Paycoin itself is only part of the recent controversy surrounding GAW. There are a number of issues that have been brought up regarding posts, articles, or entire pages disappearing from Hashtalk, and other websites, criticism about how Paycoin purchases are handled on Paybase, supposed promises made and broken, ex-Hashtalk mods claiming to have logs of internal GAW communications, the profitability guarantee of Hashlets, and that is just scratching the surface. Some of these topics are still in the process of unfolding, such as the ex-mods logs, which have not been released to the public yet…but others we can examine now.

Unfortunately, a lot of the proof that has been presented for these topics is not exactly solid. All do have merit, but also have the potential to be explained. Of course, time reveals everything, and the truth will come out eventually, for better or worse.

GAW’s Disappearing Posts

It is well known at this point that many of GAW’s posts on Hashtalk, Reddit, and other channels of communication have disappeared, been modified without warning, or seem to have restricted access. In many cases, these removed posts were announcements from Josh Garza, or other GAW staff members, that received a significant amount of criticism. In other cases, they were users that posted on Hashtalk, and seem to have been banned, or had their posts deleted, for speaking out against GAW.

However, it is hard to tell if this is actually the result of censorship by GAW, or not. At least in the case of GAW’s posts on other social networks, there have been suggestions that some of the posts were deleted by moderators of those forums, or downvoted into oblivion, but there is very little proof in one way or another. Then, with Hashtalk posts, it is often the case that posts were not actually deleted at all, but instead, the URL of the post was changed. When speaking with Josh Garza on Friday, he explained that this was an issue related to a limitation in the forum software they were using, which automatically changes the url of a topic if the title of the topic is changed. It does this without adding a 301 redirect to forward links to old url on to the new one. Of course, it seems like there should be some sort of workaround for this, but he claims that there is not. He also stated that GAW will be moving away from Hashtalk, and back to a more formal website for important announcements in the near future.

Still, this is only part of the problem, as users legitimately have had their posting ability limited, and posts removed, from Hashtalk. While Mr. Garza claims that this is only around 1% of all posts, my own experience seems to suggest that a much larger number of posts are removed. Then, even when posts aren’t actually removed, there is the issue of “shadow banning”, which allows a user to post, and the post can still be viewed if a direct link to it is followed, but it no longer shows up on Hashtalk automatically. While shadow banning is common practice across many social channels, especially those that are related to a company, it seems to be used more than necessary with Hashtalk. Unfortunately, I do not have hard numbers in front of me, so I cannot say exactly what the rate of deletion, modification, or shadow banning is, nor could I find any reliable data on it. If anyone has access to this data, please send it to us.

Finally, we get to the disappearing official posts that are not the result of moderation on another social site, nor a changed url on Hashtalk. According to Mr. Garza, GAW often writes, and rewrites a post multiple times before posting it. If they later notice that they had an error, posted something that was inaccurate, or accidentally posted the wrong comment, it is deleted. It is hard to prove or disprove this, but again, if you have proof of anything mentioned here being true, or false, please let us know.

Paycoin Paybase Purchases Traced to Pre-Mined Coins

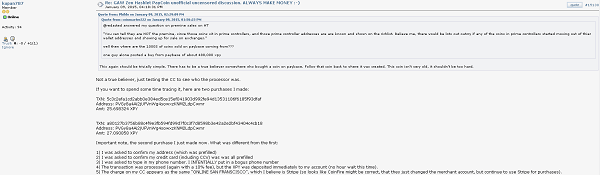

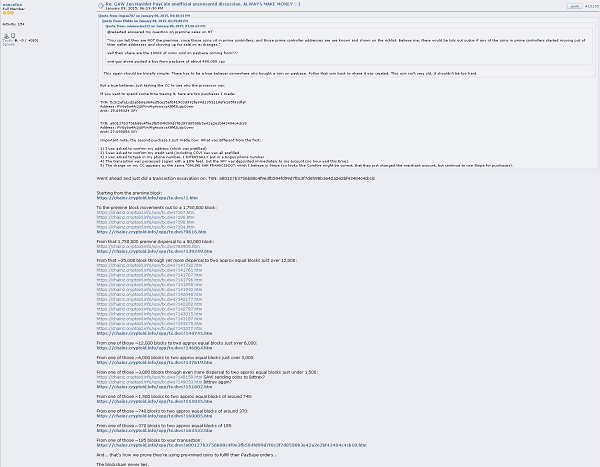

Again, there are two sides to this story. First, there is the instance that was linked to in the first paragraph of this page. A user on Bitcointalk, kupan787, purchased a little over 52 XPY from Paybase in two transactions.

Once this was posted, along with the transaction IDs for the two purchases, another user named vancefox used the Paycoin Blockchain to perform a transaction excavation on one of these transactions, with TXID: a80127b3756b88c4f9e3fb594fd99d7f0c3f7d8598b3e42a2e2bf43404c4cb18. The result of this analysis proved that the Paycoins purchased through Paybase originated in one of the pre-mined Paycoin blocks, and never was transferred to an exchange before it was sold.

Why is this an issue? Well, because GAW had promised that all Paycoins purchased on Paybase would be purchased from the market (rather than the pre-mine).

When I questioned Josh Garza about this, he stated that,”When people buy coins on Paybase, we sell ones that we have in a pool, then use Bitcoin to buy Paycoin on an exchange.” That is plausible, as that would be a quick way to get Paycoins to users, while still maintaining their promise to purchase the coins from the market.

Still, proof that this is actually happening (or not) has yet to be presented by GAW, or by a member of the community, as far as I know. Again, as before, if anyone has proof that this is happening, or not, please contact us.

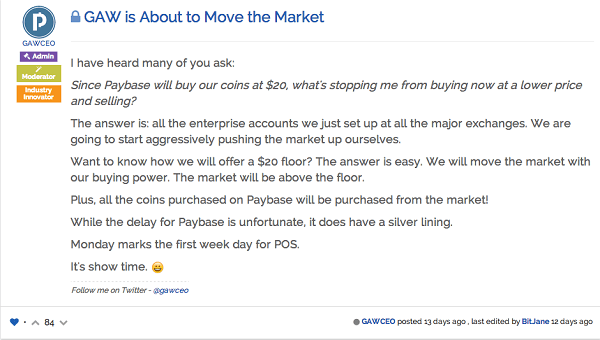

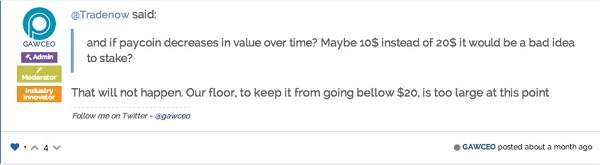

The Paycoin “$20 Price Floor Promise”

Before Paycoin was launched, GAW stated that outside investors were willing to buy Paycoins for $20 each, and that they would be working to keep the price above $20. This was a highly touted point about Paycoin’s “value”, and reinforced over and over, even after the launch. That said, truthfully, they did not promise that Paycoin would not go below $20, but rather stated that they would do everything they could to maintain that price of higher. The one exception to this, which some have stated was a promise to keep the price over $20 is available below:

By saying that it was not going to go below $20, because their “floor”, or “buy wall” as it is often called, was too large to allow it was something that really should not have been said. Without mathematically proving that they had a larger wall at $20 than the value of all of the paycoins that they did not directly control, it is impossible to say that that the floor was too large to keep it above $20. Markets can be manipulated and controlled to a point, but no buy wall is ever unbreakable, except in the situation I mentioned above.

However, the argument then becomes, was that a promise, overconfidence, or just a misleading statement? Outside of that one comment, basically every other time the “price floor” was mentioned, it was being referenced in a way that had a bit more ambiguity, or in some cases, outright uncertainty.

No matter what, even stating that they were pushing for a $20 price floor was a bad idea. If the price drop really was due to individuals, not GAW, dumping the coin on the market, they were helped by GAW’s push to keep the price up. Basically, it let anyone that had XPY know that they could sell the coins they purchased from the IPO, or mined, for $20 or more as soon as the coin was listed on the market.

Update: Today an announcement on the PayBase blog has introduced the Paycoin™ Honor Program, and has led to a spike in Paycoin’s value. The ultimate result of this program is unknown, but I will update this post after I have time to fully read through it.

Hashlets’ Guaranteed Profitability

The accusations that GAW is a scam started when they announced their Hashlets. These Hashlets, which were actually supposed to be something similar to a “mining derivative”, were guaranteed to be profitable, and no one was sure what hardware, if any, was backing them up.

In fact, in my interview with Josh Garza last month, the first question I asked was,”How can you guarantee that Hashlets will be profitable?” His reply was long, but there were two points that stuck out to me. First, he said:

Through a number of things, such as reducing maintenance, covering maintenance, rewarding them something within the system, as well as being able to use the marketplace to exchange them, we can say that you will be able to be generating a profit, and making money. Now, again, thats where there is a notion of clarity…outside of this industry, making money doesn’t mean in 2 months. If you ROI on a normal investment, it is going to take you, with a really good investment, 5 – 10 years. When you talk to a miner that is an outrageous number to them.

Now, it may be unlikely that Hashlets will be around in 5-10 years, but due to the fact that they were exchangeable for various other GAW “items” and were able to mine Hashpoints, which were redeemable for Paycoin during the IPO, it is very possible that every Hashlet had the chance to be profitable. Also, realistically, the company could just reduce the payout to almost nothing, but keep paying out SOMETHING, and the Hashlet would be profitable eventually. It just may take a long time.

The other statement he made is one that really hit me. It is what pushed me forward in looking at Paycoin and Paybase as something that, potentially, was the ultimate goal of GAW from the start.

There is a lifetime value to a customer that most people in this industry don’t see, that I see. Our most valuable assets are our customers, and we have a large customer base. That is valuable to merchants. That is valuable to partners. That is valuable to people.

Why does this statement matter? Because it is absolutely true. If GAW was a struggling mining company, relying on funds from sales of Hashlets to buy mining equipment in order to pay customers, then Hashlets would be a horrible, horrible idea. However, if GAW came into this game with deep pockets, or has individuals with very deep pockets to back them, then Hashlets do not need to be profitable. They could be, for all intents and purposes, a marketing tool used to create a strong, loyal following of customers (which GAW certainly has). In that scenario, Hashlets are an amazing idea. Of course, no one knows how much funding GAW truly has, nor do we know who may be backing them, beyond the individuals mentioned earlier in this article, and Josh himself.

Final Thoughts: Don’t Underestimate GAW or Paycoin

As I have examined as much of the information I could find about GAW, and Paycoin, that I possibly could, I have came to a point where I am truly worried about what may happen with Paycoin. Of course, it is possible that GAW really is just another scam, and that would be horrible for many, many people. Some individuals have invested thousands and thousands of dollars in the company, and it’s services.

Unfortunately, I am of the opinion that GAW being a scam may actually be the better outcome of this entire debacle. If they are not a scam, and manage to make Paycoin successful, then that could be bad for cryptocurrency in general. I’ve spoken to a few people about my thoughts on Paycoin as the “Bankcoin”, and one of the first responses I usually get is something like,”It can’t succeed. Beyond GAW’s supporters, no one else in the cryptocurrency community will support Paycoin.” The problem with this way of thinking is that it does not matter…not at all.

GAW’s current customer base has given Paycoin it’s foundation, and if the market cap increases (it is up 75% over the past 24 hours), then some people will jump in, and buy some. Many may be doing so to speculate, or day trade, but that will increase the legitimacy even more. This, combined with Paybase, will provide a proof of concept for GAW to pitch to banks, or other investors. If it reaches that point, and even one relatively large financial institution decides to jump onboard, the war will officially begin. The ideas that Bitcoin, and other cryptocurrencies, are built on will no longer matter. The cryptocurrency community is not the TRUE target market for a currency such as Paycoin.

Large financial institutions have the regulatory approval needed to do many things that Bitcoin-based companies are fighting to get permission to do. Many have more funds readily available than the entire marketcap of all cryptocurrencies combined, and can use this incredible wealth to really push Paycoin into the mainstream. They could integrate it with their existing services, and sell it to people who have no idea about cryptocurrency, don’t care about it, or are even against Bitcoin. They could make it go mainstream in a way that will take Bitcoin a lot of time and development. Even if Paycoin isn’t perfect currently, and has a few serious flaws (which is does), the way the Prime Controller voting system is setup would allow an institutions, or company, to simply bid for 2 / 3rds of all Prime Controllers, or collude with others to reach that limit, then hire as many developers as they need to change the currency in whatever way they desire.

In the past, I have thought that it would be unlikely for a financial institution to successfully create a cryptocurrency, as they would have trouble getting early users onboard for the proof of concept / testing phase. Members of the cryptocurrency community tend to be distrustful of banks at the least, or, in some cases, have an outright hatred for the current financial sector.

However, Paycoin makes me think that they won’t need to create their own. Someone else is doing it for them…

2 Comments

2 Comments

Perhaps crypto enthusiasts may initially dislike paycoin because of what it may become (as the article suggests) — but on the other hand, perhaps they should actually love paycoin precisely because it has the potential to become mainstream as it will naturally evolve to become an enabler for the masses to transition to more ideological cryptos such as Bitcoin.

I agree, but #paycoin is symptom/response to collective failure of community in running a decentralized system. #Selfish #profit