Proving the scam-mongers wrong, Novacoin has made it to its first birthday and that means it’s time to look back.

On the 9th February 2013, a new altcoin called Novacoin (NVC) hit the web, setting rigs, exchanges and forums abuzz. Created by an international team of developers, the new coin emerged to improve upon Sunny King’s Peercoin (PPCoin).

But shortly after its release, Novacoin hit off the alarm as a ‘scamcoin’ suspect as rumours of premine, price manipulation and an imminent ‘pump-n-dump’ caught on. So what is the real story? We trawled through forums, charts and interviewed Novacoin’s developer to get a balanced picture.

Steady rewards, low difficulty

Just like PPCoin, Novacoin uses scrypt hashing and combines the proof-of-work and proof-of-stake mining models in a hybrid system.

Simplistically, the difference between Bitcoin’s proof-of-work (PoW) mining model and the proof-of-stake (PoS) model is that the latter places a huge significance on coins that a miner already has. That’s his ‘stake’ in the coin – and the bigger his stake the higher his mining reward.

PoS mining might be the answer for two big questions of Bitcoin: decreasing block rewards (which, over time, could decrease interest in mining) and special hardware needs (which entail with high power bills and a constant dependence on hardware manufacturers). The developers of Novacoin liked the concept of the PoS but they weren’t convinced that PPCoin was getting the most out of the model to tackle these questions. This disagreement inspired Novacoin which uses two block chains (one PoW and one PoS).

Besides its promise to keep up rewards in the very long-run, the newcomer NVC had another selling point: low difficulty.

Scam-alert

Despite its noble ambitions, Novacoin was born under a bad sign. Already on the third day of its existence, NVC came under fire as rumours on a swelling scam started to emerge. ‘Scam Coin Do Not Use’ – the tagline blared from the posts on the coin’s official thread on Bitcointalk.org. The debate was touched off by allegations of a massive pre-mine (guesstimates put the amount between 110k and 200k Novacoins).

A pre-mine would have meant that the developers had mined blocks before the public launch of the coin, making use of a very low initial difficulty. On the 11th of February, two days after the publishing of the NVC client, BTC-e (the Bulgaria-based cryptocurrency exchange) introduced the NVC/BTC trade pair.

Another three days later (when less than 300,000 coins had been mined worldwide) BTC-e announced that it held 110,000 Novacoins in the BTC-e guarantee fund exchange. And the news didn’t help NVC’s reputation. Then, on the 14th of February, BTC-e said it had destroyed the 110,000 ‘pre-mined NVC’ – apparently under a DDoS-attack. After and amid these allegations, the coin’s market price soared on BTC-e then nosedived, stoking fears of a ‘pump-n-dump’ – a scam in which someone drives the price high before dumping their massive holdings for a landfall profit, leaving the market in ruins.

The other side of the coin

One of Novacoin’s developers, a programmer known to the crypto-community as Balthazar, has given us his take on the story, putting the incident in a different perspective. He said they hadn’t pre-mined Novacoin – they insta-mined it.

These coins were mined between 9th February, 1:00am (client release) and the 10th February 15:00pm (time of the official release of NVC/BTC trading pair at the BTC-e exchange).

So the coin was already out there for miners when the devs started the mining. Is this a pre-mine? Just look at the debate revolving around the correct definition of pre-mining and make your judgement. On that note: though pre-mining is generally regarded as unethical, some say it is not fair to expect developers to put serious work into a coin without enjoying a significant reward.

Insta-mining: a publicity stunt?

In Novacoins’s case, this reward did not manifest in a hefty balance on the developer’s address – but the insta-mining manoeuvre earned NVC a huge deal of publicity.

What happened to the insta-mined Novacoins? Balthazar says that he had them destroyed by BTC-e, which suggests that destruction was the reason for sending the coins to the exchange (and not some kind of bribery as some users thought).

The private keys and addresses were sent to the owner of BTC-e along with step-by-step instructions on how to destroy these inputs. It was my own decision, nobody asked me to do it, nobody including my friend Alexey, owner of the BTC-e exchange.

But why would someone insta-mine coins only to destroy them? Balthazar’s comment hints at a well-planned publicity stunt which helped NVC stand out of a mass of up-and-coming altcoins: “without the creation and destruction of these coins we would have needed twice as much time to achieve the current results. There were two options of dealing with the insta-mined coins: either to distribute them (proportionally, between the miners) or to destroy them. I preferred the second for its more shocking effect”.

One year on: boom or doom?

One thing is clear: the NVC ‘dump’ has never happened.

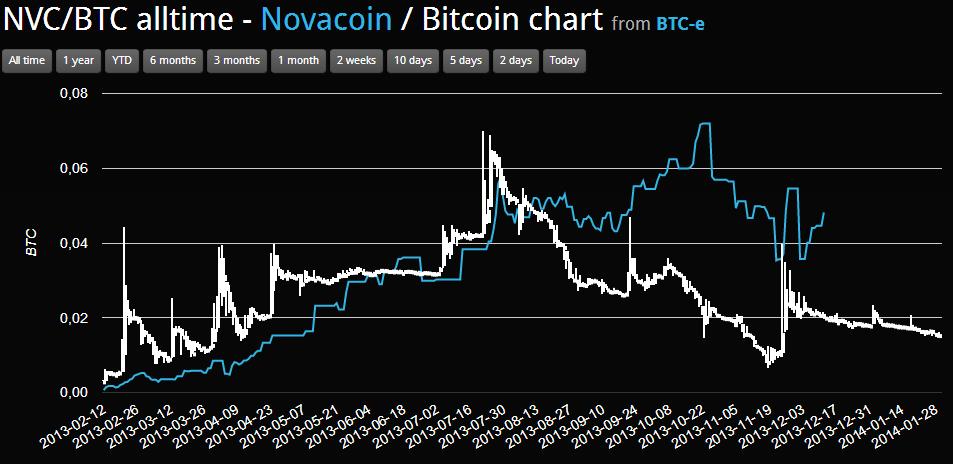

But what has happened in the first year of Novacoin? If you look at the charts, you will see that NVC’s market has been quite jumpy, the price once rocketed to $24 in late-November, but has followed a mostly downward trend ever since (note that the end of November was a launch pad for many cryptocurrencies due to a dramatic surge in BTC prices).

But what has happened in the first year of Novacoin? If you look at the charts, you will see that NVC’s market has been quite jumpy, the price once rocketed to $24 in late-November, but has followed a mostly downward trend ever since (note that the end of November was a launch pad for many cryptocurrencies due to a dramatic surge in BTC prices).

So far, NVC hasn’t become the hottest altcoin out there but at just over $10 its market price puts it in the top five. But due to an extremely low emission rate (only about 700,000 coins are currently in circulation) the market cap hovers around $7 million, placing Novacoin in the 15th/16th place of the cryptocoin ranking.

Novacoin now trades for BTC at four exchanges, as well as for USD at BTC-e. Meanwhile, Balthazar and the team have kept stuffing the GitHub with updates and new versions.

A growing fan base

Though the market price has been sliding in the past two months, Novacoin as a technology has registered steady appreciation among miners and developers. It even has its own converts.

The fans hail Novacoin on two accounts. First, they say it’s fair because an effective PoS brings higher rewards to those with more coins rather than to those who hold epic computing power. The other selling point can be security: there are two block chains so if you want to double-spend, your need to own more than 50 percent of hashing power in both chains, which seems pretty hard if not impossible. Finally, a low emission rate of NVC guarantees that rewards stay relatively high while ‘return on interest’ is continuously adjusted to difficulty – to keep miners interested.

The scam story seems to have faded away. But who knows, if Novacoin is so well-designed it might as well have earned even more followers without the insta-mine gambit.

4 Comments

4 Comments

Comments are closed.