This post was originally posted on January 2015. Now, 18 months later it’s time to revisit the facts:

Bitcoin’s price is on a downtrend, the dollar is strong, and even Microsoft’s adoption combined with a crumbling ruble isn’t picking up the slack. This past year’s decline has lead to some Bitcoin’s detractors calling it the worst investment in 2014, and if you invested in Bitcoin to speculate, it certainly was. However, none of this matters. Bitcoin can continue to decrease in price, but that won’t mean it has failed. Bitcoin has already succeeded. Even if it collapses completely, digital currency will still be the future. This is a topic I have touched on in the past, but it seems like there is a need to explain exactly why decentralized digital currency is superior to both the gold standard, and USD or other forms of fiat. To start, we must outline some of the pros and cons of the two “traditional” currency systems.

USD and Other Fiat Currency Systems VS Bitcoin

The move to a fiat currency is an easy one, as fiat is “simple”. A central bank issues the currency, they have a network of banks to handle the transactions, and there is no need for any storing, shipping, protecting, or auditing of a metal backing it. The word of the government, and acceptance of the currency for taxes, gives it value. However, as most know, this leads to other problems. Still, it has it’s benefits, which must be weighed against it’s problems. As USD is the most widely used fiat currency, it will be used as an example here. Not all fiat currency systems are exactly the same, but they share most of the same pros and cons.

Positive Aspects of USD

- It is easy to transfer, store, and claim. There are not enough physical dollars in the world to cover the amount of USD that is “owned”, but if you prefer to have your cash in physical form, it only takes a trip to the bank to get it.

- In theory, it should have the ability to inflate and deflate, as needed, to lessen the impact of economic problems, and accelerate the economy in times of growth. (whether that is pro or con depends on your viewpoint)

- By not having gold tied to currency, it frees the metal to be used for commercial purposes.

- Because it is not truly connected to anything physical, it should be very divisible, flexible, and digitally usable.

- Prevents banks from collapsing due to high number of withdrawals when the demand for money is high. (Again, this is often stated as a pro, but it is very debated)

- The process of creating fiat, and the system of loaning and debts that it uses, also creates the system needed to process transactions.

It is really difficult for me to objectively analyze the “positive” aspects of USD, and other fiat currencies. I do not agree with the logic behind many of it’s “advantages” as they seem based on accepting that debt and compound inflation are “good”. Of course, I am not an economist, but it just seems like a system aimed at creating short term benefits that later cause huge problems. The negative aspects are much easier to describe. As this politician puts it:

Negative Aspects of USD

- The power to control the creation of currency is concentrated in the hands of a small group of people. While many people that were previously, or are currently, involved with this process have good intentions, many do not. Lord Acton’s famous quote regarding papal infallibility fits here as well as it would fit any person or group that are given unrestricted authority and power,”Power tends to corrupt, and absolute power corrupts absolutely. Great men are almost always bad men…”

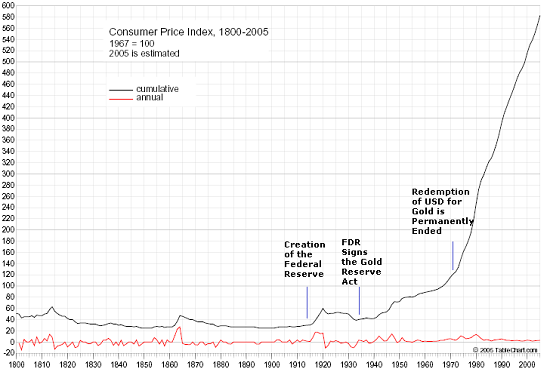

- This one is the biggest problem in my eyes, as the data is readily available, and extremely clear: While the stated mission of the Federal Reserve and Treasury is to ensure a stable value and supply of money, this has not been the case. That would suggest working to create both inflation and deflation, at different times, in a constant balancing act, to mirror the market’s fluctuations. That would, basically, simulate a gold-backed currency, while also offering protection in times of serious economic instability, or recession, and curbing the creation, and growth, of bubbles.If that had actually happened, then the buying power of $1 would have remained relatively constant since the USD went fully fiat. That is how it was between 1800 and 1930. $1 in 1800 and $1 in 1930 were worth the same amount, according to the Consumer Price Index. (Since I started writing this article, the CPI chart provided here was removed. A copy is available here.) Between these times, the value of $1 fluctuated up and down slightly after 1800, then increased until the Civil War. During the Civil War, the value went down, but still above the 1800 level, then started to increase in value again until the lead up to World War 1, where the value started to go significantly down again.By 1934, when FDR signed the Gold Reserve Act, it was starting to increase in value once again. However, after the Gold Reserve Act was put into place, the value of the dollar has only went up 5 times: in 1938, 1939, 1949, 1955, and 2009. Every other year has experienced inflation, which has compounded so much that, at this point, $1 from 1934 = $17.37 today. The dollar is worth over 17 times less today, due to inflation. This is very easy to understand by looking at the cumulative CPI chart from 1800-2005 (I chose this one because it also shows yearly CPI. There are more up to date ones, but they do not look very different…just taller)

Image Courtesy of Economic-Charts.com. Modified to Show the Events that Ended the Gold Standard The mainsteam economics of today, which generally support the actions of the Federal Reserve and Treasury, are based on a blend of neoclassical and Keynesian economics. However, it seems that they have all missed the message in one of John Maynard Keynes most famous quotes, though it is quite clear,”By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth.“

- When attempting to control the money supply, periods of expansion and constriction of the money supply are needed. These periods are what cause the “booms” and “busts” we see so frequently. Through these booms and busts, those with large amounts of capital have the ability to benefit massively during the booms, increasing their wealth, as well as protect themselves during the busts. The average person, who does not have enough liquid capital, or cheap credit, to benefit from the boom is crushed during the bust, which generally causes an economic recession of some form. Coin Brief’s Evan Faggart has written extensively on these “business cycles“.

- USD, or any fiat currency, is only backed by the word of a government, and debt. That can hold up in times of prosperity, but can result in hyperinflation or economic collapse if pushed too far.

While USD is currently the most used currency, at least in the business world, it’s departure from the gold standard leaves it vulnerable. On top of that, the compound inflation illustrated above is creating a wealth divide that is destroying any semblance of a “middle class”, while creating the illusion of economic growth via bigger numbers. A “record high” for the stock market does not mean much when that high point can be attributed almost completely to inflation.

In reality, the stock market should reach a “record high” every year that the economy is even remaining flat. Not reaching that would indicate that the economy is performing poorly compared to the previous period.

Bitcoin vs Gold – The Gold Standard

Bitcoin was founded on semi-Austrian economic, Libertarian ideas, and was meant to be something resembling a digital version of gold-backed cash. It has succeeded in many ways, with the exception of stable value, but that can only come with mainstream acceptance and time. Now, I know that there are many Austrian Economists, Libertarians, “Gold Bugs”, etc. that disagree with this, but when looking at the positive and negative points behind gold currency, or a gold-backed currency, there is certainly room for improvement.

Positive Aspects of a Gold-backed Currency

- Gold has basic value for two reasons: It is rare, and it is useful for things ranging from jewelry to manufacturing electronics to medicinal drug-delivery systems.

- Gold cannot be created (at least not without expending a cost-prohibitive amount of energy). The only way to get “new” gold is to mine it.

- It is easy to verify that gold is authentic, and relatively pure, which is necessary for auditing the gold supply of a gold-backed currency, or in the exchange of the currency for said gold.

- A gold-backed currency (as the dollar once was) allows gold to be used without needing to transport the gold itself.

- A gold-backed currency is resistant to manipulation by a central bank, government, or other powerful groups.

- Gold-backed currency maintains a stable exchange rate. For example, while on the Gold Standard, which was much of the United States’ history, 1 troy oz of gold was worth $20.67. The exception to this was during the Civil War, when the government had more debt than it could repay, and had to suspend payments in gold and silver. This was reversed after the end of the war, and the $20.67 price remained until January 31, 1934, when FDR signed the Gold Reserve Act. This was the first step toward the USD of today, and devalued the dollar by 40% overnight, resulting in a $35 per ounce of gold conversion rate.

Now, those points have always been a compelling case for gold-backed currency in my opinion. These same points would apply to currencies backed by other precious metals, such as platinum or silver, as well. That being said, gold-backed currencies do have negative points that one must accept.

Negative Aspects of a Gold-backed Currency

- A gold-backed currency needs to be completely backed up by the amount of gold it is said to represent, but there is no way to reliably prove that the gold exists in a sufficient amount. Audits can be periodically performed, but those audits still have a critical point of failure in the auditors themselves. People are corruptible. So, while it does have resistance to manipulation, which is listed in it’s pros, it can still be manipulated (There is an easy to see example of this. USD’s move from being gold-backed to fiat was the result of currency manipulation.)

- The necessary hoarding of gold to back a currency keeps it from being used in ways that are actually useful. Even gold that is not being used to back the currency ends up with a value that is greater than it’s use in many cases, and thus is not cost effective to use. This is more of an issue today, with the increasing manufacturing and medicinal uses of gold, and other precious metals, than it was in the past.

- The cost of storing and protecting the gold that backs the currency is a wasteful expenditure, and there is still the possibility of theft, even if it is unlikely to be successful.

- Gold is very divisible, but not divisible enough. Even if all of the gold that has ever been mined, which, in 2013, was thought to be between 155,000 and 171,000 metric tons, was used to back a currency (which would be impossible), then each person would only be able to own a tiny amount. Putting wealth distribution aside, if every person on Earth owned the same amount, it would work out to ~.7 – .8 ounces of gold per person. In reality, the vast majority of people would only have a claim on a tiny fraction of that amount.

- In the digital world we live in today, even with a gold-backed currency in place, there is still a need for a giant transaction processing network. This network, built on a centralized, gold-backed currency, increases the cost of all goods and services.

- In times of dire need, such as during war, a country’s economy can be completely stalled by debt greater than it’s gold reserves. I put this in the negative list, as it is generally viewed as such, but outside of very rare circumstances, such as unavoidable war, there is no reason that a country should have more debt than it can pay.

- As crazy as this sounds, there is a legitimate chance that gold, along with silver, platinum, and other rare elements, will soon be obtainable in much larger quantities. Multiple companies, such as Planetary Resources, are backed by extremely wealthy individuals, and plan to mine asteroids. Yes, mine asteroids. While most people think of asteroids as big chunks of rock, and they mostly are, they are also filled with metal. Even a small, S-type asteroid around 10 meters wide should contain, on average, 1,433,000 pounds of metal, with ~110 lbs of that being rare metals. Some larger asteroids that have been examined are expected to have trillions of dollars worth of rare metals.

Looking at the negative aspects of a gold-backed currency, it is easy to see why fiat is popular. Gold was a very efficient currency system for much of human history, when it was used directly, but in an increasingly interconnected world, it is extremely cumbersome. Also, as mentioned earlier, wars often put countries into debt that they are unable to pay. Various small wars in the late 1800s and early 190ss, as well as the first World War, did this to countries across Europe. Fiat was their “solution” to this, and the US followed suit during the Great Depression.

Bitcoin, the Blockchain, and the Future of Money

Bitcoin is a revolution, no matter what happens in the near future, because of the blockchain. The blockchain provides the ability to digitize money in a way that does not need a central authority to create it, nor does it need a 3rd party to act as a middleman for transactions. Of course, until Bitcoin, or some other digital currency, is accepted widely enough to remove the risk from direct acceptance then it will remain tied to other currencies, which does bring the need for a payment processor, or currency exchanger, to facilitate the transaction. Still, that is a problem that will be addressed with increased adoption and further development of the network.

The pros and cons for Bitcoin are very different than those of gold and USD. It takes the best of both currencies, and cuts out the bad:

Positive Aspects of Bitcoin

- Bitcoin has built in scarcity and usefulness that, in my opinion, surpasses that of gold. While gold has many industrial uses, which gives it inherent value, the use of gold as a currency, or store of value, can limit how cost-effective it is to use in many products. Bitcoin has a usefulness that does not detract from industry. The Bitcoin network’s processing power, combined with the blockchain, provides a public ledger that can be easily used for accounting purposes, it automatically verifies every transaction’s validity, prevents counterfeiting, and provides a platform to build more complex structures on. These abilities can only be obtained with a traditional currency by using businesses that sell the services, or, for businesses, by hiring staff to handle them.

- Bitcoin cannot be truly manipulated. While Bitcoin’s current value may be subject to manipulation by wealthy individuals, as the total “market cap” is still low enough to allow this, the actual supply of bitcoins cannot. This means that the core rules won’t be changed, nor will certain groups be given special advantages over the currency. Rather than a currency that is controlled by a small group of individuals, it is a currency that is controlled by consensus of everyone involved.

- Bitcoin transactions are instant. When a bitcoin is sent, the transaction immediately begins to spread through the network. The recipient can see that they have received the transaction instantly, or within a few seconds. Then, once it has been fully confirmed, it would be statistically improbable for it to be invalid. I would say impossible, but that is not completely true. However, after a few confirmations, you are more likely to win the lottery than have a transaction turn out to be invalid.

- Bitcoin transactions are irreversible. This one is a double-edged sword, at least currently. While it eliminates the risk of charge-backs, which currently plague online merchants, and drive up the cost of all goods for everyone, it also allows for dishonest merchants to accept bitcoins, then not provide the service, or goods, promised. However, the downside to this is mostly limited to lesser known, or anonymous merchants, as it is still illegal to do this, and larger merchants have a reputation to maintain. Various groups are working on solutions to this problem, with the likely answer being a decentralized escrow and/or arbitration system.

- Bitcoin is transparent. The reason I can make some of the statements above is simply because there is nothing hidden with Bitcoin. Unlike USD, where the inner workings of the Fed and what they will do with the currency, or even gold, as it is difficult to make an accurate judgement on how much gold is currently available, or may become available in the future, Bitcoin’s parameters are known. The code that the Bitcoin network is built upon is open source, so anyone with the ability to read the code is free to do so, and that code governs everything about Bitcoin. The total number of coins, how transactions are handled, or what will happen in any hypothetical scenario can be examined. Even changes to the code can be proposed, and adopted, if the entire network reaches consensus, as previously mentioned, and those changes can be proposed, and tested outside of the network, by anyone.

- Bitcoin is the most efficient transaction processing system ever created. Because the ledger is handled by computers, and the way transactions are processed and recorded is based on mathematics, it is always verifiable, and is not subject to errors. This automatic process is more efficient than any payment processing system that relies on humans to analyze, as it does not need to pay for traditional labor. Only the miners must be paid, and people are generally willing to run mining machines as long as their revenue is even slightly above maintenance and energy costs. This is why the blockchain, and cryptocurrency, will be the future, even if Bitcoin is replaced. The efficiency of the system cannot be matched except, potentially, by another decentralized, automatic system.

- Bitcoin is infinitely divisible. Currently, 1 bitcoin can only be broken down into 100,000,000 smaller units, known as satoshis. However, that limit is not set in stone. If, at some point, more than 2,100,000,000,000,000, or 2.1 quadrillion, units of currency are needed, then it would not be difficult to allow the currency to be broken down to another decimal point or two.

With the exception of transactions being irreversible, most of these points cannot be argued to be negative. Some may say that the scarcity mentioned in the first point will lead to deflation, and in a way it does, but new bitcoins will continue to be produced for over 100 years, and the biggest problem with traditional deflation is related to physical limits on the units of currency. As mentioned in the last point, bitcoins are divisible to as many decimal points as necessary. If 1 satoshi becomes so valuable that it cannot be efficiently used in the market, then 1 satoshi is broken into 10 mini-satoshis, or 10 mini-satoshis can be broken into 100 micro-satoshis (these hypothetical units have not been named).

Negative Aspects of Bitcoin

- Bitcoin is very difficult to understand, and explain, how bitcoins are created, the network is secured, transactions are recorded on the blockchain and verified, or any other aspect of the Bitcoin’s core system. In my experience, once someone does understand, on a basic level, how this works, then they immediately understand why Bitcoin itself is valuable. Unfortunately, outside of mathematicians, cryptographers, or individuals that spend a significant amount of time learning how the system works, not many do truly grasp the magnitude of what has been accomplished with the blockchain. This has been a huge barrier to entry for new users.

- Bitcoin wallets are either not very user friendly, or not very secure. There is not a lot of middle ground. Many online wallets are easy to use, but require trusting a 3rd party to hold your funds, and that 3rd party could be corrupted or hacked. On the other hand, most offline wallets are quite secure, or can be made to be secure via using encryption with a strong password, but are not that easy to use in a secure way for someone that is new to cryptocurrency. Of course, a lot of advances are being made in this area, and Bitcoin as a whole is becoming more user friendly, but it still has a long way to go.

- Scandals and fraud are rampant in the Bitcoin ecosystem. Many compare Bitcoin to the wild west, and at times that seems like an accurate assessment. Exchanges are now undergoing audits to proving solvency, offering multi-signature wallets to protect customer’s funds, and working toward becoming properly licensed in their home countries, but this process takes time. Other services, such as cloud mining driven by bitcoin mining farms, gambling websites, pre-sold altcoins, and many others have vanished with their customer’s coins, or lost their bitcoins due to poor security and/or skilled hackers.

- The bitcoin to usd conversion rate is volatile and erratic, which has made some people millionaires, and bankrupt others. This is part of the growing pains of such a novel, new currency. I would strongly suggest that no one look to Bitcoin as a long term investment unless you are heavily involved with it, and are constantly watching the market. Bitcoin isn’t built to be an investment vehicle…it is the solution to the question of,”How do we digitize currency and payments in a way that isn’t reliant on archaic, inefficient systems?” Sadly, the ups and downs of Bitcoin’s value are the focus of most mainstream media reporting, and are completely missing the point.

- Bitcoin isn’t perfect. It may evolve, with the addition of sidechains and other structure built on top of it’s blockchain, or it may eventually be replaced. This uncertainty keeps many from becoming involved, though I would argue that it is one of the best reason TO become involved. The only way to really be ready for what is going to happen next is to be there, watching, as it begins to happen. As I mentioned in a previous article, I personally keep my own funds spread between various cryptocurrencies, as well as traditional currencies, and other places. This is for more than one reason:1. It helps me remain objective when discussing potential competition to Bitcoin, as I truly do not care if Bitcoin itself is the ONE currency, is a one of many currencies, or completely fades away. As long as it is assisted, or replaced, by a system that is better, or at least brings additional benefits in some way, then I am happy.2. If one currency fails, or seems likely to catch on, I can shift my funds to others quickly enough that it will have little impact on me overall.

The Future of Bitcoin, USD, and Gold

The point of all of this is to point out the fatal flaws that I see in fiat currency, as well as a gold-based currency, while also showing why I think Bitcoin, or another cryptocurrency, will eventually become the norm.

Fiat’s big flaw is in central control and inflation. People are corruptible, and those in power have convinced the majority of the world that slight inflation each year is a good thing. That is halfway true. Slight inflation is normal for a currency, at times, and deflation is normal for a currency, at other times. Inflation, compounded year over year, is simply theft. It is a way to steal the wealth of the population, using math, in a way that isn’t easily noticeable in the short term. However, it is incredibly powerful over time.

Gold’s big flaw is also it’s strength. It is useful, heavy, divisible, resilient, and cannot be efficiently produced. In a non-digital world, with economies that are less interconnected, it is an amazing currency. There is a reason that it was the currency of choice, along with silver and other precious, useful metals, for thousands of years. Unfortunately, it cannot keep up with technology…or maybe technology cannot keep up with it’s needs. Without a way to instantly transport gold from person to person, which is impossible without some sort of incredible breakthrough resulting in teleportation, then transportation costs, or the reliance on central vaults to store the gold, remain an issue. Then, the gold itself is so useful for much of the technology we rely on today, as well as technology that is being developed, that our gold supply is truly needed for industrial uses. For the first time in history, humans are actually “consuming” gold.

Bitcoin avoids these flaws, by being decentralized and transparent, as well as providing a usefulness in the blockchain, and the bitcoin mining power to back up the network. Does it have a long way to go? Sure. Many issues need addressing. Fortunately, the problems with Bitcoin are not inherent in the system, or currency, themselves. Instead, the problems are solvable with further development and innovation. One way or another, cryptocurrency, or something similar, will be the future. Barring some incredible disaster that sets humanity, technology, and civilization back considerably, then we must digitize currency. With such an efficient system developed that is capable of doing just that, the old methods of handling currency seem likely to go the way of the horse and buggy.

5 Comments

5 Comments

Bitcoin it’s just a failed concept that can’t be trusted and utopian in the same time. It sounds good in theory but it’s disconnected from reality, very similar with the COMMUNISM concept… Gold is money and nothing else!

bitcoin and other cryptos are based on trust and transparency. No other medium of exchange can be trusted. Especially not gold. People cant be trusted, and therefore, gold cannot be trusted, because people maintain the storage and value of gold. The true value of gold is many times higher than it’s current value.

I’m not saying that we all should not own some gold or silver, I’m saying to your point that out of all these medium of exchanges, bitcoin is the most trusted, because you can always see what it is doing by checking the blockchain.

But you don’t seem to know much about blockchain, so perhaps you would do the rest of us a favor and educate yourself before making such statements as if you were an authority on bitcoin.

I think you misunderstand what is going on with USD and with inflation. Probably because focusing on money tends to be misleading. The economy is ultimately about exchanging, creating and consuming goods. No one wants money for it’s own sake….it is merely a medium of account.

In fact in a perfect world inflation wouldn’t even be noticed. Imagine for a second what would happen if a policy change was announced declaring in exactly one year every bitcoin in circulation would become 10 bitcoins. That would be a horrific rate of inflation. In an instant every bitcoin would become worth only 1/10 as much but in practice absolutely nothing would change. Being prepared for the change everyone would just move the decimal point over one place.

So what is going on with inflation and the business cycle in the world. Well dollar values are written into many contracts, your pay is a fixed dollar amount, stores and supply chains and our expectations are tied to dollar values. Inflation of USD means that every salary, every debt, etc… is worth a little less stuff. No actual stuff appears or disappears, it’s just that pre-existing agreements that tie up fixed amounts of dollars now tie up a little less. Luckily, the apparent bad effects, lower salaries etc.. aren’t really a problem as long as the rate of inflation predictable. Like the bitcoin example stores raise their prices, jobs give cost of living increases etc.. etc..

But why have inflation if you don’t want to? There are real fluctuations in the buisness cycle. Times when (say because of a mortgage crisis or troubling political events) people stop consuming as much, businesses stop investing as much so there is less demand for stuff and businesses don’t have as much money etc.. etc..

In an ideal world buisnesses would just let go of workers and lower wages (and write off some agreed on portion of debt) when they stopped making as much money. Those workers would instantly get new jobs (at a slightly lower wage) we’d get past the coordination problem of lots of people not working and wages would rise again. In the real world things don’t work like that because people resist having their wages lowered, companies can’t instantly start hiring workers at lower salaries than existing employs etc,, and all this prolongs the loss of productivity, i.e., the price of labor drops but b/c of wage stickiness at many companies the same people working for the same amount now produce less stuff because their aren’t enough buyers but their current job pays more because of wage stickiness than what they would be paid at any other company.

Inflation is a psychological blanket that protects us from the fact that wages are sticky. We don’t need to cut people’s pay, just don’t give them raises and inflation handles that for free. As a result inflation actually reduces the harms of the business cycle. On a large scale it can deal with crises like that facing Greece.

This doesn’t mean that we can’t do the same with electronic currency but the right answer is probably not a fixed total supply, Simply allowing a certain rate of coin creation could do the trick. Bigger macroeconomic questions could theoretically be dealt with via built in feedback loops and securities.

Peter what is your opinion of bitcoin/crypto coins and their evolution within our economy?

@Peter Gerdes 1 Bitcoin would never inflate to 10 bitcoins. That is not what the author is referring to when he says to add another decimal place. He is saying, instead of 8 decimal places, there can be 9 or 10, and so on. You see, it is not moving the decimal, just adding more visibility of a smaller fraction.

Try slowing down when reading, as to fully understand these unfamiliar details to you. This error of yours truly shows how little you know about bitcoin.