Bitcoin mining has received a lot of attention lately. Since Ghash suspended it’s cloud mining operation, many people have been asking a couple of very simple, but important, questions: Is Bitcoin Mining worth it? Is it possible to profitably mine bitcoins? Well the answer is complicated, and mining bitcoins can be a great financial choice…or lead to financial ruin. Bitcoin mining has a complicated history, but we can learn much from looking at what has happened over the past few years.

What Made Bitcoin Mining Worthwhile Before?

Mining bitcoins has been a very profitable venture for a very long time. While many people who tried Bitcoin mining failed to profit, didn’t receive their mining rigs due to fraudulent or inept companies, or barely reached a positive ROI on their Bitcoin mining attempts, that was not true for the more experienced miners. Those who had successfully optimized GPUs, or aquired FPGAs in 2012 and early 2013, as well as those that were able to obtain early ASICs, or were lucky enough to “bet” on the right Bitcoin mining hardware company for the following generations of ASICs have made incredible profit.

However, the business of Bitcoin mining experienced a fundamental shift between when GPUs / FPGAs were the norm, and the rise of ASICs bitcoin mining hardware. These ASICs completely changed the game by increasing the efficiency of mining bitcoins by many orders of magnitude, and completely destroyed the profitability of mining with a traditional computer.

Why Mining Bitcoins With GPUs Was Worth It Until 2013

Before the ASICs, Bitcoin mining was worth it simply because the difficulty stayed quite close to Bitcoin’s price. This was true for a few reasons:

- Many Bitcoin miners were only mining part-time, and were simply using GPUs that they already had purchased for gaming to mine when they were not using their computer. This completely removed the equipment cost from the ROI equation, as the ability to effectively mine bitcoins was just a benefit of having a decent gaming computer. Of course, mining at a high intensity had the potential to burn GPUs out, but smart part-time miners would only mine when the difficulty / price really made it worthwhile. Also, these individuals would alter their system settings, as well as the settings for the Bitcoin mining software, to lower the stress placed on their hardware, as well as increase their power efficiency.

- At that time, there were very few huge Bitcoin mining farms. The average miner was not competing with datacenters full of machines…they were competing with one another. This meant that individuals who lived in areas with low kWh (kilowatt-hour) prices could easily mine enough bitcoins to cover any additional power costs, and even those in areas with average – slightly above average electricity costs could profit from mining if they had an efficient setup.

- A large portion of the mining community, at that time, were not mining for profit alone. They were mining to support the Bitcoin network, and/or to obtain BTC that was “clean” and truly anonymous (as long as the were taking certain security measures).

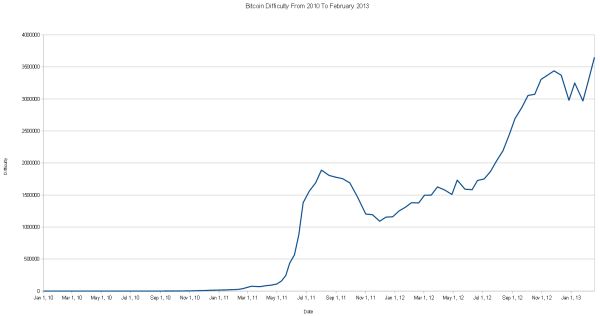

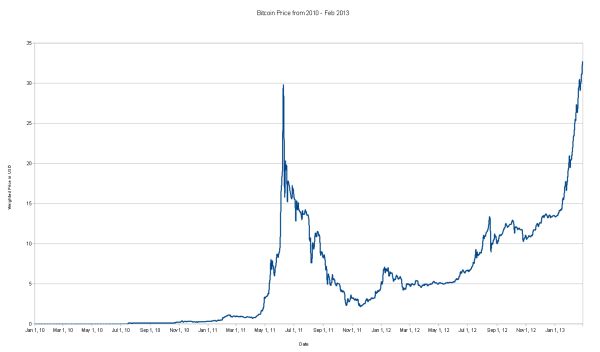

The relationship between difficulty

and price

was not perfect, but mining difficulty generally followed a pattern similar to the Bitcoin to USD exchange rate. FPGAs began to skew this slightly in 2012, then ASICs shattered it completely.

Bitcoin ASICs Killed GPU Mining Profitability

In early 2013, Jeff Garzik received the first Bitcoin mining ASIC, produced by Avalon. While one other company may have produced a functional BTC mining ASIC around the same time, Avalon was the first to develop, manufacture, and sell these incredible mining rigs to the public. His review of the Avalon ASIC confirmed that not only was Bitcoin mining worth it, but could be incredibly profitable. His comments on it’s mining power, and how many bitcoins it mined, are eye opening:

Performance is much higher than announced. 60 Ghps was announced. The unit’s cgminer self-reports 67.5 Ghps.

and

After 20 hours of mining, the unconfirmed + confirmed rewards equal 14.98832170 BTC.

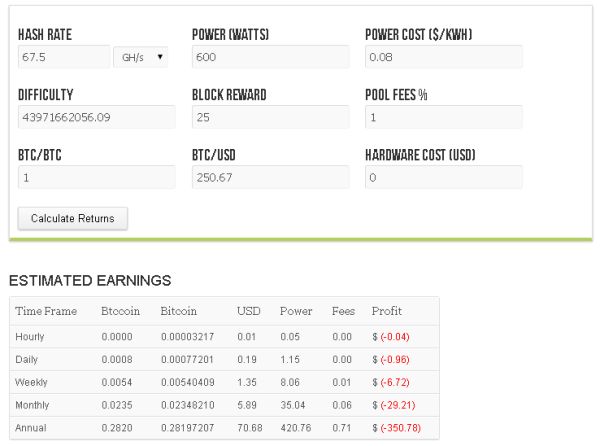

This Bitcoin miner was mining over 15 BTC per day! Of course, for anyone involved with mining today, 67.5 GH/s seems like nothing. Today, one would be lucky to get 0.0007 BTC per day with that hashrate, according to our Bitcoin mining calculator, and the fact that it used over 600 watts of power, makes operating the machine a losing proposition. In fact, by the time most of the pre-orders were shipped, the machines were barely profitable. I did make a small amount of profit with my batch 2 Avalon ASIC, which I had managed to get up to almost 80 GH/s, but not very much.

However, at that time, the top end GPUs were only capable of mining at a rate of 500 MH/s – 1 GH/s (with 1 GH/s requiring perfect conditions and incredible optimization), and often consumed 200-400 watts of power when mining bitcoins.

Though, to be fair, Butterfly Labs had successfully produced their first Bitcoin mining “miniRig” in mid 2012, which utilized 18 boards, with 2 45nm FPGAs on each board, and was capable of mining at ~25 GH/s while consuming ~1,260 watts.

For those of you that did not know why Butterfly Labs was so trusted by the Bitcoin community, or did not understand why so many people were willing to pre-order their ASICs, this is why. The first miniRig was exceptionally successful, and the powerhouse of the pre-ASIC period.

Still, Avalon’s first ASIC, which was based on ancient 110 nm architecture, managed to mine at over twice the miniRig’s rate, for around half of the power consumption, and was sold at a fraction of the cost of the miniRig. These machines started a revolution in mining that resulted in the Bitcoin network containing a level of processing power that has never been reached before in human history.

Is Bitcoin Mining Worth It In 2018?

Yes and no, depending on your situation. The emergence of ASICs created an arms race that made investing in Bitcoin mining machines more volatile, and risky, than Bitcoin itself. As Bitcoin ASICs began with the 110 nm Avalons, which was architecture available in traditional CPUs in the early 2000s, many companies sprung up to work toward out the next generation, with hopes of eventually reaching “state-of-the-art”, which is ~22 nm at the moment.

To date, I do not know of any commercially available ASICs with <= 22 nm architecture, but 28 nm has been reached. Realistically, the development of truly state-of-the-art Bitcoin mining ASICs may not be worth the investment, as the increase in power efficiency, which is the most important factor for a Bitcoin mining rig, is nowhere near as large as previous generations.

Here are some of the most recomended miners out there today:

How to Determine Potential Bitcoin Mining Profitability

So, that brings us back to the central question of this article. Is Bitcoin mining truly worth it? The best way to answer this would be to start out with a Bitcoin mining calculator like this one:

| Difficulty Factor | |

| Hash Rate | |

| BTC/USD Exchange Rate | |

| BTC/Block Reward | |

| Pool Fees % | |

| Hardware Cost (USD) | |

| Power (Watts) | |

| Power Cost (USD/kWh) |

Over the past year and a half, I would have advised against it, and said no. It did have the potential to be profitable, but it was too much of a gamble. However, with the availability of 28 nm ASICs, as well as 45 nm ASICs that can be modified to reach nearly the same efficiency as the 28 nms, and the fact that Bitcoin’s difficulty seems to be stabilizing, then Bitcoin mining may be worth it for you. I say “may” because it truly depends on a few factors:

- As has always been true, your personal cost of electricity is extremely important. However, this is not nearly as important as it was while Bitcoin mining ASICs were experiencing incredibly fast leaps in efficiency. Now, with a bit of work, and a decently priced machine, even people with average electricity costs can mine bitcoins profitably. Of course, those of you that live in areas where electricity is expensive are out of luck, unless you have access to industrial electricity (which is generally cheaper) or a way to access “free” electricity (legally, of course).

- Because so many people were burned by a combination of price drops, exponential increases in difficulty, the speed at which Bitcoin ASICs evolved, or delayed delivery of machines, there are an abundance of used 45 and 28 nm ASICs available for sale. Amazon and ebay have a large selection of miners.

The people selling these may live in an area where Bitcoin mining isn’t worth it, for whatever reason, or they may just be tired of it after the roller coaster they have been on for so long. Others may be just trying to hedge their bets, and break even on their investment through a combination of the bitcoins they mined and revenue from the sale. Whatever the reasoning, do your homework on the efficiency of the various machines that are available, look into how to lower the voltage for the different machines that are available (especially the 45 nm machines), and do the math on how long you would need to mine to obtain enough bitcoins (at today’s prices) to break even.Your calculations should include potential increases in difficulty, but at this point, increases in difficulty will likely be more closely aligned with the Bitcoin to USD exchange rate, rather than breakthroughs in technology. Is short, use a Bitcoin mining calculator. - Examine any potential ways you could utilize renewable energy. There are many small commercial/residential solar, wind, and hydroelectric energy sources that have become surprisingly affordable. This will not be viable for everyone, but if you live in a generally windy area, a sunnier-than-average area(especially places with intense sunlight), or own/have access to constantly moving water (even if it is quite shallow), you may have the ability to build an off-the-grid Bitcoin mining farm that costs very little to run.

- If you live in a cold region, then you have two amazing options:-Setup miners in a room that is isolated from where you live (either an insulated room with no/closed vents) and pipe the cold air directly into the machines. This will increase the efficiency of the machines, as processors run more efficiently at cooler temperatures. This can either be combined with undervolting (for extreme efficiency), or go the other direction by overclocking your machines, increasing the intensity in the Bitcoin mining software, etc. All of this will allow the machine to mine with a hashrate significantly higher than the advertised rate. If done correctly, this also increases efficiency, as it can run at the increased rate, but the power usage will increase at a proportionally smaller rate. If isolating the machines is not an option, then remember that energy is not lost, nor destroyed.

- If you live in a cold area, and use electric heating, then the question of “Is Bitcoin Mining worth it?” is a resounding YES! 1 kWh = 3412 BTU and it does not matter if that energy is being converted via a central heating unit, a space heater, or a computer…the heating is the same (this was actually tested with a gaming PC vs a space heater). Of course, a Bitcoin miner is not built to evenly distribute that heat, so this may not be extremely noticeable if you have one machine in your entire home, but it will have an effect. Better yet, a few machines, spread throughout a house should, in theory, have the ability to replace a central heating unit…or at least significantly reduce the amount of time it needs to be on.If you use gas heating, or some other form of heating, for your home, then the worth of using Bitcoin miners for heating is not as clear. They certainly will be useful, as they are still putting out heat based on their power consumption, but you will need to do a bit more math. An easy way to do this would be to find out the cost per 3412 BTUs for your primary heating source. As that is equivalent to the heating output of 1 kWh, then you can subtract that cost from your local cost per kWh of electricity. The result will be your true cost per kWh for running your Bitcoin miners.

- In warmer areas, this is reversed:-Your BTC miners may end up requiring more power than just the amount consumed by the mining rigs themselves. If it is warm enough for your air conditioner to be running, then it must counteract the heat put out by your machines. This could be the difference in Bitcoin mining being worth it for you to invest time, and money, into, or not. In fact, this is the reason that I personally stopped running my Avalon ASIC while it was still technically mining enough bitcoins to cover it’s own power costs. When cooling costs were added in, it was no longer profitable. Again, there are solutions to this that could change the worthiness of Bitcoin mining for you. Liquid cooling, along with isolating your machines in a room that removes, or minimizes, the impact on the rest of your home. Also, instead of piping outside air into your machines, it may be worthwhile to flip that around, and pump the exhaust air from your miners out of your home.

Bitcoin’s Price Does Impact Bitcoin Mining’s Worth

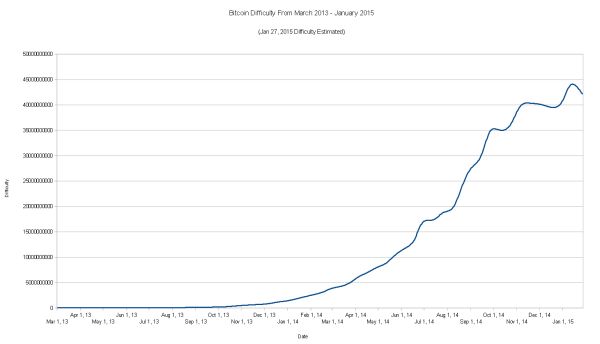

While the Bitcoin mining difficulty is now more likely to fall into a closer relationship with Bitcoin’s price, the link doesn’t guarantee stability. As long as the link between Bitcoin’s price and the total mining power of the network remain close, then changes in the value of Bitcoin would only effect those that are are barely profitable already, and would do little to change the worthiness of mining. This is because miners would be receiving more bitcoins for their hashing power when price and difficulty decline, but less bitcoins as price and difficulty increase. This chart is continuing where the difficulty chart at the start of the article left off, and includes a projected difficulty decrease on January 17. From March 2013 on, the mining difficulty increased exponentially. The last few months seem to have leveled out:

However, it could get out of sync once again.

A breakthrough in ASIC technology is unlikely in the near future, but certainly possible. That would create a new jump in difficulty, and render older ASICs less valuable, as Bitcoin’s price should not be impacted very much. Also, as difficulty is only adjusted every 2016 blocks, sharp declines in Bitcoin’s price can make it so that mining is not very cost effective until the difficulty adjusts.

A sharp enough Bitcoin price drop could, effectively, cause enough miners to be turned off that it takes a very long time to mine enough blocks to reach the difficulty change. Of course, this scenario would also result in a sharp drop in difficulty when the 2016th block is finally mined, instantly increasing the value of mining power…but, until that point is reached, the Bitcoin network could become quite unreliable and chaotic.

Still, outside of these scenarios, difficulty should continue to stabilize, and somewhat follow Bitcoin’s price. This means that yes, Bitcoin mining is worth it in many cases. However, whether it is worth it to you is something that only you can decide. Just remember, if you are considering becoming a Bitcoin miner, work through the math before you invest.

43 Comments

43 Comments

Generally speaking, buy finding good prices you can obtain ROI at 5-6 months with Asic Miners, 8-9 with GPUs and 7-8 with SSDs. **link removed**

While the first quarter of 2018 comes to an end, the crypto-craze appears to have slowed down after a slump in Bitcoin prices. Bitcoin, which boomed from $950 to over $19,500 last year – has now slowed down. The prices of the currency sunk to a low of around $6000 a couple of weeks ago. In times like this, a number of people have been questioning if it is worth their time to mine for Bitcoins now.

**link removed**

—

Regards,

Sourav Basak

Namaste UI

Genisis Mining is very profitbale.There are the most trusted cloud mining.

I am using it since a long time.They are giving daily payouts. Genesis offering mining contract for two year.At present they have contracts for etherum,zcash and monero.

most plans sold out

So pretty much this is what I got from the article unless you have a s*** ton of money to spend on mining Bitcoin don’t mine Bitcoin

Bitcoin floating around $4,800 mark… any millionaires online if it’s not too personal to ask? Half kidding but I’m interested as well. I bought 1000 @next to nothing about a decade ago and off loaded them some months later for some reason that , at the time, made sense. I’d be ~$4mill richer if I’d simply forgotten I had them for 10 or so years. ah well, such is life.

Hi all.

What does “Revenue in vacum” mean ?

At first i thought it was if one only looked at the output from the unit, and did not take power consumption etc, in the equation. Then the S9 would give 0,5 BC per month.

But if the calculator is used and all other costs are set to zero, it says that it would earn 0.164 bitcoin per month ? So what is the “revenue in vacum” ?

Hi Michael, the ‘revenue in vacum’ refers to the case to exclude not just the electricity costs but the difficulty and the Bitcoin price as well. These are however very important factors of profitability.