Bitcoin Mining Hardware Reviews & Comparison

By: Alexander Reed | Last updated: 1/5/24

Initially, Bitcoin mining was a simple task even home computers could participate in. Today, mining is done by ultra-powerful computers that are designed for that sole purpose. In this post I’ll cover the best mining hardware available today.

Bitcoin Mining Hardware Summary

Nowadays, the only way to participate in Bitcoin mining is through dedicated miners known as ASIC miners. As mining evolves, more and more companies begin manufacturing dedicated hardware.

The top Bitcoin miners on the market today are:

That’s Bitcoin mining hardware in a nutshell. If you want a deeper understanding of how to choose your miner keep on reading. Here’s what I’ll cover:

- Bitcoin Mining Evolution

- How to Evaluate a Bitcoin miner

- Notable Mining Hardware Companies

- The Best Bitcoin Miners Around

- Antminer vs. Whatsminer

- Frequently Asked Questions

- Conclusion: Who is the winner?

1. Bitcoin Mining Evolution

Before I get into the various miners on the market today, I want to make sure you’re familiar with what Bitcoin mining is. If you already know about the purpose of mining and how it integrates with the Bitcoin network, feel free to skip this part.

If not, here’s our Bitcoin mining whiteboard video to get you up to speed:

Mining has moved from being something you can do from the comfort of your own home to a specialized occupation that requires a lot of time and capital.

Miners evolved from using PCs to GPUs (graphics processing unit) and later on to FPGAs (field-programmable gate array) before reaching their current state of ASIC (application-specific integrated circuit) mining.

Today, if you try to mine with anything other than an ASIC miner, you’re in for a disappointment. ASICs are built specifically for Bitcoin mining and are therefore the most efficient type of miner out there.

For reference, a single ASIC miner has the equivalent mining power of 700 GPUs. Therefor, the massive move of miners toward ASIC hardware is easily understandable.

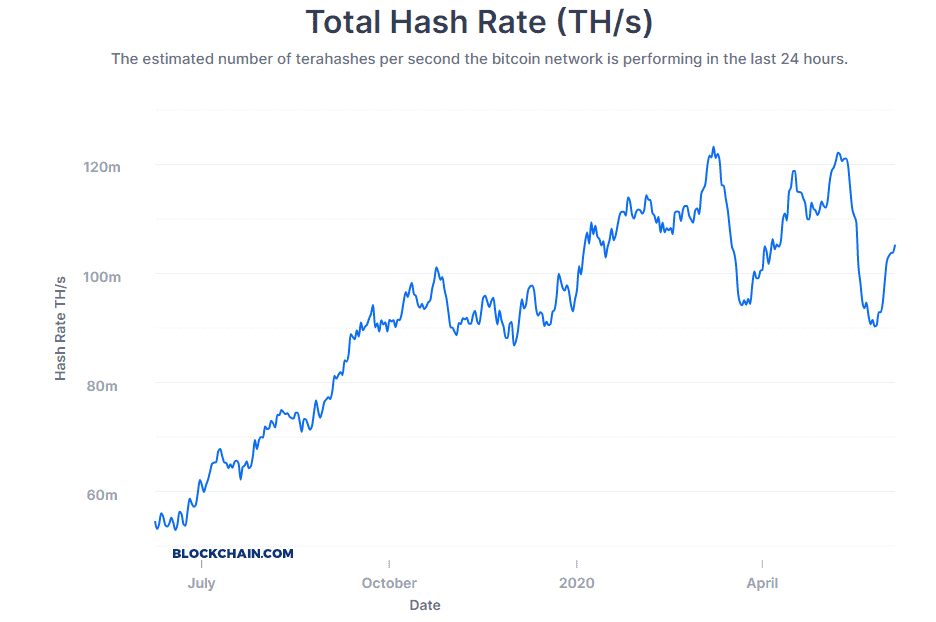

Clear evidence of this is the Bitcoin network total hashrate, which has exceeded the incredible milestone of 120 exahash per second (that’s 120,000,000,000,000,000,000 hash calculations per second!).

Image courtesy of blockchain.com

Today’s focus is on creating smaller chips for ASIC mining in order to produce more powerful miners. The smaller the chip, the more chips you can put inside a miner, increasing its mining capabilities.

The smallest chip introduced commercially to date is a 7 nm (nanometer) chip by Bitmain and their Antminer S17. However, 5 nm chips are expected to be introduced shortly by Bitmain and Canaan.

2. Evaluating a Miner

When you want to evaluate a miner, there are usually three main factors you need to check:

Power Consumption

How much electricity does the miner consume? This is important since you’re going to run a huge electric bill if you mine Bitcoin. This is measured in watts, and the lower the number, the better.

Hashrate

This is how much power the miner has to solve the mining math problem. It basically measures how many guesses the miner can make per second.

While a personal computer can make a few million guesses per second, today’s ASICs can make 1*10^12 guesses per second. The higher you hashrate is, the better.

Energy Efficiency

While having a high hashrate is good, if you’re wasting a lot of energy to get it you’ll be losing money in the end.

Efficiency is basically calculating how much power is required to generate a single bitcoin. An efficient miner requires less electricity to mine Bitcoin.

Efficiency is calculated by dividing energy consumption with hashrate. This way you can effectively measure miners against one another.

All of the above factors are important for calculating profitability, so make sure you have them all before proceeding.

Once you have this information, you can insert it into a Bitcoin mining calculator and estimate how many bitcoins you’ll be able to mine per timeframe.

| Difficulty Factor | |

| Hash Rate | |

| BTC/USD Exchange Rate | |

| BTC/Block Reward | |

| Pool Fees % | |

| Hardware Cost (USD) | |

| Power (Watts) | |

| Power Cost (USD/kWh) |

Keep in mind that this calculation will never be 100% accurate since you can’t know for sure the exact difficulty measurement at the moment, or what will happen to Bitcoin’s price a week from today.

3. Notable Mining Hardware Companies

Bitmain Technologies

The most well-known mining hardware manufacturer around, Bitmain was founded in 2013 in China and today has offices in several countries around the world.

The company developed the Antminer, a series of ASIC miners dedicated to mining cryptocurrencies such as Bitcoin, Litecoin, and Dash.

Bitmain is also in charge of two of the largest mining pools around: BTC.com and Antpool.

While Bitmain is respected for its technical excellence and reliable delivery, the company is also criticized by many Bitcoin enthusiasts for a variety of reasons:

- Its monopolization of ASIC manufacturing and mining

- Its role in delaying the SegWit upgrade to Bitcoin

- Its support and promotion of Bitcoin Cash

- Its alleged anti-competitive practices

- Its questionable methods, such as the Antbleed vulnerability and the covert AsicBoost scandal

It’s likely that the bulk of mining equipment today consists of Bitmain miners, based on analysis placing Bitmain’s share of the ASIC market at 70%–80%.

However, since these controversial events and some setbacks and closures, Bitmain has adopted a less aggressive business strategy. It’s likely that the bulk of mining equipment today consists of Bitmain miners, based on analysis placing Bitmain’s share of the ASIC market at 60%–70%.

MicroBT

MicroBT or Bit Micro is a relative newcomer to the space but a successful one; they sold 650,000 ASICs in 2019 and are shaping up to be a strong rival to Bitmain and Canaan. They are based in China, specifically the tech production hotspot of Shenzen.

MicroBT manufactures the Whatsminer range of ASICs, and have so far produced 5 series in this range: the Whatsminer D1, M10, M20, M21, and the current generation M30.

The company has certainly enjoyed a strong start, released some competitive products, and it will be exciting to follow their development.

Canaan Creative

Canaan was founded in 2013 in Beijing by N.G. Zhang. Canaan began as a producer of FPGAs, the mining hardware that preceded ASICs.

In November of 2019, Canaan raised a total of $90 million by listing on the Nasdaq, a tech-focused stock market in the USA. Canaan was the first ASIC manufacturer to list publicly.

Canaan is the world’s second-largest ASIC producer. The company has a wealth of experience in electronic design and production. It’s clear that this veteran industry player has big plans for its future.

Innosilicon Technology

Innosilicon is a hardware company with design teams in China and North America, Innosilicon pride themselves on providing low cost, high-performance, fully customizable solutions combined with award winning customer design support.

Their IP can be found in millions of mobile, multimedia and consumer electronic devices such as: tablets, cell phones, HD set-top boxes, TV, cameras, network devices, computing ICs that have achieved leading market shares.

The company has entered the cryptocurrency mining market and introduced the Terminator series for mining Bitcoin, with their latest miner being the T3+ Pro.

GMO Internet

*June 2020 update: Due to lack of profitability, GMO Internet has stopped producing mining hardware.

Japanese giant GMO Internet has also introduced a line of Bitcoin miners.

While GMO Internet is mainly engaged in the Internet infrastructure business, it also runs other businesses such as online advertising & media, Internet financial services, mobile entertainment, and of course cryptocurrency.

The company has also launched several crypto exchanges and it runs a mining business and cloud mining contracts.

Zhejiang Ebang Communication

Ebang mainly engages in R&D, manufacture and sales of fiber optical telecommunication products. The company is also one of the largest ASIC chip manufacturers in the region. Ebang miners carry the Ebit brand.

On April 2020, Ebang filed for an IPO on the U.S stock market listing, so the company definitely has big plans for the future.

Bitfury

Bitfury is a veteran Bitcoin hardware and software company formed back in 2011. The company conducts large-scale mining operations on its own and has been known to account for large amounts of the Bitcoin network hashrate.

The company offers several products including an ASIC mining chip called Clarke, an enterprise grade Bitcoin mining server called Tardis and a portable Bitcoin mining data center called BlockBox.

The company has data center operations in Iceland, the Republic of Georgia, Canada and Norway, which process and transmit bitcoin transactions.

The blockbox ac by Bitfury

4. Best Bitcoin Miners for 2022

While you can find a wide variety of miners on the market, it’s highly recommended to use the latest models out there since they will give you the best return on investment. Here’s a short overview of the top miners around.

MicroBT M30s++

The MicroBT M30s++ is billed as the “new hash king” on the company’s website. A bold claim but – at least at the current time – not untrue. Surprisingly, it uses 12 nanometer chips rather than the newer 7 nanometer chips seen in rival miners. It achieves an extraordinary 112 Th/s and is extremely efficient at 31 Joules / TH.

Antminer S19 Pro

Fighting for the title of best post-halving bitcoin mining hardware is the Antminer S19 Pro, from Bitmain – the ASICs veterans. The S19 Pro is a hashing monster that packs a 110 Th/s punch over a 3250W power consumption. With an almost identical price tag, it’s very hard to conclude which of the above 2 is better, at least on paper.

Antminer T19

The T19 range is the latest and greatest from Bitmain. Launched on the 1st of June 2020, this model was designed in an effort to find a middle ground between price tag and hashing power, mainly due to the slow sales of it’s bigger brother, the Antminer S19 PRO.The T19 delivers 84 TH/s with a power consumption of 3150W, making it a cheaper, less efficient alternative for it’s bigger brother, the S19 Pro.

Antminer S17+

This 7nm miner deployed in March 2019 is Bitmain’s popular and proven miner. The miner can reach 68 Th/s, with a power consumption of around 2680 Watts. It is still able to compete with it’s newer adversaries – if acquired for the right price.

5. Best Bitcoin Miners Comparison

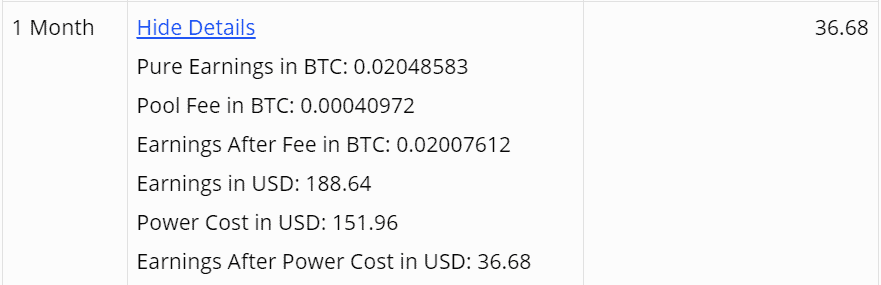

I compared the leading miners against one another in our Bitcoin mining calculator. For electricity costs I used $0.67, which is the average industrial electrical rate in the US. For sake of comparison, the average consumer electricity price for the world is $0.12. This rate gives a better idea of how important low electricity costs are for profitable mining.

Calculations are done according to June 2020 values. The Bitcoin price at the time of calculation was $9500 and the Difficulty was 15466098935555. For pool fees I used the standard 2% fee that can be found on most pools.

The calculator date is post-halving, so profitability has declined substantially now that each block mined is only worth 6.25 BTC, down from the previous 12.5.

I compared the results after 1 month of mining since mining stats such as Bitcoin price and difficulty change frequently, so using the same results for the course of a year would be unrealistic.

MicroBT Whatsminer M30s++

Antminer S19 Pro

As can be seen, “on paper” the S19 Pro shows an advantage over the whatsminer M30s++, with both giving away %63-%67 off their profits for electricity expenses. Both are coming off as profitable, even for consumer electricity rates of $0.10 per KWs, which is impossible to say for any of the competing miners available at the time of writing.

Antminer T19

For comparison, for the same mining time period, the Antminer T19 delivers less than a half of the profits of the stronger two miners, for almost the same electricity costs (even though it was released after them).

It’s clear that when it comes to efficiency, the T19 is no match for the other miners on this comparison – but keep in mind that the examples above don’t include hardware costs. In order to get a clear profit calculation you have to factor that in (the mining calc has a field for that as well).

The reason I don’t include prices in this article is because these miners tend to sell out pretty fast, and most of the time people buy them on second hand markets such as eBay or Amazon, so prices can vary a lot.

For example, prices can vary so much that you may get your hands on a T19 for less than a half of the price of an S19 PRO or an M30s++. As you can imagine, this might put things in a different perspective.

6. Frequently Asked Questions

Can I Use My Computer to Mine Bitcoins?

No you can’t. With the current Bitcoin Network hashrate it would take more than a lifetime to mine successfully using a personal computer. Only dedicated ASIC miners can mine Bitcoin.

How Much is a Bitcoin Mining Machine?

Prices new Bitcoin mining hardware usually revolve around $1000-$2000. On second hand markets, when supply is low (which is usually the case) you can find a premium factor of up to 5x.

What Year Will the Last Bitcoin be Mined?

According to the rules of the Bitcoin halving the last Bitcoin will be mined somewhere around the year 2140.

Is Bitcoin Mining Still Profitable?

Yes. If you have a powerful ASIC miner and low electricity costs you can still be profitable with Bitcoin mining.

However, since Bitcoin’s price and difficulty are constantly changing, it’s important to run detailed calculations before spending money on any miner.

How Many Bitcoin Can You Mine in A Day?

Using the Whatsminer M30s++ and a difficulty factor of 15,466,098,935,555 (June 2nd, 2020) you will be able to mine 0.00054466 Bitcoins in one day.

How Many Bitcoins are Left?

As of June 2020 there are around 2.6 million bitcoins left to be mined.

7. Conclusion: Which is the best Bitcoin miner?

The Whatsminer M30s++ and the Antminer S19 Pro emerge as the best options to allow you to make profits over your mining operation – assuming your electrical bill is cheap enough.

If Bitcoin rises in price again and mining becomes more profitable, more and more companies will start to manufacture Bitcoin mining hardware. Samsung is just one example for this.

In turn, this would increase the supply and lower miner prices even more.

Have you tried mining with any of these miners? Want to share your experience? Let me know your thoughts in the comments section below.

Bt-miners is the biggest scam i purchased 2 x S19 pro 110th totaling $26500usd and they sent me 2 x S9. they refused to replace and refund me. Their company is based of china where getting your money back is a nightmare. They pretend to be in usa but found out its just mail forwarding address where they are susbribed to dupe customers. BE AWARE HUGE SCAMMERS

thank you for your advice, unfortunately I saw it after buying one S9.

By now they only confirmed they received the money, not shipping yet.

Does anyone have any historical data or can you provide any data regarding the Bitmain S19 miners. We are in the middle of engineering the ventilation system for our pod but we are having trouble obtaining the follwoing information.

1. What is the heat generation of each unit to the surrounding space, which would include radiant heat and fan generated heat through the unit

2. What is the airflow volume of the fans for each unit?

3. Are the fans sized based on an anticipated entering air temperature? If yes, what is that temperature? What is the leaving temperature at full capacity?

the heat generation, by definition is all the power used.

Can anyone just explain how to mine a bitcoin without having to outsource? Every site I visit tries to tell you that your rig is not good enough. I am curious how these crooks can say I can’t join in on the fun…who cares if I don’t get a single portion, I am just trying to research how its done.

this is a fascinating learning curve for me. I have Heard so much about Bitcoins, but there’s not to many resources for the uninitiated like myself. This could prove to be interesting. Even profitable.

Your link for BT miner is a scamm wepage, plz take it down.

So is link to MicroBT. They apparently have a M40 with 410TH/s and 2570W. Scam!

Thks for the comparison. You didn’t indicate the cooling price (hardware installation and power consumption), wich can be quite expensive too.

Thks again.

A lurker