Nuri Review – A Beginner’s Guide

Last updated: 8/22/22

Important – August 2022 update:

On Tuesday, August 9th, 2022 Nuri filed for insolvency. Despite the insolvency process, Nuri announced that users would still have access to their accounts and wallets. The below test is kept for historical purposes only.

Nuri, formerly known as Bitwala, aims to merge the cryptocurrency and fiat worlds to make living with digital assets simple. They offer a variety of products and services which I will review in this post.

Nuri Review Summary

Nuri offers a traditional bank account linked to a cryptocurrency wallet, debit card and exchange. The company basically solves one of the most burning issues of merging between cryptocurrencies and traditional banking. The offer is available only to residents of the European Economic Area, Switzerland and the United Kingdom but it seems to be receiving very positive feedback from users so far.

That’s Nuri in a nutshell. For a more detailed review keep on reading, here’s what I’ll cover:

- Company Overview

- Nuri Services

- Currencies and Payment Methods

- Fees and Limits

- Supported Countries

- Customer Support and Reviews

- Conclusion

1. Company Overview

Nuri offers a solution linking traditional bank accounts and debit cards to cryptocurrencies.

Jörg von Minckwitz, Benjamin Jones and Jan Goslicki launched the brand in 2015, called Bitwala at the time, facilitating bitcoin transfers and prepaid card services. The company has come a long way since its inception, gaining over €42 million in funding with over 300,000 customers across Europe.

Disaster struck in 2018, when Nuri’s, then Bitwala, crypto debit card issuer Visa withdrew permissions, forcing the company to suspend services. Since then the brand has set about building a new product, blockchain banking in partnership with German Banking-as-a-Service platform solarisBank.

2. Nuri Services

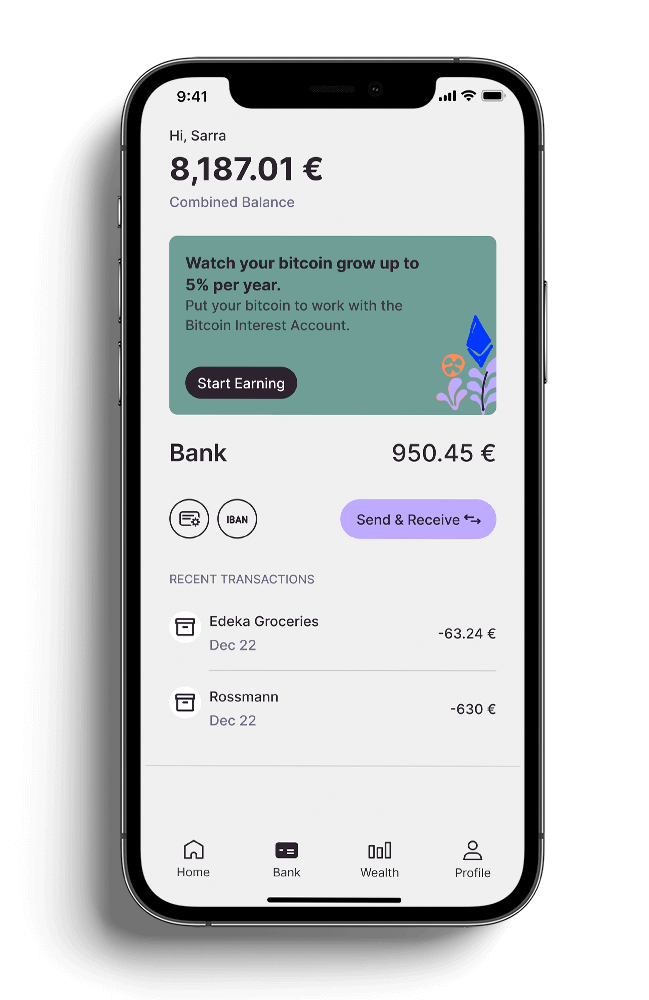

Bank Account

Nuri is based upon full German bank accounts offering all the functionality you’d expect from a fintech bank. Users can send and receive everyday transactions such as receiving wages or paying rent. It acts as a regular online euro bank account including a German IBAN, SEPA functionality as well as international payments, standing orders and direct debit.

Nuri offers a very high level of security for your fiat funds, with deposits into your bank account being guaranteed up to €100,000 by the Compensation Scheme of German Banks (EdB).

Crypto Wallet

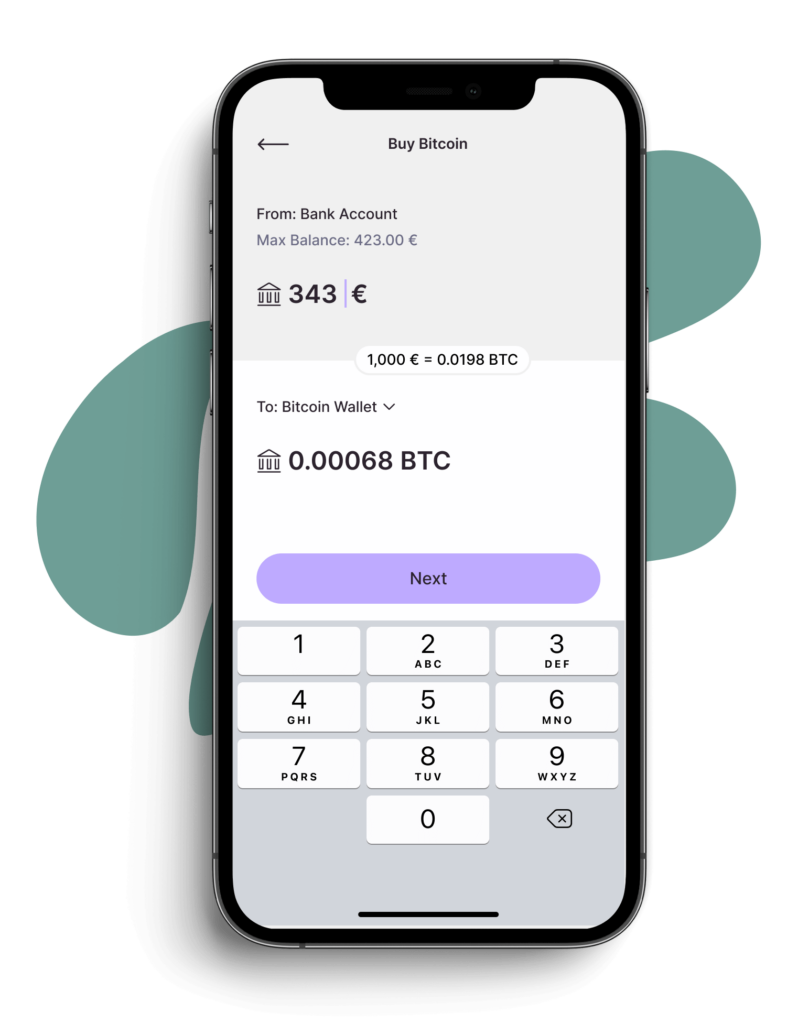

Nuri supplies customers with a Bitcoin wallet that links directly to the bank account, enabling seamless transfers. The wallet operates with all the normal cryptocurrency features allowing the owner to send, receive, store and trade Bitcoin. It also supports fiat to crypto exchange and vice versa.

Having initially only offered Bitcoin wallets, Nuri now also offers Ethereum Wallets, allowing customers to invest and trade Ether just as they would with Bitcoin.

Nuri crypto wallets are custodial wallets, this means you don’t need to worry about losing your private keys as they are all handled by Nuri. There are some advantages to using the custodial wallets, mainly the convenience of being able to access your wallet using just faceID or your fingerprint on your phone instead of needing to remember your private keys or password.

Additionally, when you use the custodial wallet there are zero network fees for buying or selling Bitcoin, these are all covered by Nuri.

Crypto Vault

In addition to crypto wallets, Nuri offers crypto vaults. These are more “traditional” wallets aimed towards more experienced users who trade less frequently and are looking for a secure crypto storage option. Crypto Vaults are non-custodial, meaning that you hold the private keys and have complete control of the wallet. Whilst being non-custodial has its benefits, there are also a few drawbacks, mainly the fact that if you lose your private keys, Nuri won’t be able to access or recover the vault or the funds inside it.

Unlike the Nuri Crypto Wallet, if you buy and sell crypto from your vault, network fees will apply since the transactions are settled directly on the blockchain.

One key feature only available with Vaults is the ability to import your Ethereum Vault to MetaMask if your phone gets stolen or stops working. All you need is the seed phrase to your Ethereum Vault that Nuri gives you when you create the vault.

Debit Card

Visa backs the Nuri contactless debit card which links to the German bank account, allowing holders to use the card like any normal debit card. In order to spend crypto funds via the card you must trade crypto for euros from the Nuri website or app – unlike bitcoin debit cards that allow you to pay directly from your crypto balance. You can get the card for free and use it in almost any country as the card will work with all major fiat currencies.

Visa backing provides all the security and worldwide support you’d come to expect from an international debit card.

Bitcoin Interest Account

Nuri has an exclusive partnership with Celsius to provide Bitcoin Interest accounts that allows Nuri users to earn up to 5% interest on Bitcoin, which is paid out weekly, starting with as little as €10. Users can deposit and withdraw their bitcoin at any time with no minimum investment period. Interest payments will be made by Celsius instead of Nuri themselves.

3. Currencies and Payment Methods

Nuri operates in 3 currencies. Euros, Bitcoin and Ethereum.

Euros are stored in the regular bank account where you can deposit, withdraw and spend funds.

4. Fees and Limits

Nuri is very transparent about their fees and generally they are pretty reasonable. The banking service is mostly free with no account, card or transaction charges.

The card transactions and cash withdrawals are free in euros but be aware that foreign transaction fees and exchange rates are set by Visa. There is however a limit for maximum card withdrawals of €1500.

Bitcoin and Ethereum trades incur a 1% trading fee as well as a €1 flat fee for buying crypto. While this is not the cheapest, it is reasonable for the convenience of being connected to the banking system and being able to trade instantly. Of course, blockchain network fees also apply which Nuri has no control over, the €1 flat fee is in place to cover such network fees. This makes Nuri a fast way to cash out your crypto with the lowest crypto costs possible.

The minimum trading amount for crypto is €30 per trade (this applies to trades via both the Crypto Wallet and Crypto Vaults), with a maximum trading amount of €25,000 per trade. The crypto trading limit is €50,000 per rolling seven days and you can find out more about fees and limits here.

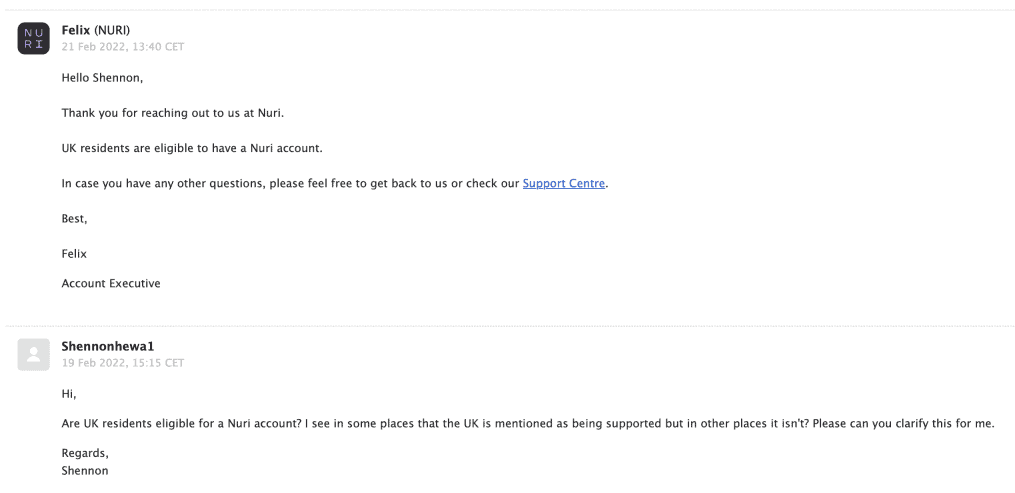

5. Supported Countries

The service is only available to residents of the European Economic Area, Switzerland and the UK, because fiat banking and transactions are processed in euros. The bank account is German, so naturally, it will work best there.

SEPA transfers and euros are seamless across Europe so the service is useful anywhere in this area. Nuri also only offers debit cards to members of the European Economic Area (EEA), Switzerland and the UK.

6. Customer Support and Online Reviews

Nuri provides an extensive support section on its website. The information here is highly detailed which is really helpful. It was able to answer any questions I threw at it, including some more technical crypto queries.

The customer service team is also really responsive. Nuri offers a live chatbot to help with most queries, in addition to traditional support via email. They answered my email query after 5pm in just over an hour. Very good compared to a lot of Bitcoin exchange and wallet platforms.

Nuri products score highly on review websites with a rating of “Great” on TrustPilot, 4.2 stars on the Apple App Store and 3.4 stars on the Google Play Store.

The customer support team are very active in these areas, quick to offer genuine replies and helpful comments to problems. They appear open to feedback and actively try to aid customers.

7. Conclusion

Nuri does a decent job of creating Bitcoin and Ethereum banking solutions, particularly for Europeans. The product does genuinely merge the world of fiat and cryptocurrency, reducing barriers to mass adoption.

The main downside is the lack in currency range and coin offerings which will turn many cryptocurrency enthusiasts away. These users might like a competitor like Wirex which provides a longer list of bank accounts and cryptocurrency wallets.