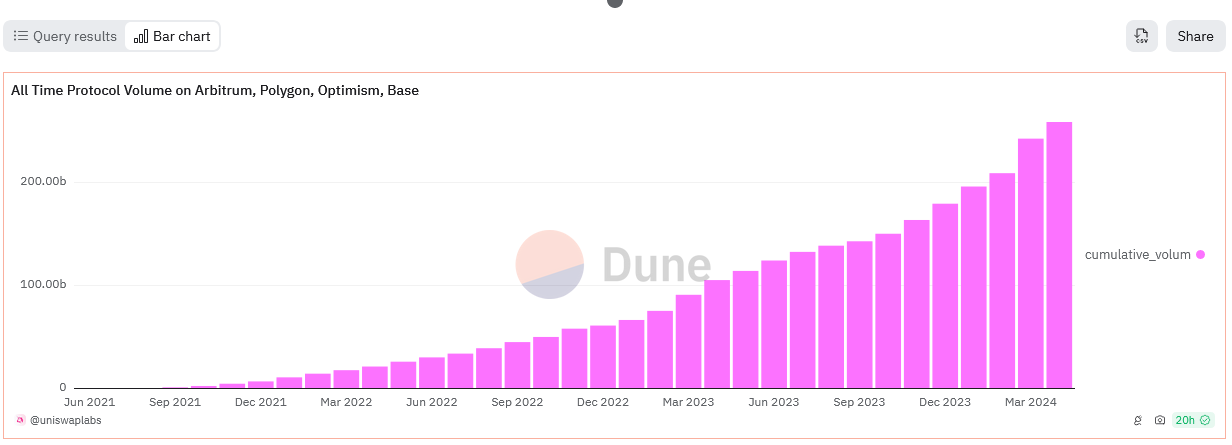

According to Dune Analytics data on April 17, Uniswap, a popular decentralized exchange (DEX), has generated trading volume exceeding $250 billion across multiple layer-2 solutions like Base, Arbitrum, and Optimism and on Polygon, an Ethereum sidechain.

The high transaction fees on the Ethereum mainnet have historically been a barrier to entry for many users, accelerating the development of layer-2 platforms.

Base, Arbitrum, and similar solutions process transactions off-chain before settling them on the main net, enhancing scalability and drastically slashing gas fees. Since Uniswap has been deploying on these networks, more users have been flocking to these cheaper options.

Digging Into Uniswap Success: Lower Fees, Higher Volume

Looking at trends, Uniswap’s cumulative trading volume across these platforms has been picking momentum over the past months.

To illustrate, by January 2023, it stood at over $66 billion. Fast forward a year later, in January 2024, it had more than 3X to over $196 billion.

By the time of writing, this stood at over $258 billion, highlighting the growing significance and shifting preference from traders.

(DUNE)

Uniswap, unlike centralized versions like Binance and Coinbase, allows for the non-custodial swapping of assets.

While tradable assets are only those supported in the deployed network, users can launch liquidity pools and quickly list their tokens without paying fees.

In centralized exchanges, projects looking to list tokens sometimes have to pay a huge fee.

However, with the growing popularity of DEXs like Uniswap, protocol developers, including those launched by anonymous developers, can list freely.

If they pick up momentum, as seen from the success of some meme coins like PEPE, their higher liquidity and popularity can see them listed on centralized exchanges, further pumping valuations.

Uniswap’s trading volume has rapidly risen over the past year, which points to increasing interest from traders and investors. However, other fundamental and network-related triggers have catalyzed demand.

Recently, Ethereum activated Dencun. The hard fork introduced several changes, including improvements that further slashed layer-2 trading fees. Optimism, Arbitrum, and Base, being layer-2 platforms, have integrated this update, further enhancing user experience.

UNI Price Analysis: Uniswap Labs Faces SEC Scrutiny

Despite this positive growth, a recent Wells notice from the United States Securities and Exchange Commission (SEC) to Uniswap Labs, the developer of the DEX, casts a shadow of uncertainty.

(UNIUSDT)

The Wells notice indicates the SEC’s intention to sue Uniswap Labs. Following this news, UNI has dumped by around -40%, trading at $7 when writing on April 17.

However, current price levels, underpinned by a lower support level could offer an alluring entry point for retail investors ahead of the Bitcoin Halving event.

EXPLORE: Buy The Dip: 3 Under the Radar AVAX Meme Coins That Look Primed to Explode | 99Bitcoins

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

No Comments

No Comments