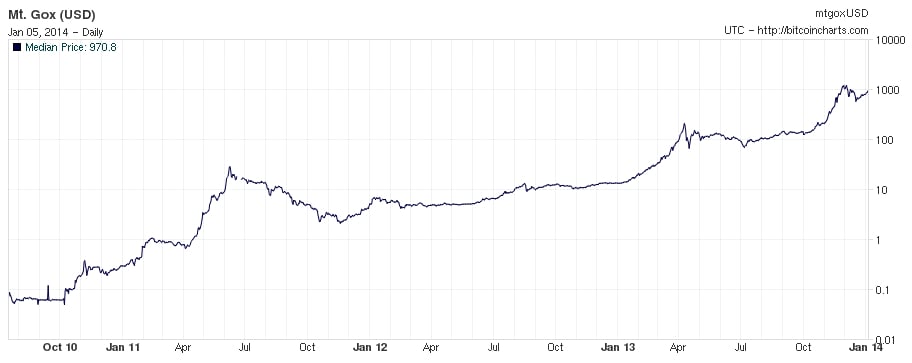

Over the past 3 years, the Bitcoin exchange rate has skyrocketed. In the beginning of January 2011, 1 bitcoin would trade for roughly $0.31 USD. Currently, at the beginning of April 2014, 1 bitcoin will fetch $445 USD. That’s an increase of roughly 143,548% over the course of 3 years.

Why would anyone pay that much “real money” for some made up digital hoosie-whats-its that you can’t even hold in your hands?

The answer comes from understanding that every form of money, from dollars to gold to bitcoins, is only valuable if people consider it to be valuable. A money’s worth is completely based on our own individual perceptions. If we trust and value a form of money, we’ll accept it in return for our own goods and labor. But our trust in particular forms of money is not arbitrary or without reason. Nearly every form of popular money in history has possessed particular traits that have caused people to want to use it.

Bitcoin has nearly all of the properties of secure, sound, and useful money. And if a new form of money possesses enough of these qualities, especially to the point where it’s advantageous to use over other existing forms of money, people will voluntarily choose to accept it as payment and hold it as store of value. As demand increases, value increases, and the exchange rate goes up.

The adoption of Bitcoin as a means of payment is prevalent throughout recent news. Bitpay now processes Bitcoin payments for over 10,000 merchants, Virgin Atlantic will fly you into space for bitcoins, and Overstock.com will begin accepting bitcoins in 2014. Perhaps the most telling of all is that an escort agency in the UK now accepts bitcoins as payment for their “companionship” services. Some might say that if people will have sex for Bitcoin, then it’s money.

This does not discount that some of the short-term gains and losses Bitcoin has experienced may be due to speculation. Investors looking to make quick profits are pouring cash into Bitcoin; not to use it as a means of exchange, but to later sell for an easy profit. Price bubbles have inflated and burst into dramatic crashes as panicky speculators sell off their holdings upon hearing word of negative Bitcoin related news and events.

Yet Bitcoin is still a new concept still in its infancy. The market is trying to figure out how much it’s worth, causing the short-term price to be very volatile. As time moves on, and Bitcoin becomes more discovered and evenly distributed, the market value will become less volatile. For example, when the 4 year price of Bitcoin is viewed on a logarithmic scale, it becomes clear that each subsequent bubble has been less dramatic (in terms of orders of magnitude), and the long-term price has continuously moved upwards.

The Qualities of Money

Here’s a list of some of the most important properties of sound money, followed by a basic table indicating various forms of money and which properties apply.

-

Limited Supply/Rare: for a form of money to be successful, it must be available in limited quantities. This is basic supply and demand: a small, fixed supply generally equates to some amount of value. The more rare a substance is, the more it is typically valued.

-

Utility: the utility of an object plays a large factor in determination of its value. More useful items yield a higher demand, and hence command a higher price.

-

Fungible: single units of money need to be identical and interchangeable with one another. Otherwise, conflicts are created: certain units end up having more value than others, making commerce more difficult.

-

Divisible: the ability to divide a unit into smaller pieces is necessary to match specific prices, like smaller payments for inexpensive goods and services. Money that has insufficiently small units, or is destroyed by dividing it into smaller parts, is less than ideal.

-

Counterfeit Proof: if money can be faked, it cannot hold value. Counterfeiting creates a false perception of value from worthlessness, and artificially inflates the money supply, driving down the value of the other units.

-

Decay Proof: one of the purposes of money is a store of value. If the monetary units tend to rot or disappear over time, there is little incentive to hold or accept the money as a form of payment.

-

Easily Transferable: money also exists to be used as a method of exchange. If money cannot be conveniently exchange for goods and services, it will not be used.

-

Voluntary/Uncontrolled by Authority: this property means that usage of the money is not mandated by an authority. People should be free to use the money only if they choose to do so. Otherwise, they will eventually choose another form of money or revolt against the authority. Additionally, if an authority is in control of the money supply, the authority must be trusted not to abuse it’s power to create money and not to limit how and when the money can be spent. Money unjustly controlled by an authority will be abandoned by a free, general public.

-

Anonymous: all humans have a right to privacy, which includes keeping the knowledge of how, when and where their money is spent and received limited.

Comparison of Different Forms of Money

| Cryptocurrency – Bitcoin, Litecoin, etc. | ||

|---|---|---|

| Limited Supply/Rare | Only a fixed amount can ever be created, e.g. Bitcoin is limited to 21 million BTC units. | |

| Utility | The Bitcoin protocol has the capacity for other uses (contracts, proof of ownership, etc.), but it may lack immediate utility to someone in a dire straits situation. | |

| Fungible | Currently fungible, though in the future, certain coins tainted by things like theft may be worth less to certain individuals. | |

| Divisible | A bitcoin is divisible up to 8 decimal places. | |

| Counterfeit Proof | Cannot be counterfeited as the history of every unit can be traced and verified to its origin. Theoretically, though, double spends may be possible during a 51 percent attack. | |

| Decay Proof | When properly stored with multiple back up copies, a Bitcoin wallet is not susceptible to decay. The exception would be forgotten passphrases for encrypted wallets or physical destruction of all backups. | |

| Easily Transferable | One of the most prominent features of cryptocurrency is that it can be sent instantaneously around the world, and transactions usually confirm within an hour. | |

| Voluntary/Uncontrolled by Authority | Not controlled by an authority. Usage is not mandated by an authority. | |

| Anonymous | Bitcoin is pseudoanonymous, so usage can potentially be linked to your identity. | |

| Fiat Currencies – dollars, euros, pesos | ||

|---|---|---|

| Limited Supply/Rare | Unbacked fiat currency can be created at a whim by governments and banks. | |

| Utility | Fiat’s utility may be limited to fireplace kindling and toilet paper. | |

| Fungible | Most fiat currency is identical and fungible. | |

| Divisible | Normally divisible up to 2 decimal places. | |

| Counterfeit Proof | Fiat currency has a long history of being counterfeited. | |

| Decay Proof | Paper and electronic fiat is mostly resistant to decay. | |

| Easily Transferable | Can be transferred relatively easily electronically, yet this usually incurs fees. Paper money requires a physical presence for exchange. | |

| Voluntary/Uncontrolled by Authority | Nation-states and banks essentially create fiat money. As taxes must be paid to governments in fiat currency, usage is required by citizens. Failure to comply can result in financial penalties and/or incarceration. | |

| Anonymous | All digital transactions are tied to your identity. Physical cash transactions are anonymous. | |

| Precious Metals – gold, silver, platinum | ||

|---|---|---|

| Limited Supply/Rare | Precious metals are rare elements with a limited supplies existing on the planet. | |

| Utility | The utility of precious metals is subjective. Gold is an excellent conductor and useful if you’re an electronics manufacturer. Jewelry made from gold and silver can be found to be attractive. But precious metals don’t fill any general, basic, survival need. | |

| Fungible | 1 ounce of raw bullion has the same value of any other ounce of raw bullion. | |

| Divisible | Mostly divisible: raw bullion can be cut, bullion coins come in various denominations. | |

| Counterfeit Proof | Tungsten filled bullion is a popular method of counterfeiting precious metals and coins, and counterfeits can be difficult to detect. | |

| Decay Proof | Gold is a Noble metal, and does not corrode. Silver does tarnish, but would take millions of years to corrode to nothing. | |

| Easily Transferable | Requires a physical presence for exchange, must be shipped across large distances, heavy to carry, and subject to customs at borders. | |

| Voluntary/Uncontrolled by Authority | Not controlled by an authority. Usage is not mandated by an authority. | |

| Anonymous | Usage is not linked to your identity. | |

| Livestock – cows, goats, pigs | ||

|---|---|---|

| Limited Supply/Rare | Potentially unlimited supply due to procreation. | |

| Utility | Unquestionably useful for food, agriculture, and survival. | |

| Fungible | Sick or scrawny livestock have far lower market value than healthy livestock. | |

| Divisible | Once livestock is slaughtered, market value instantaneously depreciates. | |

| Counterfeit Proof | Counterfeiting a live animal would prove very difficult. | |

| Decay Proof | Limited to the lifespan of the animal. | |

| Easily Transferable | Low value per mass, so very inconvenient (and messy) for transferring large amounts of value. | |

| Voluntary/Uncontrolled by Authority | Not controlled by an authority. Usage is not mandated by an authority. | |

| Anonymous | Usage is not linked to your identity. | |

| Tide Laundry Detergent | ||

|---|---|---|

| Limited Supply/Rare | Procter & Gamble, a private company, controls the production. | |

| Utility | A top brand name of laundry detergent, can be used in most modern households to clean clothing. | |

| Fungible | Sealed containers of Tide will typically be identical. | |

| Divisible | Possibly, it’s unclear if a half full container of Tide has a 50 percent market value of a full container of Tide. | |

| Counterfeit Proof | Containers could potentially be diluted and resealed. | |

| Decay Proof | Surprisingly, unopened laundry detergent is only good for 9 months to 1 year. | |

| Easily Transferable | Requires a physical presence, low value per mass, so requires large amounts to transfer large value. | |

| Voluntary/Uncontrolled by Authority | Not controlled by an authority. Usage is not mandated by an authority. | |

| Anonymous | Usage is not linked to your identity. | |

| Seashells | ||

|---|---|---|

| Limited Supply/Rare | Rarity would be dependent on the shell. Seashells are available for the taking on beaches, lakes, and rivers across the world, and as long as there are snails and other shell-forming critters, the supply is unlimited. | |

| Utility | Very little utility besides jewelry. | |

| Fungible | Sealed containers of Tide will typically be identical. | |

| Divisible | Not really divisible, unless smaller seashells are considered smaller denominations. | |

| Counterfeit Proof | Possible to counterfeit with modern plastic and a mold. For the time frame though, probably difficult to counterfeit. | |

| Decay Proof | It’s not immediately clear how long it takes for a shell to decompose. | |

| Easily Transferable | Requires a physical presence, low value per mass, so requires large amounts to transfer large value. | |

| Voluntary/Uncontrolled by Authority | Not controlled by an authority. Usage is not (currently) mandated by an authority. | |

| Anonymous | Usage is not linked to your identity. | |

Note: some of listings in the above tables are generalizations, and certain qualities can be influenced by subjective situations, time frame, and geographic locations. For instance, a starving man in a remote location will certainly find a pig to have more immediate utility and value than a bottle of Tide or a bitcoin. Another example is that adult males of the central African Kanem-Bornu Empire were required to pay taxes to the king in the form of cowry shells during the 19th century, making seashells, in this instance, a state mandated money.

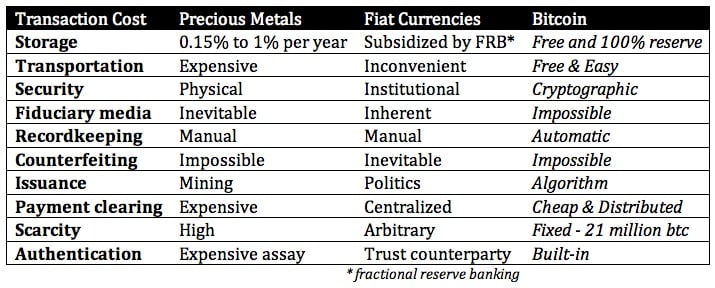

A Comparison of Precious Metals, Fiat Currencies, and Bitcoin

One of Bitcoin’s most valuable features is its transferability: you can send funds nearly instantaneously to anyone on the planet without the need of a trusted 3rd party. No other form of money in history can make this claim. When combined with the other key properties listed above, it should be plain to see why cryptocurrency is quickly gaining popularity. As such, increased demand of a limited supply drives rates up.

The properties of money, and how well they’re fulfilled, are used by the free market to deem how suitable a money is for usage. They determine to what extent a money can be trusted by people.

Trust in Money: Comparing Fiat Currency and Bitcoin

The most ubiquitous form of money in the world today is, by far, fiat currency. Fiat currency “derives its value from government regulation or law”. Nearly every country in the world has their own currency that is their official legal tender. Sometimes the currency is managed by the government itself, other times it’s managed by a central bank. In either case, an authority is in control of creating it, and citizens must pay taxes with it.

In the case of the United States, that monetary authority is the Federal Reserve, a private company that creates US dollars, and loans them out to other banks and the government. The Federal Reserve is free to create and loan their currency without any limits, and every dollar created and loaned out is due to be paid back to the Federal Reserve, plus interest. Additionally, all taxes must be paid by citizens and residents in US dollars to the US government. Failure to do so can result in hefty financial penalties and imprisonment.

Fiat currencies require you to trust the monetary authority not to abuse the management of the currency: making too much currency will devalue it, causing prices of goods and services to go up. How have some nations handled this self-imposed responsibility? A basic determination can be made by comparing the long-term buying power of a fiat currency to a commodity that has a stable long-term value, such as gold:

-

Since 2009, the Argentine peso has lost roughly 70% of its value.

-

Since 1998, the Japanese yen has lost roughly 70% of its value, the Canadian dollar has lost 66% of its value, and the euro has lost about 73% of its value.

-

Since the Federal Reserve central bank was created in 1913, the US dollar has lost about 98% of its value.

By comparison, Bitcoin and cryptocurrencies require trust in math, cryptography, and the existence of a network infrastructure.

Cryptography is a core part of Bitcoin. Cryptography uses mathematical theory in the design of algorithms that secure data; complex computations make it infeasible for an adversary to “crack” or reverse such security, even with access to huge amounts of processing power. Bitcoin uses cryptographic algorithms to secure its ledger and prove ownership of funds.

With Bitcoin, there is no requirement to trust a human authority.

However, electricity and Internet access are required for Bitcoin to work (this is also true for modern fiat currency, though physical cash could be an unwieldy fall back). Without a network of connected computers, new transactions could not be transmitted or processed, and the block chain would grow stale and unpropagated. In the unlikely event of an “internet killswitch” being engaged or widespread network failure, would Bitcoin survive? Probably. Bypassing proprietary cable networks through the usage of decentralized networks like Meshnet could be a viable alternative. But would Bitcoin be injured? Without a doubt — just as communications and commerce would be damaged without internet.

So, given a choice between fiat and cryptocurrency, this question must be asked: which can be trusted more? Banks and government, or math and cryptography?

The answer to that question might yield another: will banks and government try to interfere with an international alternative currency that becomes more trusted than their own currency?