Bitcoin Debit Cards Reviewed and Compared

By: Alexander Reed | Last updated: 2/20/24

This post will cover the most popular active Bitcoin debit cards around, meaning debit cards that can be loaded with Bitcoin.

Bitcoin Debit Card Summary

Bitcoin debit cards let you pay for your regular transactions using your Bitcoin balance. They can be used at any store or website that accepts regular debit bank cards. There are often fees that apply and can vary depending on the card, but it may be worth it for the convenience of more easily spending your crypto balance in the real world.

Over the last few years, Visa and Mastercard have made a big push to embrace cryptocurrency companies offering cryptocurrency cards for various exchanges and vendors.

If you’re an EU resident, you’re probably best off using the Coinbase Card, a Visa card that can be ordered from within the Coinbase mobile app. If you’re an EU resident, but Coinbase doesn’t support your country, you can try Wirex as a great alternative. For US residents, we’d recommend either the Coinbase Card or the BitPay card (which has been in the US for a little longer).

If you want a detailed review of each card, keep on reading. Here’s what I’ll cover:

- What are Bitcoin Debit Cards?

- Best Bitcoin Debit Cards

- New and Untested Bitcoin Debit Cards

- Inactive Debit Cards

- Conclusion – Which Card Should You Choose?

1. Does Bitcoin Have a Debit Card?

No, it doesn’t. Any single centralized party doesn’t control Bitcoin, so it can’t issue its own debit card. However, you can get a third-party prepaid debit card that you can load with Bitcoin and then use to buy almost anything.

While many businesses don’t accept payments in Bitcoin (yet), most accept debit cards. With a Bitcoin debit card, merchants get paid in their own currency while you are charged in Bitcoin from your prepaid balance.

Keep in mind there are downsides. Firstly, when using a Bitcoin debit card, you’re basically giving someone else control over your coins (at least the ones you’ve deposited).

Secondly, this service usually comes with a price. Every payment you make will often involve processing and conversion fees for paying with a foreign currency.

2. Best (working) Bitcoin Debit Cards

Despite many crypto debit card issuers having their services suspended in 2018 by Visa, the payments sector has become more crypto-friendly again since then. Both Visa and Mastercard have now started initiatives to work with crypto companies, allowing more firms to issue their own crypto-funded debit cards.

Here’s a look at some of the best active Bitcoin debit cards available today:

Coinbase Bitcoin Debit Card

Pros: Multiple coins supported, established company, widely available

Cons: High chargeback fees

Coinbase, one of the leading Bitcoin exchanges around, issues its own Visa debit card for the UK, broader Europe, and the US.

The card is linked to your Coinbase account and allows you to easily spend crypto held on Coinbase anywhere that accepts Visa payments.

Choosing which cryptocurrency you’re spending can be managed through the Coinbase app, which is available both on Android and iOS. The card also offers multiple security features, such as two-factor authentication, instant freeze, and more.

Coinbase claims to charge no transaction fees to cardholders from the US. However, there is a spread that applies each crypto-to-fiat conversion behind the scenes – this is variable and could be considered a fee of sorts. More info about the Coinbase card for US residents can be found here.

In Europe, there’s a £4.95 or €4.95 fee for issuing the card. Coinbase does not charge ATM withdrawal fees, but the ATM itself may charge a fee. One major drawback is the £20/€20 fee for processing a chargeback if required. The complete fee schedule for the UK and Europe can be viewed here. Here’s how to get your Coinbase card:

- Sign up to Coinbase

- Download the Coinbase mobile app

- Order the card from the app

Wirex Bitcoin Debit Card

Pros: Multiple coins supported, established company

Cons: Limited availability outside of the EEA/Asia-Pacific region, frequent account closures

Wirex was rebranded from E-Coin in 2016. The company supplies a debit Mastercard that can be loaded through the Wirex app (desktop or mobile). Depending on your region, the card can be loaded with cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), XRP (XRP), Litecoin (LTC), Stellar Lumens (XLM), Waves (WAVES), Dai (DAI), and Nano (NANO).

Card balances can be converted to several fiat currencies, including CAD, CZK, EUR, GBP, HUF, PLN, RON, HRK, and USD.

The card is available to all EEA residents, a lot of the Asia-Pacific region, and the US. More countries are being added over time, so you can check here if you want to see if your country is supported yet. The card can be used anywhere Visa is accepted.

In-store and online purchases are free no matter where you are, while ATM withdrawals are free up to 200 GBP for the UK, 200 EUR for the EEA, 400 AUD for Australia, and 250 USD for the US per month. After these monthly maximums are reached, a 2% fee applies. Fees are set at different rates for the EEA and Asia-Pacific. Account management costs are generally free. The complete fee and limit schedule can be viewed here.

Wirex also supplies a virtual card if you don’t need the actual plastic card.

Keep in mind that some of our users have stated they have had issues withdrawing cash from certain ATMs and paying online with the Wirex card. Others have reported unexplained account closures by Wirex themselves.

Read my full Wirex review here.

Nexo Debit Card

Pros: Spend crypto balance without selling the assets; cashback rewards

Cons: Only available in the EEA and the UK

Nexo, a crypto-financial service provider, has released a crypto card with dual modes in partnership with Mastercard. The same card can be toggled between both debit card and credit card modes.

The credit card is unique in the sense that users can spend the value of their cryptocurrency without actually selling it – instead, the back-end borrows fiat currency against the user’s crypto balance. Nexo gives users fiat to spend, using their cryptocurrency as collateral, starting at borrowing rates of 0%. Credit card users can get up to 2% cashback plus daily interest.

In debit card mode, users are provided an easy way to spend their EUR, GBP, and USD stablecoins. Users earn daily compound interest of up to 9%. Users can also create a free virtual Nexo Card to instantly begin spending from their phone.

Depending on the Loyalty tier, users will receive a certain amount of free ATM withdrawals and no foreign transaction fees up to a limited amount per month. Basic, Silver, Gold, and Platinum tiers all offer different amounts of monthly free ATM withdrawals and limits on no foreign transaction fees.

Unfortunately, the card is currently only available in the EEA and the UK.

BitPay Bitcoin Debit Card

Pros: Well-known company, no transaction fees, supports multiple cryptocurrencies

Cons: Limited to US residents only

For US residents, there is the option of using BitPay’s Bitcoin debit card. The card is available in all 50 US states. You must have a home address (no PO boxes), a government-issued ID, and a Social Security number to apply.

They offer a free virtual card for online use. However, a physical card costs a flat fee of $10 and takes about 7 days to arrive in the mail. There are no transaction fees for the Bitpay card when using it to pay in the US. When using the card outside the US, there is a 3% currency conversion charge. There is a $2.50 USD fee for ATM and cash-back withdrawals inside and outside the US.

BitPay’s card supports Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), XRP (XRP), Dogecoin (DOGE), Shiba Inu (SHIB), Litecoin (LTC), Dai (DAI), Wrapped Bitcoin (WBTC), Gemini Dollars (GUSD), USD Coin (USDC), Binance USD (BUSD) and Pax Dollar (USDP).

There are also additional deposit and mailing fees, which can be seen here.

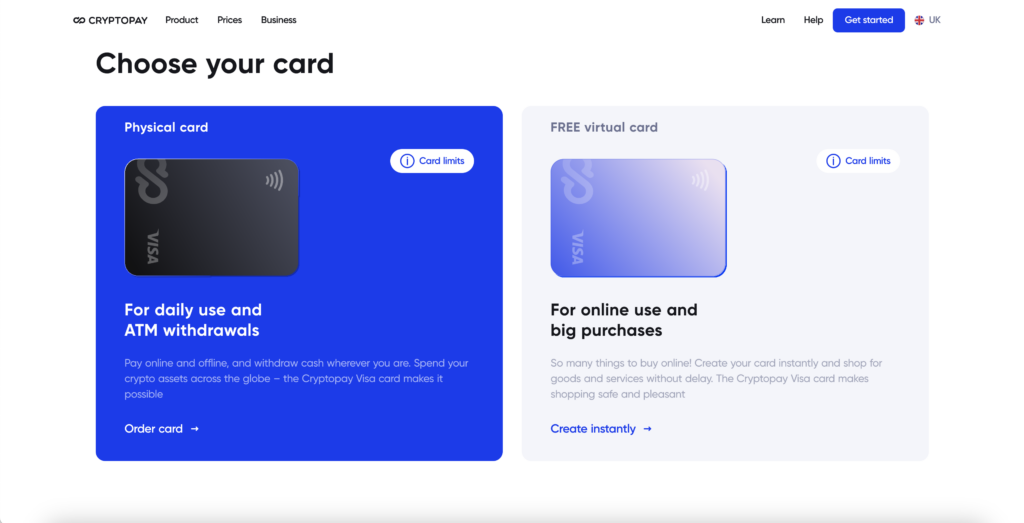

Cryptopay Debit Card

Pros: High limits

Cons: Relatively high fees, limited cryptocurrencies supported, only available in the UK

Founded in October 2013, Cryptopay is a wallet and payment platform that also issues a Bitcoin debit card. The card is currently available in the UK. You can order a physical contactless or virtual debit card if you’re just into online shopping.

The card can be loaded with any of the 40 crypto assets they offer, which will be converted to euros automatically.

The virtual card is free, while ordering a physical card will cost 5 EUR/GBP. ATM withdrawals cost 2.50 EUR/GBP in the card’s currency and 3.50 EUR/GBP + 3% foreign transaction fee if not in the card’s currency. The card has a monthly maintenance fee of $1 and a 1% commission for loading (and unloading) money. The complete fee table can be viewed here.

SpectroCoin Debit Card

Pros: Connects to an exchange wallet, great customer support

Cons: Must manually convert balances to fiat, only available in EEA

SpectroCoin is an all-in-one crypto exchange that offers an exchange-linked debit card to customers in the European Economic Area (EEA).

Although the SpectroCoin debit card is linked to a user’s exchange account wallet, the card itself can only be funded with EUR. This means that users will manually have to exchange their crypto to fiat within the exchange as needed – an extra step compared to most other Bitcoin debit cards.

The card is free and comes with free standard shipping, and it’s free to load via the SpectroCoin wallet. There is also no monthly service charge.

The SpectroCoin wallet can hold BTC and a range of other major coins, but remember you’ll have to manually exchange these to EUR to use your card. Exchange fees are variable and can be hefty at times of volatility.

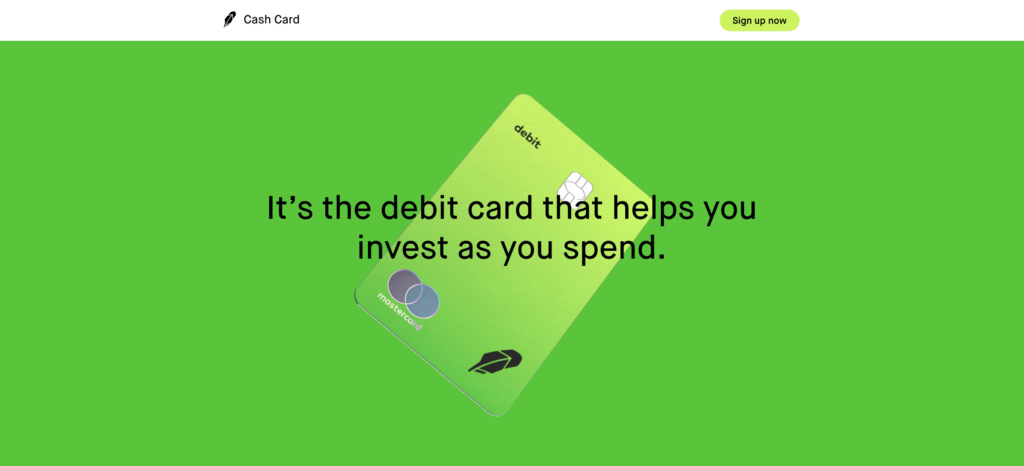

Robinhood Cash Card

Pros: Fully regulated and available in the USA; zero fees on a number of services

Cons: Poor customer support and online reputation

The popular app and trading platform Robinhood also offers its own Bitcoin debit card, the Robinhood Cash Card.

The card comes with 24/7 support, Mastercard’s Zero Liability Protection, and the ability to send checks. Cardholders can elect to have part of their paychecks automatically purchase their choice of stocks or crypto. If eligible, you can also receive your direct deposit paycheck up to two days earlier than usual.

With the Robinhood Cash Card, there are zero monthly fees or overdraft fees. There is no required minimum balance, either. If that wasn’t enough, the card has a $0 activation fee, direct deposits cost $0, and bill payments are $0 as well (though third-party fees may apply).

Read our full Robinhood review here.

3. New and Untested Bitcoin Debit Cards

Aside from the companies mentioned above, I have found several lesser-known companies that claim to supply a Bitcoin debit card. However, many of these companies have very limited information about them online, and they should be treated with caution.

Trastra debit card

The Trastra debit card is a Visa payment card enabling users to receive funds in crypto and spend them in Euros. Though relatively new, the reviews seem to be mostly positive, with support being highly responsive.

What makes it special is the ability to exchange crypto for Euros without the need for a bank account. You can receive and hold crypto in your Trastra wallet and spend it as Euros whenever you need.

The card supports the following cryptocurrencies:

- BTC

- LTC

- ETH

- BCH

- XRP

- USDT

- USDC

The card is competitive, especially for its convenience, with no fees to trade and spend your crypto funds for Euro purchases. There are no card loading fees. However, it costs €9.00 to order a card with a €15 annual card management fee.

Bitnovo debit card

Bitnovo caters mainly to residents of Spain. It allows users to buy several major cryptocurrencies through their mobile app, website,, or via vouchers that can be purchased in more than 40,000 shops around Europe. You can find them in Fnac, Worten, Game, Eroski, and more.

The platform enables users to top up a prepaid Mastercard or Visa card with the following cryptocurrencies:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Dash (DASH)

- Litecoin (LTC)

- XRP (XRP)

- Zcash (ZEC)

Like some of the cards above, Bitnovo requires users to manually sell their coins to top up their debit card rather than providing a service that automatically converts it upon spending.

You can read additional Bitnovo reviews here.

4. Inactive Debit Cards

- TenX debit card

- Shift debit card

- CoinsBank debit card

- ANXPro debit card

- Uquid (active but doesn’t accept new customers)

- Crypterium (seems to be getting a ton of negative reviews online – I suggest avoiding it)

- Nuri debit card

5. Conclusion – Which card should you choose?

Aside from availability in your region, the most important deciding factor when choosing a card would likely be the company’s reputation, followed by fees. Other than that, since most of these cards work more or less the same, there’s no ‘clear winner,’ or loser, for that matter.

UK and EU residents are probably best off using the Coinbase Card. Meanwhile, US users would be best off using the Coinbase Card or the longer-established BitPay card.

On a personal note, using a Bitcoin or crypto debit card is a great way to start realizing your crypto gains on a day-to-day basis.

Have you had any experience with a Bitcoin debit card? If so, I’d love to hear about it in the comment section below.

hi all do any of the cards work in Toronto Canada i want to maybe use one of them to help someone out who’s in the Ukraine

This is probably one of the best overviews of Bitcoin debit cards. *** Link removed***

Thanks a lot!

I’ve spent about two years trying to get a card,

I got one which worked for about two months, then

stopped working when the Banks shut them down.;

Binance est une bonne carte de débit

Why is Crypto.com not listed?

I am wondering the same thing.

Since I applied they have been verifying even now

I have not had access to my Wirex account or funds for 130 days. Wirex standard response when I complain is ‘We would be glad to provide you with the requested information, however, unfortunately, we are unable to do so until the completion of the investigation.’

I’ve no idea what they are investigating, why or why it is taking so long.

When I ask for an update on their escalation support thread they remove my comments. They don’t like others to hear that they have stolen my money.

Hi Nate! Are you able to create a review on youtube for Crypto.com and Crypterium and Wirex?

Hi Tan,

A feature on debit cards would make sense however the situation with these cards tends to change frequently so it would be hard to keep it updated. We will look into it, thanks for the suggestion!