The following article represents the writer’s personal opinion only and should not be considered as investment advice.

Can we accurately predict what would be Bitcoin’s price in 2020?

Bitcoin has turned out to be perhaps the hottest investment commodity of all time. Once upon a time you could pick up bitcoins for less than a penny. Now? A single coin costs hundreds of dollars ($410 at the time of writing this). Still, some people are worried that bitcoin has peaked and that investing now would be like investing in fool’s gold. I have to disagree. Digging deeper shows that bitcoin is just starting to pickup steam, and several underlying factors suggest that the cryptocurrency will only continue to gain value in the future.

Mind you, I’m not the only one arguing that bitcoin will rise in price over the coming years. If I had to pick a very conservative number, I’d wager that by 2020 bitcoin will be worth at least $1,000 dollars. According to the currently available information and the opinions of other experts, this number appears to be on the cautious side.

Respected cryptocurrency consultant Richelle Ross is predicting that bitcoin will hit $650 dollars this year, a reasonable prediction. Daniel Masters, a co-founder of the Global Advisor’s multimillion dollar bitcoin fund, is predicting that bitcoin could test its all time highs in 2016 ( the all-time high so far is $1,124.76 dollars), and could reach $4,400 by 2017. If Masters’ prediction turns out to be correct, investors who snatch up bitcoin now could see their wealth grow ten fold in just a few years.

Of course, nobody knows the future. That’s why it’s important to understand the underlying factors that could cause bitcoin to increase in value in the weeks, months, and years to come. Bitcoin is different from other currencies in that it has been designed from the code up to appreciate in value, rather than depreciate. Understanding what this means is essential for investing in bitcoin.

The “Trickle” of New Bitcoins Will Continue To Slow

If you’re familiar with bitcoin, you probably already know that the supply of all available bitcoins is limited to 21 million. While national governments have a tendency to print new money whenever they feel like it, the supply of new bitcoins entering the market is tightly controlled and ultimately limited. Once 21 million bitcoins are created, no more new bitcoins will ever be issued.

Not only is the total number of bitcoins capped, but the supply of new bitcoins entering the market is slowing as bitcoin mining becomes more difficult. Once upon a time, you would have been able to use your home PC to create blocks and be rewarded 50 plus bitcoins in exchange. Now, if you want to create a single block, you’ll either have to join mining pools, thus linking your personal computer power with other computers, or buy extremely specialized and expensive mining rigs.

The number of bitcoins awarded for solving a block is cut roughly in half every four years. Up until the end of November in 2012, 50 bitcoins were awarded per block chain. Currently, 25 bitcoins are awarded for each added block. It’s estimated that sometime in 2016 the number of bitcoins awarded for creating a block will drop from 25 to 12.5. Then, sometime in 2021, this amount will be cut in half again, and thus bitcoin miners will only be rewarded 6.25 bitcoins.

This is perhaps the most important single aspect of bitcoin, at least from an investor’s point of view. Satoshi Nakamoto, the creator of bitcoin, believed that by reducing the number of new bitcoins entering the market over time, bitcoin’s value would rise over time. This would address one of the largest criticisms of regular, national currencies, which have constantly expanding supples, and thus declining value.

Confused why supply has such an affect on the value of bitcoin? The simplest way to think of a currency is as a “pie”. When you create more of a currency, the size of the pie doesn’t increase, but instead more slices are created. This means that the slices become smaller and smaller over time. The full story and theory behind currencies is a bit more complex, of course, but this basic principal holds true. As governments print up more money, the value of individual dollars (or pounds, euros, etc.) decreases.

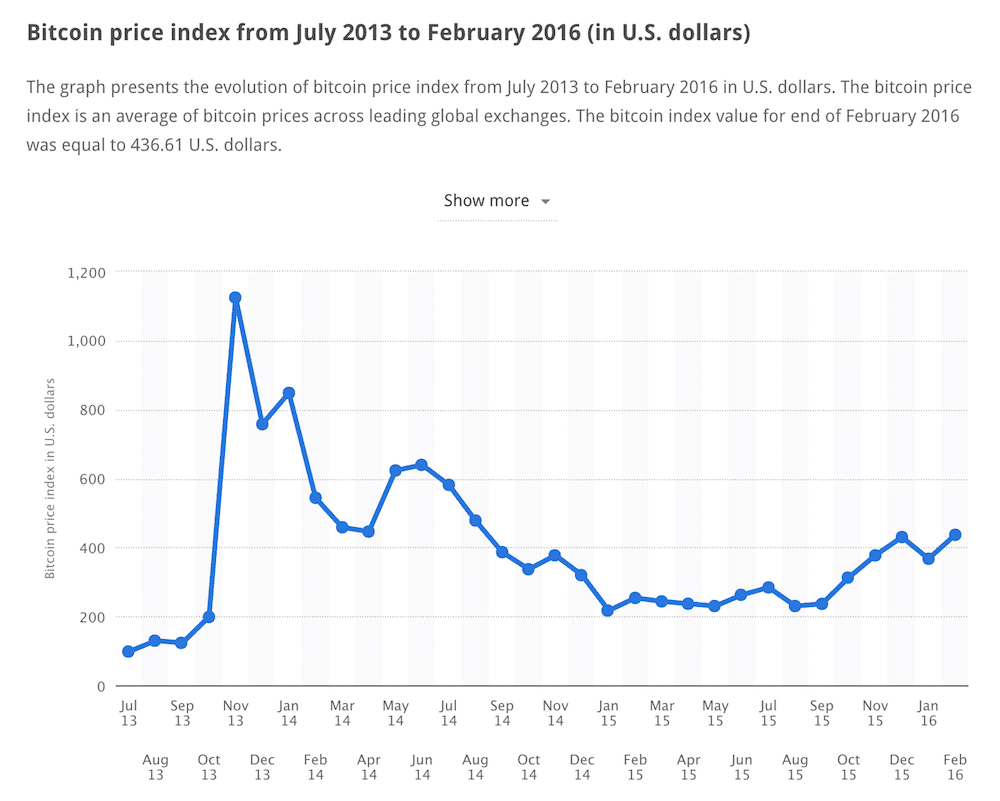

If you look at the value of bitcoin, it has generally trended upwards over time. Of course, the past can’t predict the future, but trends are important to observe and consider. In January of 2015, bitcoin was valued at $215, but by November of the same year it it had risen to over $300, a substantial increase.

Forget the last bitcoin bubble

Since its inception, bitcoin prices have generally trended upwards. At the end of 2013, bitcoin peaked at over $1,000, then sharply declined afterwards. During this period, bitcoin does seem to have been overvalued due to speculation. Speculation can occur in every type of financial market. Occasionally, rising prices can set off a sort of avalanche. As prices climb, people believe that they have to buy, and they have to buy now before prices rise even higher. This sets up a feedback loop with more and more people jumping onto the bandwagon to buy. Prices in this scenario can become artificially inflated. Eventually, however, the music has to stop, and hard crashes can occur.

It happened with the housing marketing in the U.S. back in 2007-2008. It happened in Japan’s real estate market back in the early 90’s, and in China last summer. Oil has seen bubbles form. Same with gold. Where there is speculation, bubbles can occur.

So yes, bitcoin was overvalued in 2013, and a market correction was due. Whenever prices rise rapidly in a short period of time, you need to be careful and cautious with your investments. It doesn’t matter if you’re buying stocks, real estate, bitcoin, or anything else.

You also need to be aware of hype. In 2013, bitcoin was receiving a lot of hype, and a lot of new people were joining the bitcoin community. Back then, bitcoin was in the news everywhere, major firms were just beginning to look at bitcoin as a potential opportunity, and big names, such as the Winklevoss Twins, were just beginning to draw attention to it. This hype can spur demand and increasing demand means increasing prices.

Could bitcoin be a safe haven currency?

One last thing you should consider if you’re looking to invest in bitcoin. As of late, stock markets have been extremely turbulent. If and when stock markets suffer a major decline, bitcoin could become a safe haven investment. When stock markets are hit, people tend to lose faith in financial systems and even national currencies. During the great recession of 2008, for example, gold prices spiked as people fled paper currencies and stocks and invested their money in gold and other physical assets instead.

Again, predicting the future is difficult, but should stock markets suffer a big hit in the near future (which is very possible), bitcoin prices could spike. As bitcoin is an alternative currency, and because national governments tend to use stimulus policies that deflate the value of their national currencies during economic crises, bitcoin could start to look like a very attractive safe haven.

This means that bitcoin prices will go up and up, which is something to every investor should consider. Should the world suffer a major recession before 2020, bitcoin prices could potentially surge past my conservative $1,000 estimate. This is pure speculation, of course, and no one knows when the next recession will occur.

The current state of bitcoin

Right now, bitcoin isn’t being hyped, at least outside of reason. The market itself has matured, and prices are now moving at much more moderate rates. The steady, stable gains being made by bitcoin hints at the underlying stability now found in the more mature bitcoin market. Yes, prices have been gaining, quicker than many stocks and markets, in fact, but these gains are within the realm of reason.

These steady gains should continue in the future. I’m not making this claim based on wishful thinking, but instead am considering the slowing supply of bitcoin in combination with the increasing legitimacy of the currency and its widening adoption by users and investors.

Gains between 15 to 25% appear to be reasonable, based both on past growth and future potential . If bitcoin gains just 15 percent each year between now and 2020, coins will be valued at $717 per one Bitcoin. If bitcoin gains 25%, prices will top $1,000. Such gains are reasonable, and will most likely outpace gains in stock markets and other financial markets.

So $1,000 dollar bitcoins? It seems likely. Mind you, this prediction is relatively conservative. As already mentioned, many bitcoin experts believe that bitcoin will reach far higher heights. Of course, you might argue that these experts are simply trying to promote their own self interest, perhaps even trying to drum up a little bit of hype. Regardless, even if bitcoin doesn’t hit the $4,000 mark, it should continue to gain ground.

This article represents the writer’s personal opinion only and should not be considered as investment advice.

47 Comments

47 Comments

lol at least $1,000. By 2020 the new bottom will be 100k and the top in 2021 will be 356k. By 2025 it will pass the one million dollar mark or we will not even have a dollar value anymore after the collapse of the dollar by 2020-2021.

Bitcoin has overcome more than 300 deaths now. There were times when crypto critics gave their verdict that it is the end of Bitcoin. However, it bounced back every time proving them wrong.

Despite the struggles that Bitcoin has experienced, there has been a noteworthy influx in terms of investments in the market.

Long-term BTC holders believe that the Bitcoin market moves in cycles. If that is the case, BTC price will certainly shoot up.

Considering the speculations, you should as well be convinced that the price of Bitcoin depends on risk tolerance and belief in the long-term viability of the number one cryptocurrency as an asset.

Let us have a look at the Bitcoin price graph for the last one week.

Image Courtesy: Coindesk

The graph does not follow a downward trend throughout. It touches the peak at $6800 on 22nd September and then comes down to more than $6400 on 25th September.

Bitcoin is subjected to volatility. For a stable rise in Bitcoin price, we have to allow it some time. It is too soon to predict that Bitcoin will rise exponentially in the near future. However, I am bullish about the fact that it will crash and rise again in cycles.

“pick up” not “pickup” you tard.

omg i luv bitcoins! they get me all the d oh yeh boi

In essence, doesn’t the supply of Bitcoin increase with hard forks such as Bitcoincash and Bitcoingold; reducing its expected price? Each of these adds approx. 21 million more coins and they are in all respects identical to Bitcoin with touted beneficial alterations (e.g., increased blockchain size)

Hi Digimonarch,

Well, the supply of actual Bitcoin isn’t increased at all. I’ve come to regard these forks as very similar to altcoins. The only advantage they have over newly-created altcoins is that, by awarding much of their supply to existing Bitcoin holders, a huge number of people then demand that these coins get onto exchanges. This creates a number of instant markets and also a great deal of awareness for these altcoins. This allows them to trade at a price which is, in my opinion, vastly inflated.

I believe that as more and more of these forks are launched, eventually the market will learn to see through these shenanigans and discount them as simply new alts. There is some evidence this is happening, as each successive forkcoin seems to be trading at a lower price. Bcash captured the majority of the novelty value and support of those disgruntled types opposed to Bitcoin’s development path. Bgold has had a far less meaningful impact, and I expect the next forkcoin (Diamond? Super BTC?) to have even less.

No

Good but very conservative analysis…Wondering why I didn’t see this earlier.

I have approximately $280 worth of btc now and am looking forward to buying some more.