This week, we were crazy about Bitcoin lists: from the “22 Strangest objects you can buy with Bitcoins” to “A collection of the 15 best Bitcoin cartoons”, you can find them all in our latest news.

The last few days were pretty lively, with the Winklevoss twins going all in with their new exchange-traded fund proposal delivered to the SEC and the awaited conference Bitcoin London 2013, which was a true success. Check our latest weekly round up, every Friday here for you!

A study about Bitcoin awareness

During the event “Virtual Currencies: Gold Rush or Fools’ Gold, The Rise of Bitcoin in a Digital Economy”, hosted by Stanford University, in California, there was the feeling that Bitcoin is already going mainstream, but that might not be completely true.

To prove this theory, YouGov made a questionnaire, with a nationally representative sample of 1000 United States residents, and the results aren’t the best, as most people still don’t know what Bitcoin is. When asked “have you ever heard of Bitcoin”, 30 percent of the participants said ‘yes’. This means that 70 percent of them still doesn’t know Bitcoin or have ever heard about it. If you want to check the rest of the results and check the complete article, click here.

The possible benefitis of Bitcoin to online gaming

According to the experts, Bitcoin payments could quickly become the boost that online gaming needs to become even more powerful and attractive to players.

The theory is all there, but why isn’t this happening in reality? Well, according to a Forbes collaborator, who recently attended the conference Gaming in Holland, which occurred in Amsterdam, there are two main reasons that explain it: online gambling companies don’t want or need the scrutiny from the regulators and, also, players aren’t asking for it.

Romney’s blackmailer caught and indicted

Remember the case of Bitcoin-related blackmail against the US presidential candidate Mitt Romney? Well, it seems like the suspect was caught and it’s now being indicted for several crimes, after trying to extort $1 million in Bitcoins from the politician. His name is Michael Mancil Brown, he has 34 years old and it’s from Tennessee.

In 2012, when the case happened, the man claimed that he had undeclared tax records belonging to Mitt Romney. At the time, the suspect contacted PricewaterhouseCoopers, the accounting firm that worked with the candidate, and warned them that he had stolen several computer documents with more than 20 years of information about tax returns that the politician had refused to make public during the presidential campaign.

Well, like you know, he got squat and he has been indicted on six counts of wire fraud and six counts of extortion.

ASICMiner’s USB Block Erupter sold out in 40 minutes

BTCGuild, currently the second largest mining pool (with 17 percent of the network hashpower), started selling the ASICMiner’s USB Block Erupter a few days ago. They only needed 40 minutes to sell out the available 1000 units, so the initiative was a true success.

As you may know, ASICMiner is the largest mining company in the Bitcoin universe. Alone, the company is responsible for one quarter of the whole cryptocurrency network!

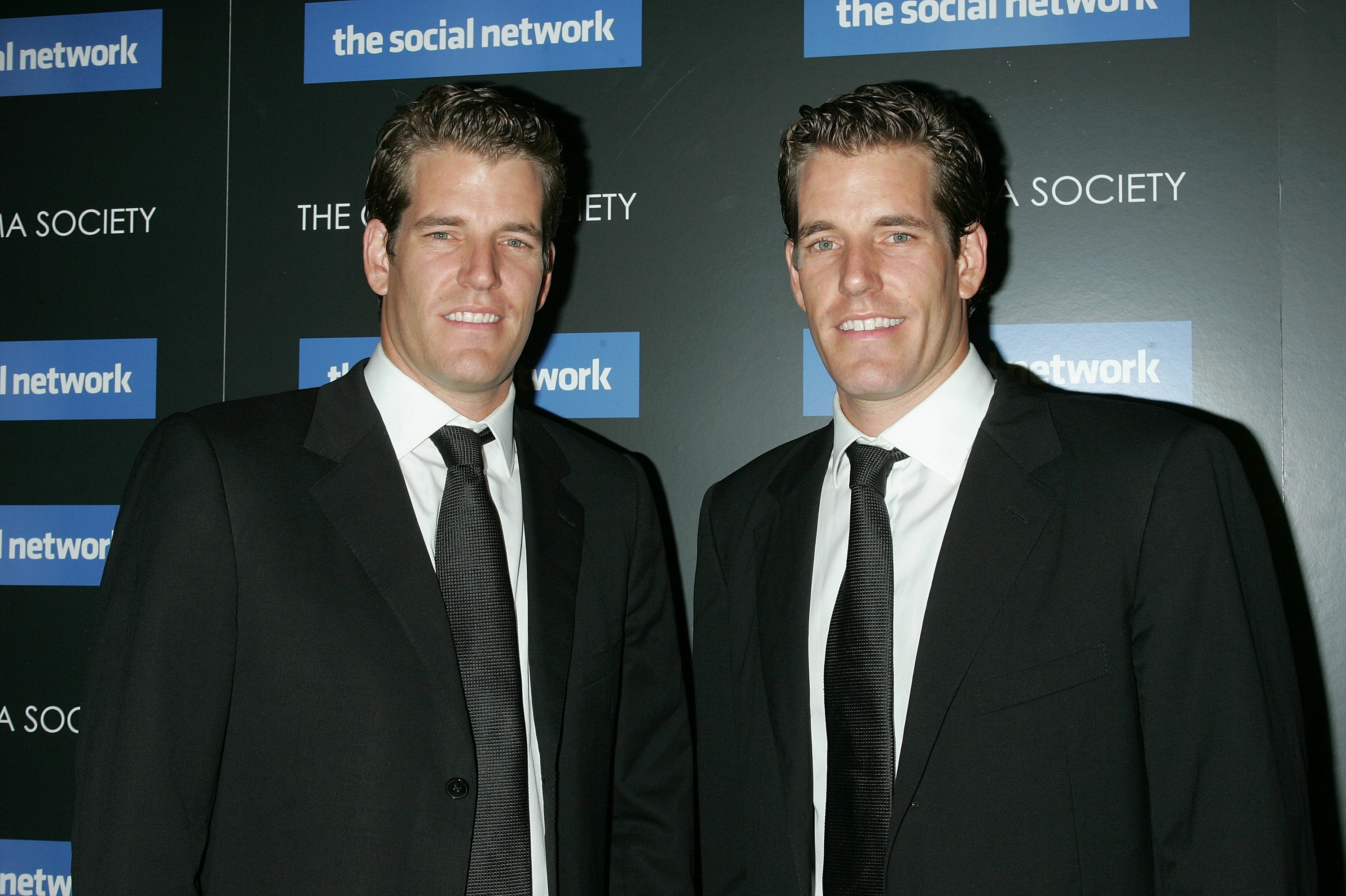

The Winklevoss twins announced the creation of their Bitcoin exchange-traded fund

The most famous twins from the technology world, know for their legal battle against Facebook, filed some important documents with the SEC on July 1. It looks like the Winklevoss twins are making their own Bitcoin exchange-traded fund (ETF) public. However, the plan has a lot of risks, described in 18 pages of the report.

Without any surprise, some of the major risk factors noted in the document delivered to the SEC are related to security and the spread of the cryptocurrency in the retailing field.

Bitcoin London 2013

The big conference Bitcoin London 2013 happened on July 2 and it was a true success, leading a lot of experts and investor into the British capital. Check out the major conclusions of the meeting.

Germany is leading the Bitcoin taxing process

The German Parliament, known as Bundestag, declared that profits from the sale of Bitcoins held as an investment are exempt from taxes if the cryptocurrency is held for over one year, making the first official move when it comes to tax Bitcoin.

The man behind this change is Frank Schäffler, of the Free Democrat Party (FDP). The new German ruling sees cryptocurrency as a “privately held movable asset”, which means that the digital coins will only be subject to capital gains tax if the asset is sold within a year of purchase. If the Bitcoins are sold for profit before the one year mark, the operation will be subject to a 25 percent capital gains flat tax. But, like we said before, if one year has passed, the gains are exempt of taxes.

The Bitcoin Foundation answers to the financial authorities of California

This week was marked by another episode of the “Bitcoin Foundation vs. Department of Financial Institutions of California” dragging fight. After receiving a ‘cease and desist order’ for allegedly engaging in the field of money transmission without a license or proper authorization, the Bitcoin Foundation wrote a letter with the date of July 1, where it explains why the institution “believes it does not require licensure as a money transmitter under California law”.

“In light of the Foundation’s mission to promote Bitcoin through public education, the Foundation also details below why it believes the sale of Bitcoin is not regulated under the California Money Transmission Act”, the document adds. You can read the full letter here.

Mt. Gox resumed US dollar withdrawals

The biggest Bitcoin exchange platform in the whole world, the well-known Mt. Gox, has finally resumed US dollar withdrawals after a suspension period that lasted two weeks.

The company, based in Japan, was being bombarded with questions on their official Twitter page since the beginning of July 4, when the suspension should have been and was revoked.

Interview with Adam B. Levine, from Let’s Talk Bitcoin!

Adam B. Levine, the founder and editor-in-chief of Let’s Talk Bitcoin!, answered some questions and gave a lot of interesting answers. The interview mainly focused on Bitcoin regulation. If you’re curious, check the complete interview.

Kipochi launches a new wallet “designed for the whole world”

The company Kipochi has recently launched their new Bitcoin wallet and, according to the brand, it’s a “service designed for the whole world”, especially thinking of places like Portugal or Kenya.

The most significant feature of Kipochi’s wallet is the fact that it “allows users to receive and send Bitcoin all over the world, even for people using simple low-cost feature phones”. This means the service recently arrived in the universe of cryptocurrency works on all mobile phones, as well as on desktop computers.

Bitcoin malware scandal leads to lawsuit against ESEA

And, finally, our last news highlight. Three claimants have filed a suit against E-Sports Entertainment Association (ESEA) due to a hurtful discovery: cryptocurrency-related malware was found in the community’s popular anti-cheating client.

It all went down last May. At the time, the players were using the ESEA client especially in games like “Counter Strike”, “StarCraft 2? or “Team Fortress 2?, as an anti-cheat device. However, some users started noticing that the client was cornering an unusually high amount of system resources, damaging some GPUs.

After a quick investigation, it was discovered that the client was hosting a piece of malware, which was capitalising on user’s idle time to mine Bitcoins.

1 Comment

1 Comment

Comments are closed.