Digital currency technology has emerged as a remedy to perceived failures of the present financial system. The unique feature of digital currency tech such as the Ripple network, Bitcoin, or any blockchain-based technology lies in their decentralized, low cost, instant and global nature. Geographical boundaries are indistinguishable to these networks, thus they lubricate global finance, payments, transactions, settlements and so much else.

There are millions of Africans who suffer directly and indirectly from the present, inefficient international payment systems and networks. These networks encumber remittances, export earnings, outsourced labor payments, donations and FDI; money inflows into the economies of Africa that rely on unfavorable international payment networks.

How Valuable are International Cross Border Payments for Africa?

FACT: the economies of African countries are currently export driven and exports support a vast majority of people.

Export Figures from 2012: Kenya $ 6 billion Tanzania $ 6 billion Uganda $ 2 billion

The East African economy is highly dependent on inflows from export of raw agricultural and mineral commodities: tea, coffee, horticultural flowers & vegetables and commodities.

One country in East Africa, Kenya, earns foreign exchange from: Tea ($ 1.42 billion), coffee ($ 250 million), fresh flowers & vegetables ($ 1.4 billion), remittances ($ 1.29 billion) and tourism ($ 1 billion). Agriculture accounts for 27% of the Kenyan GDP, employing 60% of Kenya’s labor force and contributing 50% of Kenya’s export earnings. According to the Tea Board of Kenya “there are over half a million smallholder tea farmers.”

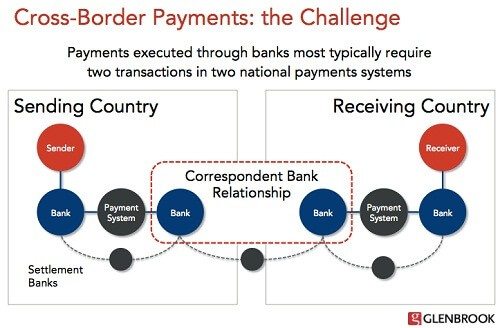

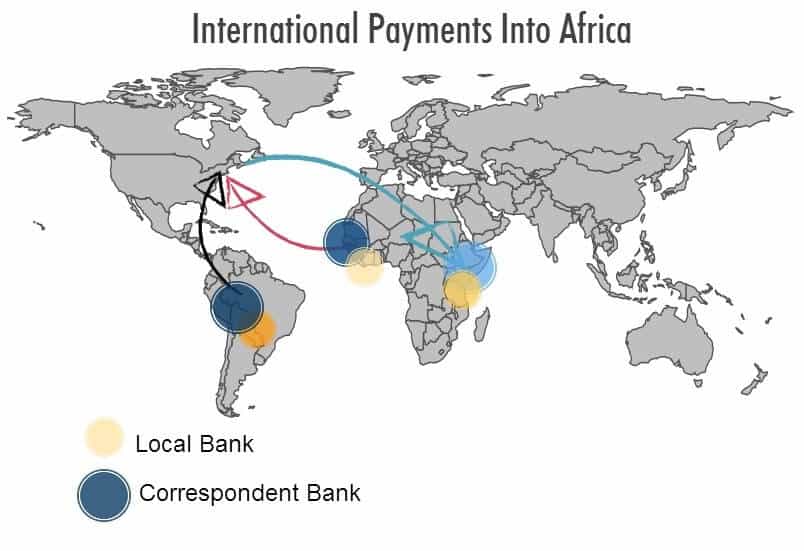

The present payment network is antiquated and discriminatory. African countries unfortunately rely on payments from trade relations with Europe, the United States, Middle East and Latin America. As a result of direct exclusion from the broader payment network, payments encounter friction in a long chain of correspondent banking networks that skim inbound payments through- transaction costs, commissions, conversion fees, foreign exchange fees, correspondent fees and correspondent banking time delays. On the very end of this chain, are hardworking African farmers who bear the brunt of a ghastly inefficient payment system.

Usually, your bank cannot tell you how much the transfer will cost (how much fees correspondent banks will deduct from the transfer. The Terms of Service and Tariff Guide are obfuscated with legal jargon. Some European banks are working with several correspondent banks in chain, thus, several correspondent fees are taken by every bank in the chain

Payments expert Faisal Khan suggests international wire payments network is ripe for digital currency disruption, especially for developing countries. The friction of cross border money transfer wired from one country to the next, via correspondent banks takes as much 6-7% off the actual funds coming into parts of Africa.

Why Are International Payments in this Part of the World so Dire?

Payment systems differ across different regions and interconnectivity amongst these networks depends on infrastructure, standards, agreements and trust. The US is home to the world’s reserve currency, and home to correspondent banks in international payment routes. CHIPS & Fedwire are payment/messaging systems in the US. SWIFT, a financial payment messaging system, works cross border.

Intra-African commerce & trade suffers from lack of common payment wire system across the entire continent. East, West, Central and South Africa have separate distinguishable payment systems – that are not linked. Two African countries trading with each other use third party correspondent bank(s) in the US and another domestic/local correspondent bank. A SWIFT white paper aptly described the problem

Cross-border payments intra-Africa and between Africa and the rest of the world are skewed towards USD usage and USD clearing via North American banks. Transaction costs remain high at least partly because a large proportion of settlement processes within Africa involve banks outside of Africa.

Equity bank, Kenya’s second-biggest lender by market value, maintains a relationship with 5 correspondent banks in 5 different countries for 11 different currencies.

Alice’s Local Bank – Alice’s Bank Local Correspondent Bank – US Correspondent Bank – Bob’s Local Correspondent Bank – Bob’s Bank

The SWIFT white paper then goes on to suggest remedies for this challenge

Given the presence of at least 800 commercial financial institutions in Africa, the next step will be to assist banks, particularly domestic banks develop the capacity to become confirming and corresponding banks so that we can lower costs.

Where Does Bitcoin, or other Digital Currency, Fit in?

Today, innovative digital currency tech such as Ripple networks and Bitcoin can massively impact present structures for African countries excluded from international payment network. By leveraging the sheer low cost global scalability and instant transaction speeds of the Ripple network – transfers from ANY where automatically more efficient. East African destined payments can take an hour, incurring a pre-determined, transparent flat fee. The Bitcoin blockchain is a global Peer-to-Peer network. With the right set of services built around it, multi-tier payment transfers can drastically drop to within 12 hours at a flat fee. Payments experts widely acknowledge the potential of the blockchain for a global payment network. Presently, the blockchain is worked on by some of the best minds.

Opportunity for Bitcoin, Digital Currency tech, FinTech and Money Transmitters

The challenges presented represent a unique opportunity for digital currency tech to introduce transparent, faster, direct, reliable and low cost payment services across B2B (business to business), B2C (business to consumer) and P2P(peer to peer) cross border payments. Favorable regulation for Financial-Technology (FinTech) and Digital Currency tech will allow money transmitter startups to step in and offset some of these challenges. In recent comments, George Osborne’s, UK Chancellor of the Exchequer, spoke warmly on FinTech, digital currency and virtual currencies in the United Kingdom. His comments bode well for money transmitter opportunities on this corridor. Of the $ 1.2 billion remittance industry in Kenya, 51% emanates from the US and Canada, while 25% originates from the UK. Enabling regulation here makes digital currency money transmission a viable alternative for previously skeptical businesses and consumers.

Because money transmitters do not have account relationships with their customers, they are not required to perform customer identification and verification other than pursuant to the Funds Transfer and Travel Rules and the CTR requirements. – FinCen

In transactions such as agricultural exports from East Africa, payers and payees on both ends are clearly known. KYC, KYCC, AML and CFT regulations can be met while still offering low cost value propositions. Digital currency startups like BitPesa (in East Africa), could use the same channel employed for digital currency remittances to funnel in other types of UK money flows destined for East Africa. Developments in the Bitcoin and digital currency ecosystem will be crucial to making this possible.

2 Comments

2 Comments

Well articulated. The question is how – beyond sitting around tables – are we going to get Bitcoin accepted and used in Kenya?

What is the Bitcoin Community doing to get some Bitcoins into Kenya or does it expect us to spend our meager resources buying Bitcoin?

Bitcoin has huge potential in Kenya and I can see a situation whereby Kenyans are teaching their relatives abroad about Bitcoin and telling them to use it for remittances.

We at sotemoja.com are working towards making this a reality.

See another post at

Lol this is pretty smart!