BTCJam is a Bitcoin peer to peer lending platform. About 6 months ago I reviewed BTCJam and concluded it to be a solid option for people who are willing to take calculated risks on their Bitcoins for higher rewards.

I concluded my review with 3 different investments I’ve chosen in order to see how Bitcoins can be leveraged long term. These were my 3 chosen investments:

- 20.19% APR – Investing in continued leveraged Bitcoin trading

- 53.10% APR – Investing in trading and mining operations

- 16.3% APR – Investing in backing a new crypto based business

All of these investments had A+ ratings, positive feedbacks for the borrowers and most importantly their issuers repaid their debts 100% of the time.

So I took 0.9BTC (at the time worth around $200) and decided to invest them in these 3 loans. The loans were all long term, meaning it would take about a year to get back the money. But hey, where can you get a 20% APR (Annual Percentage Rate) these days?

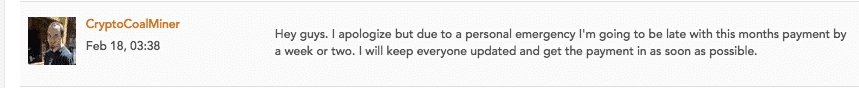

So two of my investments are still pretty solid and are paying on time. However one of the investments seems to have defaulted. This investment was supposed to make the last payout around February. You can read the borrowers “final words” on the comment section”:

Hey guys. I apologize but due to a personal emergency I’m going to be late with this months payment by a week or two. I will keep everyone updated and get the payment in as soon as possible.

Ever since then, the guy and the listing has gone silent. All you can see are people ranting about the payment and desperately trying to get their money back. This has been going on for 3 months now…

If you look at the borrower’s profile you’ll see he has another loan that hasn’t been repaid – the total of his unpaid debt comes up to 34.1BTC which is roughly 15.5K USD.

On May 4th I got the following email from BTCJam:

NOTICE OF ARBITRATION

Dear Alexander Reed

This notice serves to inform you that [borrower’s name] is delinquent on the Additional working capital for new crypto-based business — loan #3 loan in which you invested 0.3 Bits/BTC (“Loan”). In order to enforce the obligations due under this Loan, the Loan will be sent to arbitration 14 days from the date of this notice.

To avoid arbitration you can still negotiate repayment of the Loan by contacting the Borrower through the comments page for the Loan (“Website”). However, under no circumstances, should you attempt collection outside the Website as you run the risk of personal legal liability. Additionally, attempting to collect from the Borrower outside the Website is a direct violation of BTCjam’s Terms of Use. BTCjam cannot be held liable for any violations of the Terms of Use.

In the event that the Loan is sent to arbitration, the Borrower shall have the opportunity to request a hearing. If the Borrower declines a hearing, an award will be issued to you that can be enforced in a court against the Borrower.

So basically this listing is going to arbitration. If the borrower declines the hearing we will be issues an award which I can then use to claim back my 0.3BTC (or actually 0.19BTC) that is left in this listing.

The way I see, there’s no way I’m getting back my $80 (the money remaining in BTC at today’s exchange rate). Even if I will be issues this award I don’t have any interest to invest any more time or money in chasing this.

The lesson to be learned here is very very simple. High yield = high risk, and in this case I didn’t manage to escape from the risk in the investment. So what are my options?

- Don’t invest in BTCJam if you don’t feel you have the time and experience to choose a diversified portfolio.

- Use the “auto-invest” feature in BTCJam which is supposed to diversify your investments for you.

If you’re still looking to invest in BTCJam I think this second option would be best for you since it should give you a more diversified portfolio than what you’ll create on your own. However since I haven’t tested it out I can’t say for sure.

Why BTCJam just lost some of its credibility

While I know BTCJam doesn’t have full responsibility for this loan defaulting I still think the way its system is built really causes confusion. For example, I tried to write some negative feedback about the guy who defaulted however the system didn’t let me write anything. So this guy can just continue to pick up loans without people giving their opinion about him. I’m not sure why I wasn’t able to write negative feedback and whether this is a bug or a feature, but if I were BTCJam I’d be much more proactive about getting users to write feedback about their loans.

The Second issue I have with BTCJam is that they seem to not care that much that so many people (730 to be exact) just lost their money. Other than that email about arbitration which was sent automatically I haven’t received any communications from them. As a startup I’d expect some more guidance to their early adopters about this kind of situation, as this sort of thing will make you lose users forever. I’ve even sent an email to the company about this 3 days ago and haven’t received any response.

UPDATE: I’ve just received an email from BTCJam stating the following:

After 90 days of a borrower missing a payment, the borrower and investors go through the process of arbitration. Arbitration is a legally binding contract in which the investors of the defaulted loan receive all of the borrower’s personal information via an arbitration award. The investors may then use this information to pursue legal action if desired. The borrower technically has 14 days from the date their case is escalated to arbitration to file a dispute. If no dispute is filed after that period, then yourself and the rest of the investors will receive the arbitration award with the borrower’s information automatically via email.

Nothing new under the sun here really..

So all I can do now is wait a few more days and see what happens with this arbitration, although I’m clearly not getting my hopes up. In the meantime, unless you like to gamble, I suggest staying away from BTCJam as an investment vehicle. If you’ve read my previous review you know that my first investment also had a hard time with being repaid.

If you’ve had any other experience with the company I’d love to hear it in the comment section below.

23 Comments

23 Comments

I lost 4 BTC at BTCJAM!!!! the mother fucker is from SPAIN!!!!

I got burnt on bitpetite. Also, laser.online just disappeared with $8k of my money.

Hi i wanted to share my experience with BTC Scam so that other people will not get burned. It is not a good idea at all. I used auto-invest as well as invested in all the A-rated loans manually. I invested over a long period of time, up until USA residents were banned.

I have several issues.

1) the fact that USA residents cannot sell notes. this is not fair at all, since it was part of my strategy. Lets say a listing was A+ rated and yielding 5%. I would sell the note at a 2 or 3% profit immediately instead of waiting a full year for the pay out. When they stopped letting me sell notes I lost my shirt.

2) my wife is a Mexican citizen, has a Mexican drivers licence, a Mexican passport and we travel to mexico on a regular basis. I emailed BTC Scam and asked them to transfer my account to my wife and they would not.

3) BTC Jam obviously does not verify identities. It is probably really easy to use a fake ID due to all the scammers. These people are not honest people who just happened to stop paying due to hardship. their intent the entire time was to run off with the money. BTC Scam has no in-house collections. Its really really bad, i want to sue them rather than the scammers. If backpage.com got in trouble for facilitating prostitutes, the BTC Jam should face legal action for facilitating theft.

here are my investment results, copied and pasted from BTC Scam. as you can see i lost over $5,000 in principle, which if i had just used a buy and hold strategy, my coins would have more than trippled in value

In Funding (0) $ 0.00

Current Receivables (162) $ 204.24

Fully Paid (104) $ 7,337.00

Late 1-30 (83) $ 241.25

Late 31-120 (116) $ 1,172.88

Default (135) $ 4,105.19

I just wanted to clarify, i wrote the above comment. BTCJam actually did end up letting me transfer the notes to my wife, so i have to give them credit for that, maybe the owner of the website can modify or delete my previous comment

Do not invest in BTCJam.

It is infestated by scammers.

Admins are not doing enough to ban dubious profiles.

Avoid it. I lost some BTCs in it.

Hello,

I have been a client of several PBTC based 2P lending clubs and after more than than one year, I lost money due to scammers. I would say you can’t be a winner on the long term with those sites. just my 2 cents.

Well,

My Credit Rating was calculated as D+ when tried to receive loans. As a result I stopped using it, and went ahead with the few funds I had available. The funny thing is that I achieved 5000% ROI…

Bottom line.

I am better investor than they are Credit Rating Calculators…

Anonymous