As I am sure that 99% of the people reading this are aware, Bitcoin recently dropped significantly in price, and at a rather quick rate. This did not surprise me, as Bitcoin has traditionally followed a pattern of volatility, followed by stabilization, followed by more volatility. What did surprise me was the reaction from so many in the community. So many people are rushing to find a reason why this happened, and not stopping to think it through rationally, nor to analyze it based on Bitcoin’s history.

[toc]

Full Disclosure: Bitcoin, Reddcoin, and Ethereum

I am almost completely invested in digital currencies in general, with the exception of the cash that I need for specific bills and day-to-day life, and I keep small amounts of a wide range of currencies. However, the majority of my funds are in Bitcoin, Reddcoin, and Ethereum. While it is obvious why Bitcoin is on that list, as it is the reason that the cryptocurrency industry exists at all, when I mention the other two people sometimes become confused. It is not an attempt to “hedge my bet” as some people like to do, but rather an understanding that this journey into cryptocurrency didn’t actually start with Bitcoin, but rather with the multiple digital currencies that came before it, and Bitcoin is not the end either. There is no end. The genie is out of the bottle.

So, I Must Think That Bitcoin Will Fail! Right?

Not at all. I fully expect Bitcoin to continue to grow and evolve. What that evolution will look like is beyond my ability to predict, as there are multiple paths it could take. However, Bitcoin’s growth has been incredibly organic in nature, including replication and reproduction, which is why we have such a wide variety of cryptocurrencies today. This is also the reason that the vast majority of the cryptocurrencies today will die within a few years.

Although it took a genius to create Bitcoin, it is the inevitable conclusion to the failures of fiat currencies, combined with the incredible advance in technology that began in the mid 1900s, and has been steadily accelerating since, and the evolution of society as a whole toward a more free, individualist, thinking culture. Without Satoshi, we likely would not have had Bitcoin in 2009. However, with the number of very bright individuals that were pursuing similar ideas at the time, it is quite likely that something very similar would exist by today.

The problems Bitcoin was created to address have not gone away, and Bitcoin’s simplistic elegance in solving them has not diminished. I fully expect that it will continue on it’s path to widespread adoption, and in doing so, will succeed in bringing about balance between society, governments, and the economy of the world…or, it will at least be a giant leap in the right direction.

Then, Why Reddcoin and Ethereum?

I am only human, and only have a certain amount of time to research all the options in this vast cryptographic landscape that has been created. There are many interesting currencies, and with more time to research each one, I am sure my portfolio would become less heavily weighted toward these two. That being said, out of all the currencies I have analyzed (and, I have spent significant amounts of time researching dozens of different currencies), Reddcoin and Ethereum have the greatest potential to fill two very important voids that Bitcoin does not, and should not, as that would take it away from it’s true purpose.

Reddcoin Provides Needed Support for Microtransactions

Reddcoin has the potential to truly be THE Social Currency. There are a lot of currencies that fill that can fill that role part-time, but none that have such laser focus on that specific goal combined with such a strong development team. There are many currencies with the potential for use in microtransactions, but most are, in my opinion, going about this all wrong. Microtransactions have useful purposes in the real world, and are great for charity, crowdfunding, etc., but that is not where they will get traction. The strength of online charity, crowdfunding, tipping, and, really, the interconnectedness that we all experience today originates in social networking. Myspace pioneered it, Facebook “perfected” it, and now it powered a fundamental shift in how the world interacts.

Reddcoin has the potential to truly be THE Social Currency. There are a lot of currencies that fill that can fill that role part-time, but none that have such laser focus on that specific goal combined with such a strong development team. There are many currencies with the potential for use in microtransactions, but most are, in my opinion, going about this all wrong. Microtransactions have useful purposes in the real world, and are great for charity, crowdfunding, etc., but that is not where they will get traction. The strength of online charity, crowdfunding, tipping, and, really, the interconnectedness that we all experience today originates in social networking. Myspace pioneered it, Facebook “perfected” it, and now it powered a fundamental shift in how the world interacts.

By focusing on being a currency for social networking, Reddcoin will, most likely, become the currency for these systems, and thus the currency for the microtransactions they power. Sure, Bitcoin now can be used on social networks through 3rd party systems, and that will be sufficient for the moment, but that defeats the purpose of a decentralized network. Bitcoin will soon have a fully decentralized exchange, but that won’t completely fix the issue. However, using the Bitcoin blockchain directly to power microtransactions is also untenable for two reasons: Transaction fees are too high (and will only increase), and the bloat it would cause to the Bitcoin blockchain, and strain it would put on the network, would make using Bitcoin for its intended purposes much more difficult to maintain.

Reddcoin solves this by providing a decentralized system that, at this point, does not rely on mining, and thus has a network that is cheap to maintain and has low transaction fees. Beyond that, it promotes social interaction directly through it’s wallet GUI, and has the liquidity needed to appease the human psyche with sufficiently large numbers. The advantages it has over other currencies in this arena are impressive, and the fact that it has achieved this in less time than other currencies, as it is younger than most of it’s “competition”, tells me that it is very likely to succeed.

Ethereum Will Provide the Support Needed for a New Kind of Network

Ethereum is one of those “revolutionary” ideas that seems impossible at first, but becomes more believable once you look at the work being done, and listen to the people who are developing it.

Ethereum is one of those “revolutionary” ideas that seems impossible at first, but becomes more believable once you look at the work being done, and listen to the people who are developing it.

I’ve heard people saying that “Ethereum will replace Bitcoin” or that “Bitcoin can just be upgraded to provide the functionality of Ethereum.” While both of those statements are technically possible, neither of them are likely to happen. A more reasonable outcome is that Ethereum will provide a framework in which Bitcoin can be used more effectively, while Bitcoin will provide the basis and support needed to create this framework. It would be a symbiotic relationship in which the synergy between the two creates a system that is greater than the sum of it’s parts.

Of course, that doesn’t explain what “need” or “void” that Ethereum is filling. The reason behind that is that it is filling one that wasn’t recognizable before…or at least no one recognized that there was a way to fill it with current technology. Many other Crypto 2.0 systems are providing contract based interactions that there is certainly a need for, and are very identifiable. However, with Ethereum, it is the open-ended programmability that will give it it’s strength.

Ethereum has the potential to transcend currency and contracts, not to become not the next phase of cryptocurrency, but the next phase of the internet itself. Beyond that, it could finally provide Bitcoin with the ability to be completely decentralized by dismantling the last few industries that have a large amount of influence over it. If Ethereum’s creators are successful, then we could see a blending of the cryptocurrency world with the internet. Through that new integrated, yet decentralized and autonomous, system, the possibilities are beyond my imagination. The developers of the world will decide what happens next. With over 28,000 BTC invested thus far, the Ethereum team should have sufficient resources to create this system, especially with the amount of work that has already been put in to it.

People have claimed that “2014 is the year of Bitcoin”, and that has been true thus far. The price does not show it, but there are reasons for that. You can see it in the rate of adoption, increasing investment in Bitcoin based companies, government interest, and growing fear in certain circles. However, I expect that 2015 will be the “Year of Decentralized Autonomous Corporations” with Ethereum providing the platform upon which to build them.

By now, I am sure you are wondering how this relates to Bitcoin’s recent price drop. Well, it both does and doesn’t.

Bitcoin’s Recent Price Drop

Bitcoin’s recent price drop is painful for many people to see, but was predictable if you were paying attention. The signs have been all around that this was going to happen, and it isn’t the end of the world. Bitcoin will likely recover, as it always has, and continue in it’s overall upward trend. However, for those of you who were caught off guard, I will try to outline some of the reasons behind this drop…at least from what I can see. I am 100% sure that I am not covering everything, because every price movement has hidden actors, and random individuals, that influence it in one way or another. Sometimes this is intentional, and other times it is not, but the impact is still there.

Bitcoin Price Charts Were Signaling a Drop

While one of our authors, Evan, tends to be against using complicated algorithms and calculations to try to predict market movements, even he agrees that more broad analysis can often show the general mindset of the market. Beyond that, the very fact that people do analyze the charts has an impact on the price due to people trading based on their analysis. It is a system that creates self fulfilling prophecies.

At one time I was an active Bitcoin day trader, and I was quite good at it. Had I started off with a slightly larger amount of funds, I would likely be quite wealthy by now, and truly I could go back to it, or trade on the stock market, and do quite well for myself. However, I did not like day trading as a job, and tend to stick to small spurts of altcoin trading these days. That being said, I still like to go analyze the charts from time to time by rewinding it back to the last time I looked, then using my long term system to see where I would have made trades.

Bitcoin Charts Showing Bearish Signs

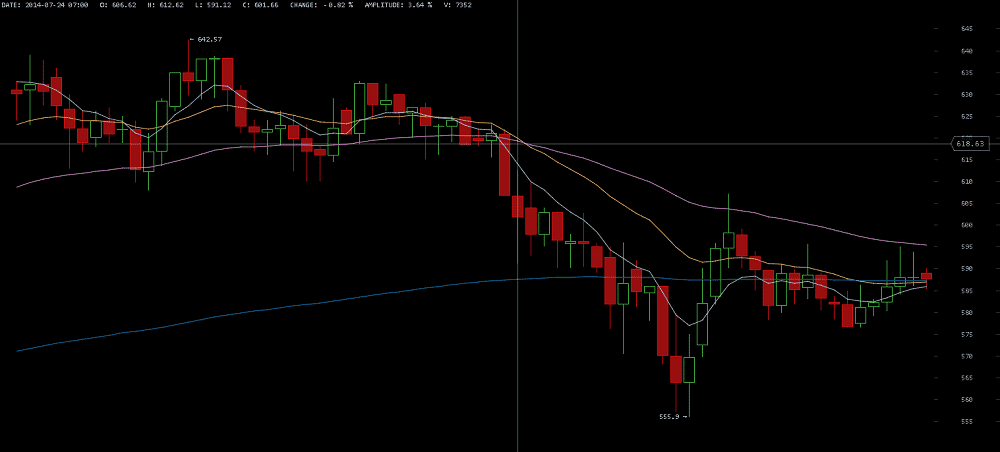

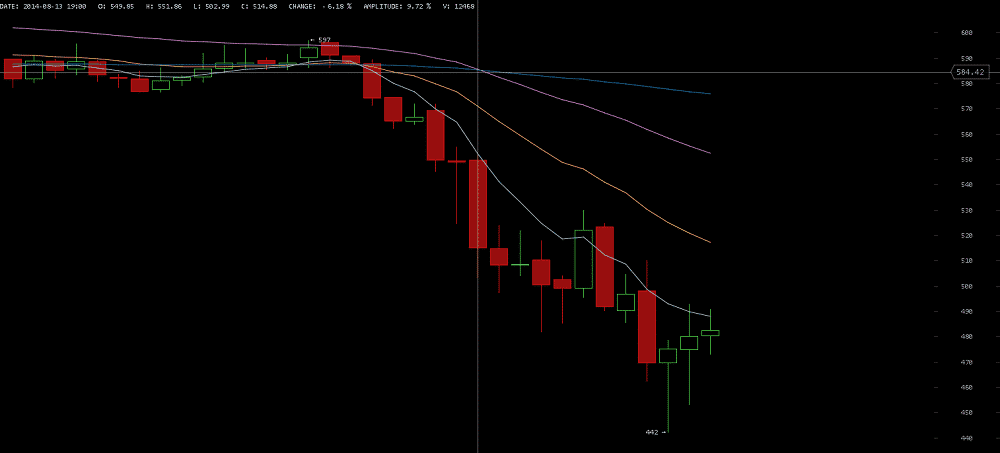

While we have a Bitcoin Price Chart here on Coin Brief, that is not our general focus, and so it does not yet have the depth of tools needed to do true analytics. That will change in the future, but for now I must use Bitcoinwisdom to present this:

In my day trading days, I would have liquidated all of my BTC when both the yellow and blue passed under the purple. That would have put me at an exit ~$610-600 on July 24. Now, that alone does not signal doom and gloom. That is a strong bearish sign for me, but could bounce back. That sign (or its inverse for a bullish trend) would put me into a very careful watching phase. With the rules I had set for myself when day trading, while this type of signal was showing, I would keep at least 50% of my funds in USD, and the other 50% I could use for short term trading (such as trying to grab a little BTC at the bottom you see shortly after, then selling it again at the following top).

Second Signal of a Bearish Bitcoin Market

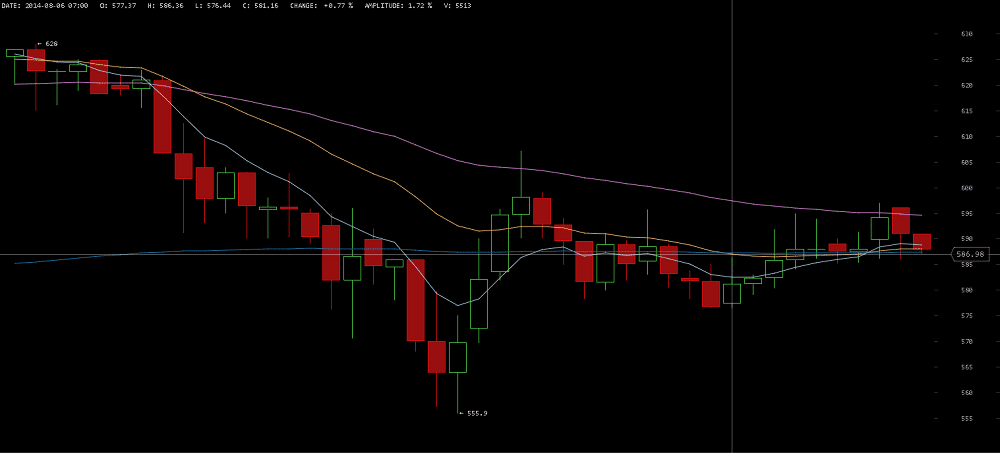

This would have put me in 100% fiat until I saw a change:

You can see this in the first chart as well, but I wanted to highlight it here. Once both short term indicators are on below the long term indicator, that would signal for me to stay in 100% fiat. No buying Bitcoin at all until both short term were back above the long term, and either stayed there for a significant amount of time, or jumped considerably above it. Instead, they twisted around it.

Final Confirmation of a Hard Bearish Trend for Bitcoin

This leads us to the final step, which is where we are now, and has traders around the world watching for the bottom:

Now we are at the opposite end of where we were in the weeks leading up to the first sell on July 24. At this point, I would be, and many other traders likely are, waiting to see a change. Today’s results have been promising, and could start to even out the short term indicators. Once light blue and yellow short term indicators start to point upward a bit, and the purplemid term flattens out, I would start to trade again, and if the light blue leads the yellow across the purple, that would be another all-in on Bitcoin (with the option to use 50% to trade).

I’ve watched, effectively, this same series of events happen multiple times in Bitcoin’s past, and every time it happened while I was day trading I made significant gains by picking the bottom, and riding it back up. However, this trend has reasoning behind it beyond just traders manipulating the market by using indicators to create self-fulfilling prophecies. In fact, that is why I used the method of trading displayed above when I did trade, as it was quite effective at removing the “noise”.

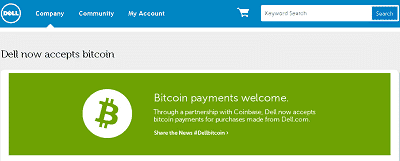

Increasing Adoption of Bitcoin by Large Companies

This sounds backwards to a lot of people, but large companies deciding to accept Bitcoin adds significant selling pressure. As they generally must pay their suppliers with USD, or some other form of government-issued currency, they tend to cash out all, or most, of the bitcoins that they are paid with. However, this downward pressure lessens as the price swings down, as people either are holding their BTC until they are worth more, or they have already purchased whatever goods they wanted from the company in question. Still, it seems like a paradox at first. For Bitcoin to grow, it needs more people to start using it. For more people to start using it, more companies need to accept it. However, if more companies accept it, that causes price fluctuations which make new users hesitant to dive in. Fortunately, it is not a paradox at all, and it is only part of the growing pains that Bitcoin must experience as it works toward mainstream acceptance. There are two important factors to remember about large companies accepting Bitcoin.

Large Companies DO Influence Individuals to Start Using Bitcoin

Large companies accepting Bitcoin has a net positive on Bitcoin’s price, and the network as a whole. A new company accepting Bitcoin may very well make people who were on the fence about it decide to try it out. Some of those people may become hesitant if they see the price swing down, but others will have either researched it already, or start researching it’s history, and see that such fluctuations are common. Those that researched it will either decide to just buy some BTC anyway, or they will join the traders and try to catch the bottom. After the bottom has been reached, and the price begins to rise again, a portion of the remaining individuals will jump on board, as their fears will start to disappear

Large Companies Influence Other Companies, Big and Small, to Accept Bitcoin

While every company that decides to accept Bitcoin does add some selling pressure, that selling pressure becomes a smaller % of the whole as the market grows. As large companies influence other companies to accept Bitcoin, two things will begin to happen:

- Many companies will begin to hold a portion of their Bitcoin based income in Bitcoin. Some will not hold any BTC, others will just hold what they saved over a debit or credit card, and a small portion will dedicate a larger % of their payments to remaining in BTC (with some actually keeping 100% of BTC payments in Bitcoin).

- Suppliers for large companies will begin to accept Bitcoin. This really does not have an immediate effect, beyond just adding another company to the list, but over time can reduce the companies costs, and if enough of a supply chain accepts Bitcoin, can lead to the “end game” goal of not needing to turn Bitcoin into USD at all. However, each step up the supply chain you go, the less incentive there is to do this. The companies supplying the retail companies tend to do fewer, but larger, sales, and transaction costs are generally a much smaller portion of their total costs.

Of course, adoption of Bitcoin is not causing THIS drop. The selling pressure is nowhere near enough to cause a serious crash in Bitcoin Price, and any downward pressure would have normally been offset at this point. There are other factors.

Government Regulation is Tightening On Bitcoin

I will not spend much time on this subject, as it has been mentioned so many times before, but it is an important factor. The BitLicense in New York, the ban in Ecuador, impossible regulations in Argentina, and many other issues we have discussed in the past all contribute to negative pressure on Bitcoin. However, this pressure has been around, in one form or another, for years now. Even before regulations were being seriously discussed by any part of the US government, the fear of regulation was always a downward pressure on Bitcoin. Every mention of regulation has caused a push down. Every time a government has discussed Bitcoin in an unfavorable way, or discussed laws rules based on a complete lack of understanding about what Bitcoin actually is or does it has had a negative impact. However, this one is a big push, because New York is the financial center of the US, and potentially the world (debatable in some cases).

Fortunately, no matter what the BitLicense regulations in New York end up being, this too shall pass. Either New York will be left out of Bitcoin, which will hurt, but won’t be the end of the world, or people will just go around the regulations. In a best case scenario, the BitLicense is completely revamped, and made into something that is more palatable. If not that, then the regulation will likely burn itself out as Bitcoin continues to grow, and New Yorkers begin to suffer financially because of their inability to legally use it without going through ridiculous procedures.

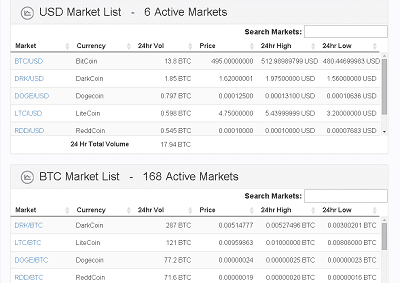

Other Cryptocurrencies Pull from Bitcoin’s Marketcap

This is a big one, and upsets a lot of people who invest in only Bitcoin. It is also the reason I mentioned Ethereum and Reddcoin in the first part of this article. When Bitcoin goes down in price, so too do a lot of altcoins. However, many of those altcoins also gain in relation to Bitcoin, and thus consume a larger portion of the total digital currency market cap. Rather than downward pressure from an outside force, I tend to think of this as more a pulling down on Bitcoin as they lift themselves up.

While the reasons for this are numerous, there are a few that I would like to highlight, as they are actually more positive than negative.

Bitcoin to Altcoin is Better than Bitcoin to Fiat

One of the big reasons for this pulling force is that altcoins give users who do not want to sell BTC for USD (or another government currency) a place to store their funds when Bitcoin dips. These are funds that will likely turned back into Bitcoin when the price begins to rise once again. Even if they do not, this still keeps the total marketcap for digital currencies higher than it would be if funds are sold for fiat and not used to rebuy later.

Altcoins are Testing Grounds, and The Marketcap of Altcoins Relative to Bitcoin is a Voting System

Altcoins are a testing ground for new features, ideas, and products. Even though I highlighted Ethereum and Reddcoin earlier, as they stand out to me as something that could grow beyond being considered just an “altcoin” that doesn’t mean they are the only ones. There are quite a few cryptocurrencies that are working on creating truly anonymous transactions and wallets, which is certainly wanted by much of the community. Others are working on different styles of “Crypto 2.0” with features that extend significantly beyond currency. Then there are coins, such as Myriadcoin, that are trying out unique ways of implementing a hashing algorithm. Myriad is using 5 concurrent hashing algorithms, which has lead their developer to propose a new type of merged mining, where a coin could be merge mined with a select number of algorithms, while keeping other algorithms that were non-merge mineable.

Every altcoin that introduces something new, or tries a different combination of parameters, algorithms, distribution systems, or goals is providing a valuable service to the cryptocurrency community, and potentially the world as a whole. We are witnessing digital evolution via competition and selection. The faster, safer, more useful, more resilient to attack, more marketable, more efficient, or more “valuable” in general a currency is, the more likely it is to rise. The cloned, underdeveloped, or useless are doomed to failure.

Altcoins do not hurt Bitcoin. They only help cryptocurrency to grow. They bring in new people who are unfamiliar with scared of Bitcoin, and often convert those to Bitcoin users. They promote competition. They create a more decentralized environment for decentralized currencies, which is an amazing development in itself.

Bitcoin’s Price Will Recover, and Bitcoin’s Future Will Be a Revolution

Many of us claim that Bitcoin is revolutionary, but the revolution has not truly happened yet. It is coming, but we must be patient. The price may ebb and flow up and down, and Bitcoin’s market wave will likely continue to have a much higher amplitude and frequency than other markets, but that is ok. In the end, as I said before, the genie cannot be put back into the bottle.

Bitcoin and cryptocurrenciesdigital currencies are here to stay. They WILL revolutionize the world, in one way or another. While I, and many others, like to think we know exactly what that is going to do, or how it is going to happen, the truth is, we probably are completely wrong. I do not think that anyone on the planet today truly understands what decentralized systems like this are actually going to become, but I do know one thing: I can’t wait to find out.

1 Comment

1 Comment

Im amayzed of quality of there articles. Thank you