Trust is built with consistency. Bitcoin’s adjudged lack of consistency is much of what keeps those still fully entrenched in conventional finance leery of adopting Bitcoin or block chain based technology.

The fledgling cryptocurrency has had its fair share of growing pains. Among them, confusion in coming to a clear Bitcoin price valuation, a lack of liquidity, and a few high-profile BTC exchange collapses. Several members of the financial elite made clear their standoffish sentiment when asked to share their thoughts on Bitcoin during this fall’s money 20/20 conference.

More often than not, price volatility is pointed to as the source of worry for skeptics. Yet the market that is frequently compared to Bitcoin, the U.S. stock market, is prey to volatility of its own.

Crashes From the Shadows of Central Trust

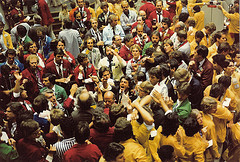

October 24, 1929. A decade long speculative boom swings to a bust. More than 12 million shares are traded in a single day as the public makes a run on banks and stock exchanges, sending ticker tape and investors reeling.

October 19, 1987. The FED attempts to rein back an overheating economy by raising interest rates, triggering an avalanche of sell orders on the futures market. As a result $500 Billion is culled from the Dow Jones Industrial Index at the height of a 5-year bull market.

September 29, 2008. Lehman Brothers, Merrill Lynch and Fannie Mae & Freddie Mac suffer major financial trauma from overexposure to the subprime mortgage market. The Dow drops a record 774 points after a government planned bailout stalls in congress.

A single point of failure lies in what backs the conventional finance system; centralized trust.

Trust in brokers that lent investors 65% the face value of stocks on margin.

Trust in the decision making of a central bank.

Trust in the solvency of a hidden network of derivatives worth trillions.

According to Paul Volcker, former chairman of the U.S. Federal Reserve, the transparency of conventional finance seems to be becoming more clouded as time goes by. “We have moved from a commercial-bank-centered, highly regulated financial system, to an enormously more complicated and highly engineered system. Today, much of the financial intermediation takes place in markets beyond effective official oversight and supervision, all enveloped in unknown trillions of derivative instruments.”

Bitcoin: Pushing Finance Into the Light of Decentralization

Borne out of chaos is decentralized finance. Simply put in Satoshi’s Bitcoin white paper “We have proposed a system of electronic transactions without relying on trust“. The complex puzzle of financial intermediation is rendered unnecessary with Bitcoin’s block chain.

Ironically, the “secretive” block chain public ledger is much easier to grasp than the knotted up network of the conventional securities market. But while Bitcoin’s network may be easier to understand than that of the legacy financial system it does not make Bitcoin any easier to use than the Dollar, because of the plain fact that the dollar is still the most widely accepted medium of exchange (at least in the U.S.). So unless one is being paid wages in BTC for providing labor or a good, they will have to first exchange dollars for Bitcoin.

The Interlocking of Fiat and BTC

Here arises a point of contradiction. One must use currency backed by centralized trust to conduct a transaction on the decentralized network of BTC. Prompting BTC users to store wealth (at least momentarily) in the very currency that they are trying to shield their wealth from. Thus making BTC/USD exchanges responsible for holding enough reserves to ensure interoperability between USD and BTC and cover counter-party risk of options/derivatives contracts.

The complications of the conflict of interest between the centralized nature of a BTC/USD exchange and the desire of its customers to conduct transactions on a decentralized network are evident. Fraud and manipulation have lead to the collapse of exchanges (most notably Mt. Gox). Sensitive data backed by exchanges has been exploited for theft (most recently Bitstamp’s hot wallet hack). Such complications are collateral damage of an ecosystem that is growing out its nascent stages and moving its way closer to decentralization.

Where does the ideal vision of a block chain-based decentralized economic system meet the reality of an economy that is still dependent on fiat currency? CoinBrief writer Evan Faggart recently noted the implications of marrying Bitcoin banking and Central Banking, “Bitcoin banking would have a serious potential to diminish the banking system’s ability to produce business cycles (or volatility). However (assuming fiat currency was required for payment of taxes), central banks would still pose a major threat to economic stability regardless of Bitcoin’s positive effects, as they would still retain the power of creating fiat money and giving banks excess reserves.” For Bitcoin to hold enough influence to reduce volatility, and reliance on fiat currency, it must first be more widely adopted. Innovations of late in the Bitcoin ecosystem indicate that progress is being made towards wider spread adoption.

Bitcoin 2.0

2014 was the year of Bitcoin 2.0. Developers flocked to Bitcoin, with Bitcoin currently being the 31st most forked repository on Github, and block chain based technology. A flow of venture capital soon followed behind to support the budding ideas of this community. 2014 saw the existence of 582 Bitcoin start-ups according to AngelList. Up from 193 in 2013 and 13 in 2012.

Emerging from the Bitcoin 2.0 market as leaders were Counterparty, a platform that leverages Bitcoin’s block chain protocol to allow peer to peer financial interaction without counter-party risk, Blockstream, which is developing an idea known as “Side Chains”, and Ethereum, a platform that enables the same peer to peer financial interaction with the use of an alternative block chain. Founders of Counterparty recently shared their positive outlook for 2015 in the following blog post. “(We) are excited about the tremendous growth and change that 2015 can bring for blockchain technology adoption”.

Adoption of blockchain technology should not be inhibited by a lack of understanding from potential users. One does not need to to know the ins and outs of this technology to enjoy its benefits. A sentiment echoed by venture partner Adam Ludwin of RRE Ventures, “It (Bitcoin) has the quality of early Internet. People don’t actually know anything about how it works, but they don’t need to know, or care. They just know they turn their computer on and can check email.” The opportunity to create an application that popularizes the advantages of Bitcoin’s decentralized technology: payment freedom, near-zero fees and removal of intermediaries, is waiting. We may see a platform seize this opportunity sooner rather than later.

1 Comment

1 Comment

@CounterpartyXCP @ethereumproject @Blockstream i think you missed @BitHaloOfficial